The Role of Repos in Fund Management

Mark Doran

40 years: Fund management

In the final video in his series on fund administration, Mark Doran explains what is a repo and how they are used by asset managers. He also covers the working of a repo trade by outlining the purpose of the General Master Repurchase Agreement (GRMA).

In the final video in his series on fund administration, Mark Doran explains what is a repo and how they are used by asset managers. He also covers the working of a repo trade by outlining the purpose of the General Master Repurchase Agreement (GRMA).

The Role of Repos in Fund Management

13 mins 28 secs

Key learning objectives:

Understand what a repo trade is and why asset managers use them

Outline the General Master Repurchase Agreement (GMRA)

Overview:

Asset managers use repo to borrow money for the day-to-day running of the fund or to create leverage. They can also lend money through repos. This is done by using a General Master Repurchase Agreement which governs how the trade must be treated.

What is a repo trade?

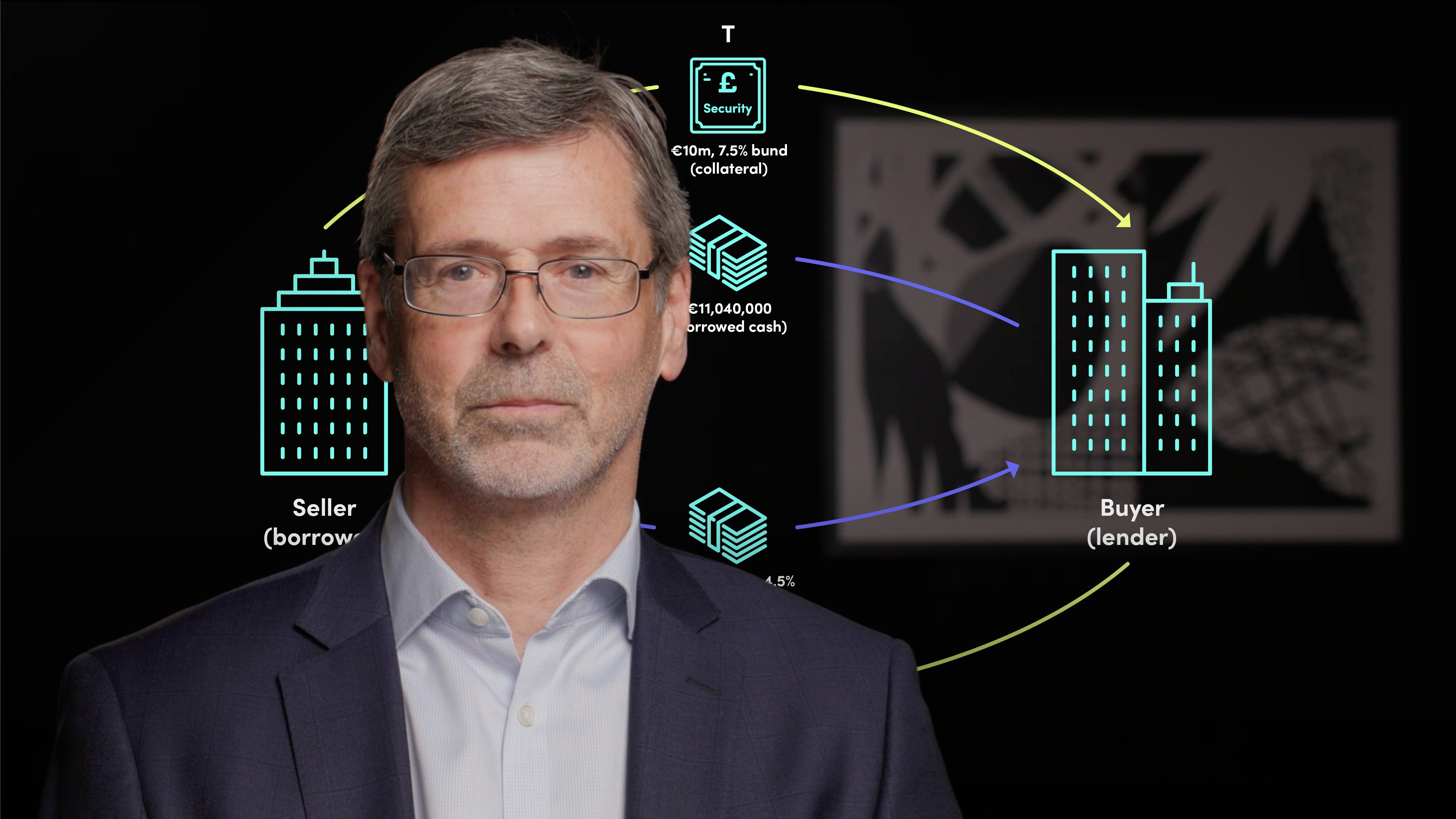

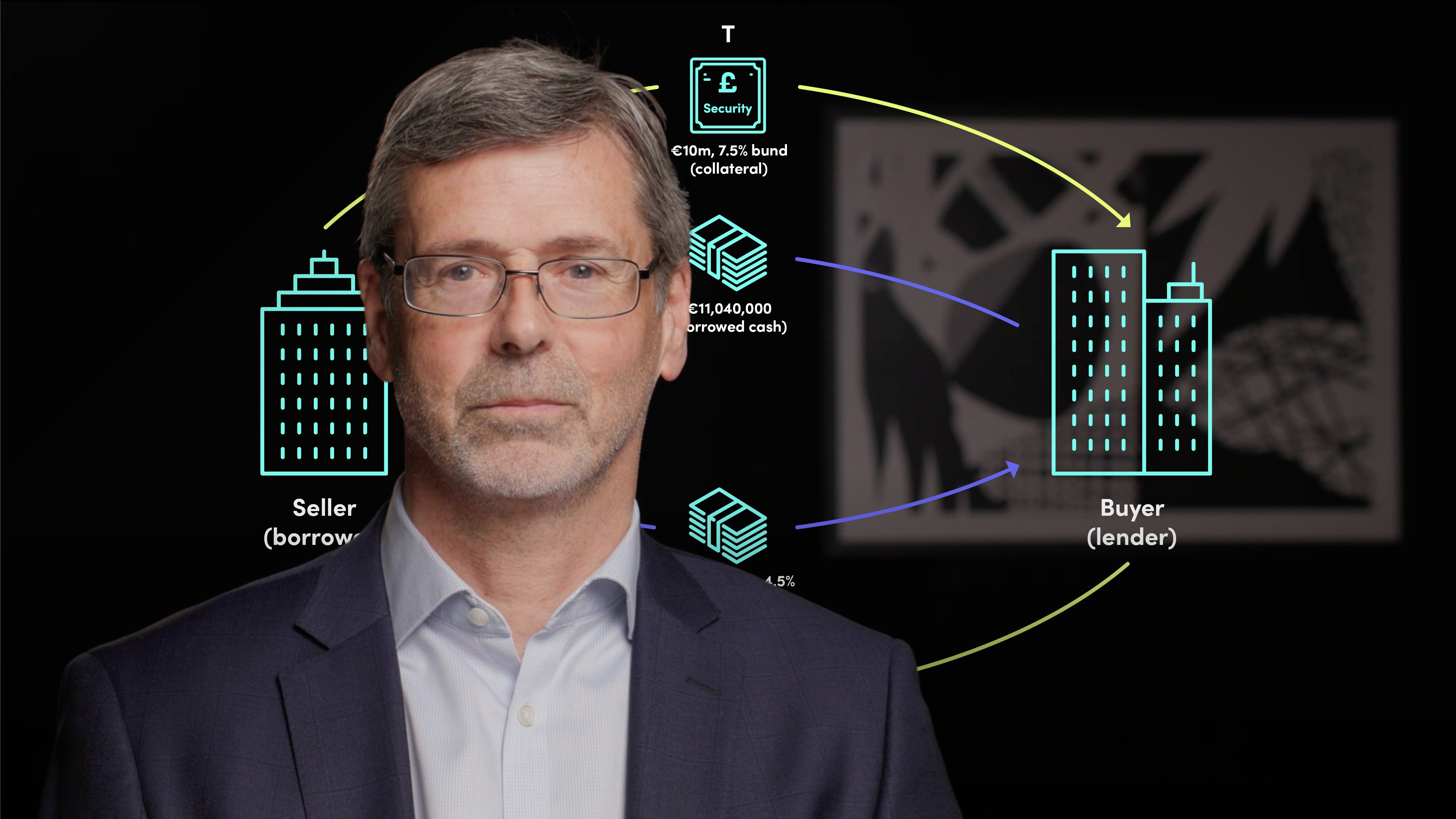

A repo trade is also known as a ‘sale and repurchase agreement’. This is when a security is sold on the first leg at a price agreed today and then is bought back on the second leg of the trade at another date in the future.

When you sell a security in a repo trade (e.g. a bond) you will receive cash, effectively borrowing the cash. They are essentially collateralised loans, which makes them very popular as you are reducing the credit risk you get from a normal loan.

Within a repo transaction any economic benefits the collateral receives stay with the original owner (the person who has borrowed the cash), therefore the lender is required to pay the original holder for any benefits, such as a coupon.

Asset managers use repo either to lend out cash on a secure basis or with the intention of borrowing cash to use for the day-to-day running of the fund or to increase leverage. Repos are one of the main tools asset managers use to manage their portfolio.

What is the purpose of the General Master Repurchase Agreement?

For a repo trade to take place, a GMRA must be agreed upon and signed by both parties. The rules in the agreement govern how the trade must be treated.

Trades are structured as sales and repurchases of securities with full transfer of legal, but not beneficial ownership, to the buyer. The buyer of the security is required to return a similar security from the same issue, not necessarily the same one.

Provision in the GMRA is made for margin payments, both initial and maintenance. Term trades that are for more than one day will have haircuts and margins applied.

Mark Doran

There are no available Videos from "Mark Doran"