Rating Agencies Assessment of Insurance Hybrid Debt

Gurdip Dhami

25 years: Treasury & ratings

While rating agencies are broadly aligned in how they assess insurance hybrid debt there can be some noticeable differences. Join Gurdip Dhami as he explores how Moody’s, Fitch Ratings and S&P treat hybrid debt.

While rating agencies are broadly aligned in how they assess insurance hybrid debt there can be some noticeable differences. Join Gurdip Dhami as he explores how Moody’s, Fitch Ratings and S&P treat hybrid debt.

Rating Agencies Assessment of Insurance Hybrid Debt

13 mins 12 secs

Key learning objectives:

Outline how each rating agency treats hybrid capital

Overview:

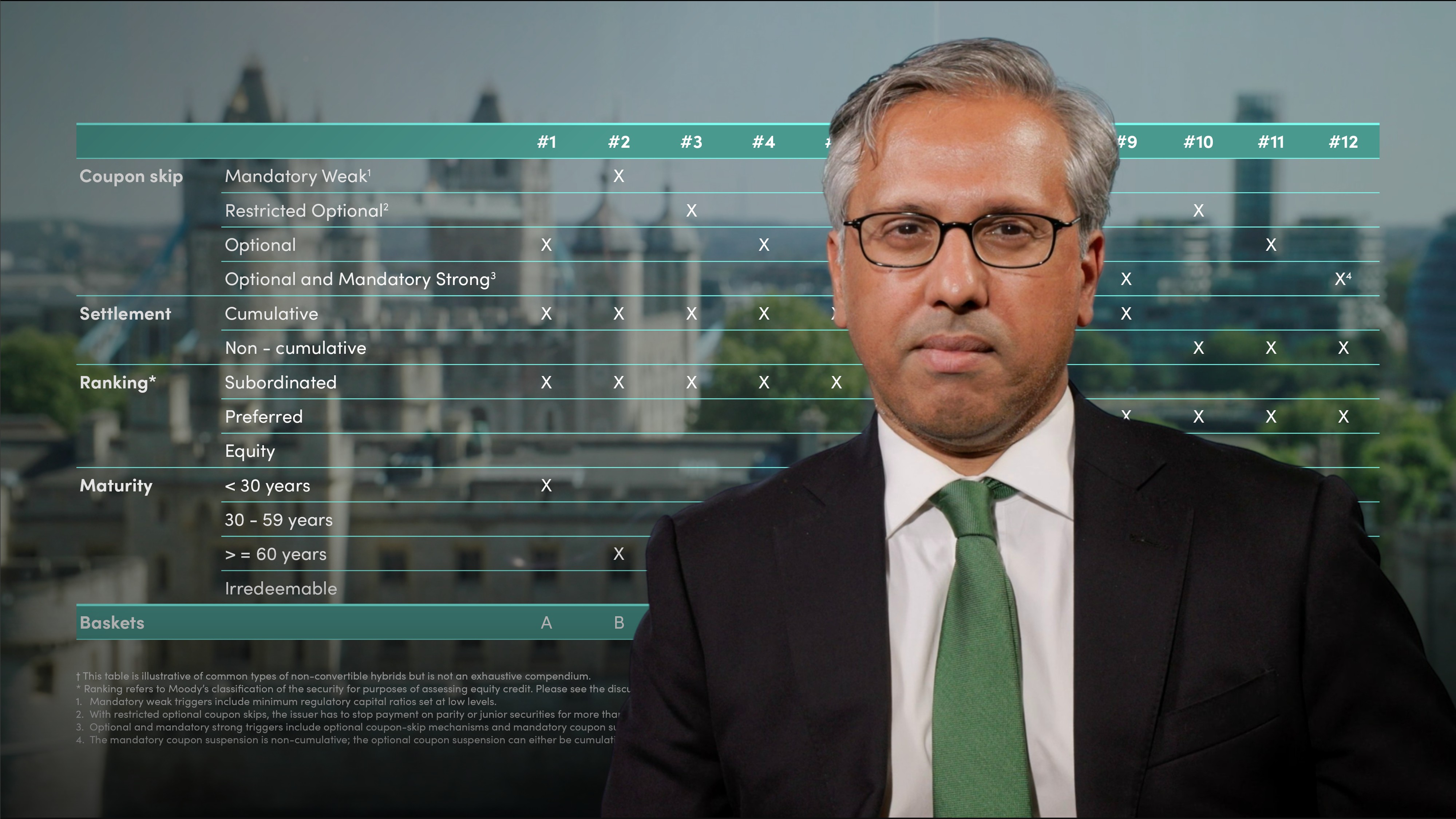

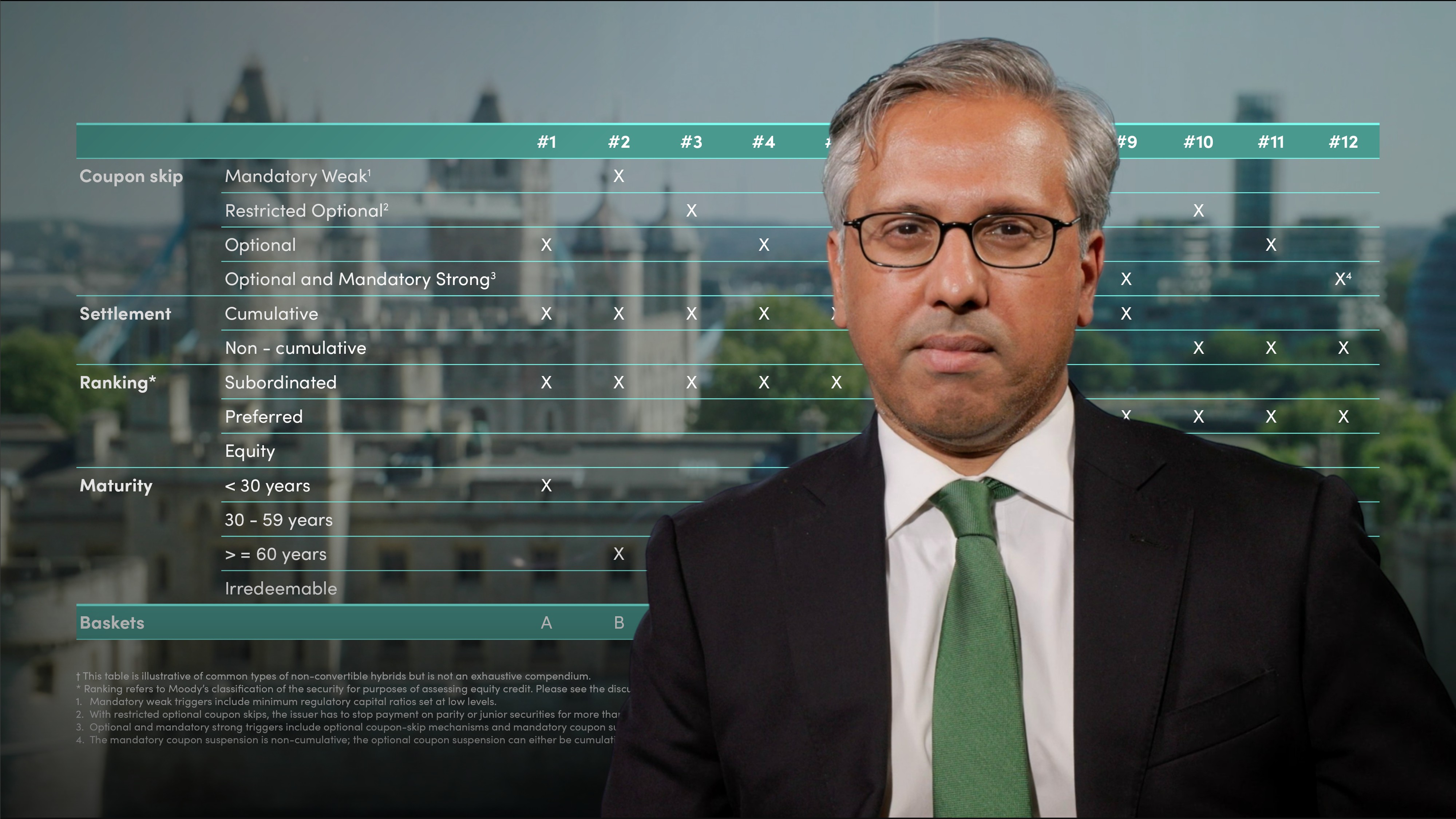

As a general rule, the rating agencies follow the regulators and give more equity credit to Tier 1 (than to Tier 2 and Tier 3) in their calculations of capital and leverage because Tier 1 is more equity-like. Although the three rating agencies have the same general concept when considering the level of equity credit assigned to insurance hybrid debt (that the level of equity credit should reflect permanency and loss absorbency) they have different detailed eligibility criteria.

How do the three main rating agencies (Moody’s, S&P’s and Fitch Ratings) analyse hybrid capital with respect to capital adequacy and leverage?

The rating agency treatment of hybrid debt varies by agency. As a general rule, the rating agencies follow the regulators and give more equity credit to Tier 1 (than to Tier 2 and Tier 3) in their calculations of capital and leverage because Tier 1 is more equity-like.

Details on hybrid debt treatment can be found in the rating agency criteria which are published on their websites.

Although the three rating agencies have the same general concept when considering the level of equity credit assigned to insurance hybrid debt (that the level of equity credit should reflect permanency and loss absorbency) they have different detailed eligibility criteria. Therefore when structuring insurance hybrid debt, the rating criteria should be examined carefully and the classification agreed with the rating agencies before issuance.

Gurdip Dhami

There are no available Videos from "Gurdip Dhami"