Qualitative Insurance Company Credit Rating Factors

Gurdip Dhami

25 years: Treasury & ratings

In the third video of his series on ‘Insurance company credit factors', Gurdip explains the rating factors - reserve adequacy, market position, business risk and diversification, governance and management, risk management, and reinsurance and catastrophe risk.

In the third video of his series on ‘Insurance company credit factors', Gurdip explains the rating factors - reserve adequacy, market position, business risk and diversification, governance and management, risk management, and reinsurance and catastrophe risk.

Qualitative Insurance Company Credit Rating Factors

18 mins 4 secs

Key learning objectives:

Define Reinsurance and Catastrophe Risk

Define rating factors for the adequacy of the reserve

Outline risk of business and diversification and role of governance

Identify the role of risk management

Outline the value of the insurance company's market position

Overview:

Reserve adequacy, market position, business risk and diversification, governance and management, risk management, and reinsurance and catastrophe risk. Usually market position and business risk tend to be rating drivers. For some P&C insurers reserve adequacy may be more prominent depending on the type of business written.

What are the key factors for rating Reserve Adequacy?

Reserve adequacy, market place, industry risk and diversification, compliance and strategy, risk management, and reinsurance and disaster risk. For certain P&C insurers, the reserve adequacy may be more prevalent depending on the form and volume of company written down.I also offer an overview of how the credit rating agencies are actually integrating ESG risks into their credit analysis and credit scores. The credit rating agencies use qualitative and quantitative approaches to carry out their research. The departments are also using their own percentages. For life insurance providers, over-reserve and value-added loans are granted by Fitch and S&P. These objects are absorbing losses in a stress situation. Moody's and Fitch have ratios that compare the production of contingency losses.

What is the importance of an insurance company’s market position in the competitive landscape?

All three companies have a common credit metric, which assesses how the insurance provider is positioned in the business environment. An organisation shall examine the depth and diversity of the distribution networks of the insurer. Moody's measures the proportional market share ratio, which relates the written premium of the insurers to the overall written premium of the sector. For example, an insurer with a limited total market share ratio could get a higher score than the baseline if Moody's feels that it has a good niche position within a segment of the market.

What are the equations between Business Risk and Diversification within the role of Governance and Management?

The authorities analyse the policies that the insurer offers and manages to consider the amount of risk that they are taking.The agencies favourably regard insurers that provide a variety of insurance plans that practice in different locations. Diversification into emerging technologies and new industries without adequate experience and skills would be deemed negative.The manner in which the insurance industry is regulated and controlled has an effect on all facets of the business. Governance and administration is not normally the driver of ratings in emerging markets. Agencies can study processes and restraints on retail prices in order to determine long-term viability and whether premiums will cover underwriting.

How does Risk Management play a role in credit rating?

The three departments review the general risk management practices of the insurer. Only S&P has explicit risk management scores that are calculated as part of their risk exposure ranking factor. Moody's and Fitch do not have a distinct risk management rating component, but ratings may be adversely affected if there are major vulnerabilities in this sector. For higher rating insurers, the agencies consider risks to be internally handled in such a way that there is an enterprise risk management solution.

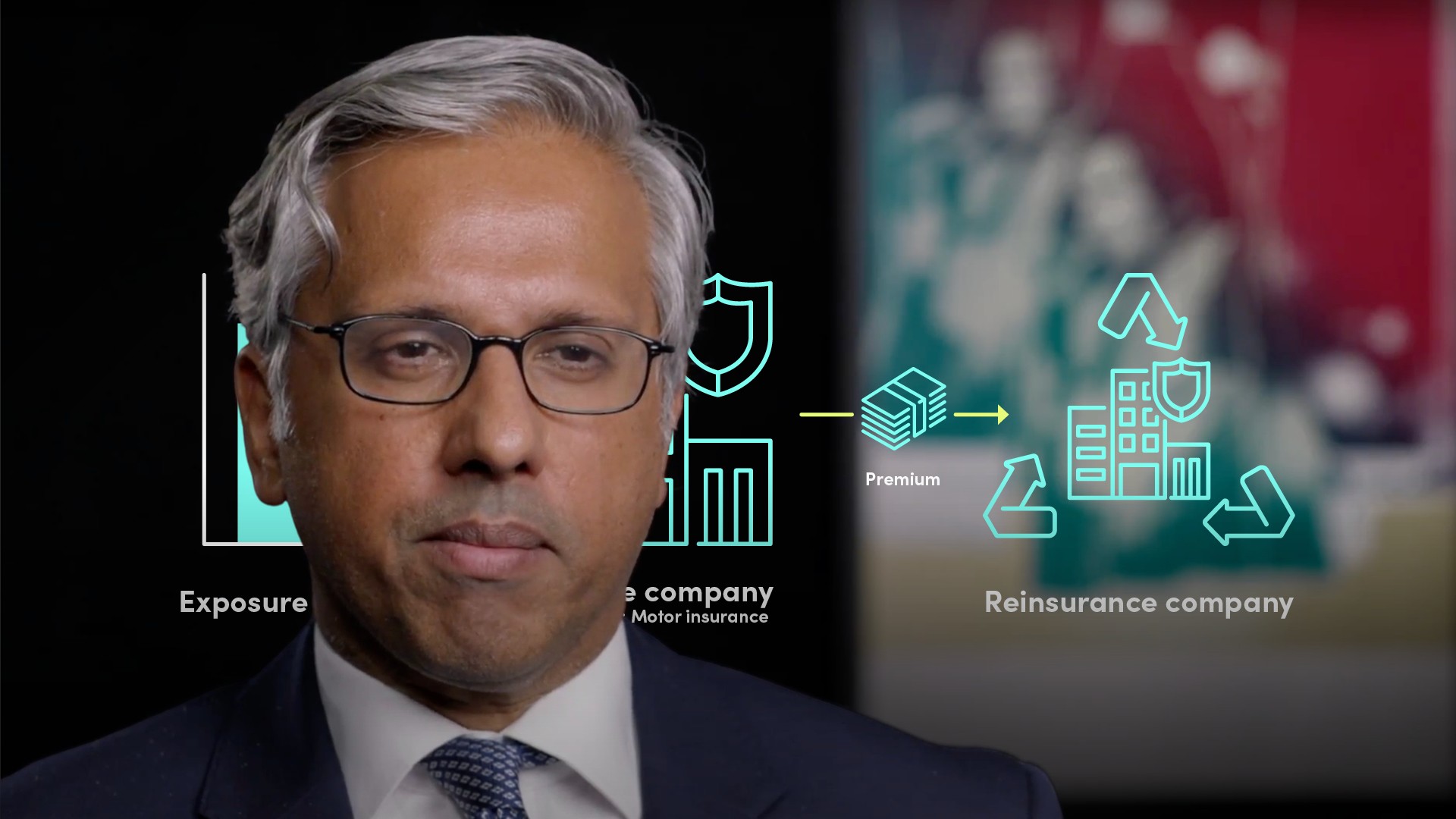

What are Reinsurance and Catastrophe Risk?

An insurance provider may have sold a number of insurance policies in a single geographical area. In order to reduce its exposure, it could buy out policies from a third party, the reinsurer, by paying a fee to cover extreme accidents. Insurance providers also buy reinsurance to improve their ability to write insurance plans.Rating agencies shall check the standard of the reinsurers, including their credit rating. If the insurer depends on relatively few reinsurers to create a concentration risk, this could be considered adversely by the agencies. The default risk of the insurance policy can be mitigated by seeking collateral from the reinsurance company.

Rating agencies analyse the extent of disaster risk posed by non-life insurers. Potential disaster risk occurrences for the insurer may depend on the form of insurance policies that the insurer writes. Catastrophe incidents can include low-probability/high-impact events such as hurricanes, earthquakes, conflicts, cyber attacks and pandemics.

Gurdip Dhami

There are no available Videos from "Gurdip Dhami"