Risk Factor Attribution Models

Ali Chabaane

25 years: Investment management

In this video, Ali focuses on another family of attribution models: risk factor attribution models, which provide a significant step up to the Brinson model.

In this video, Ali focuses on another family of attribution models: risk factor attribution models, which provide a significant step up to the Brinson model.

Risk Factor Attribution Models

8 mins 11 secs

Key learning objectives:

Understand the maths behind risk factor attribution models

Outline the three different types of risk factor models and their differences

Overview:

Risk factor attribution models provide a significant step up to the Brinson model, and aim to attribute the performance of a portfolio of securities to the effect of a set of risk factors. These models try to explain the performance of a securities portfolio by decomposing its performance on a set of desired factors.

How do the risk factor attribution models work?

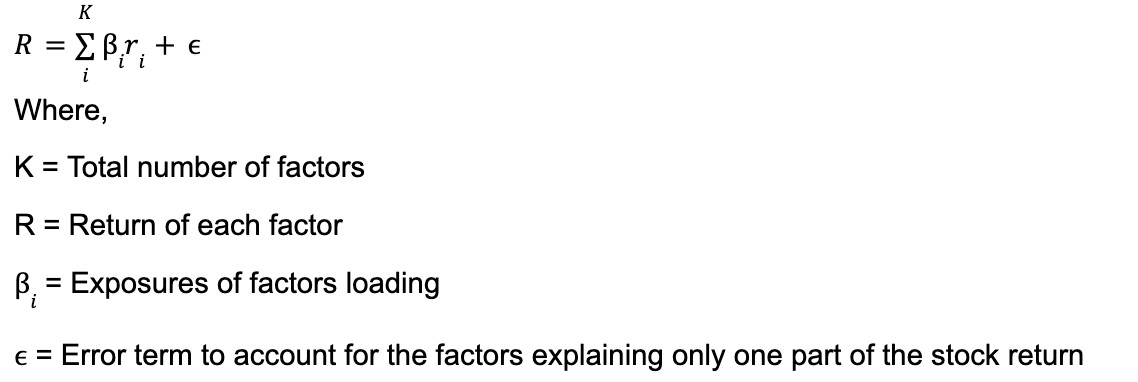

The models try to explain the performance of a securities portfolio by decomposing its performance on a desired set of factors. Mathematically, it can be written out as follows:

common factors adjusted by the exposures plus a specific return to that stock.

What are the three different risk factor attribution models and how do they differ?

The three main risk factor models are: Market factors models, fundamentals models, and statistical models.

With the market factors models, we use observed market indices or macro-economic factors such as:

- A global market index

- Sector indices

- Country indices

- Interest related indices

- Macro indices such as Oil prices or inflation

- Some Style indices such as Value or growth

Exposures are estimated through statistical procedures such as regression methods.

Performance attribution using this method can provide valuable insight into the influence of market factors on achieved performance.

With fundamental factors risk attribution models an assumption is made that stock prices are mainly influenced by some fundamental characteristics of each underlying company and have some idiosyncratic element that is specific to each stock. These characteristics include:

- The country in which the company is operating

- The sector to which the company belongs

- The size of the company

- The valuation level of the company

- The Value of Growth nature of the company

- The dividend yield of the company’s stocks

- The company’s equity price momentum

- The volatility or the beta of the company’s underlying equity

Exposures of each stock are usually defined by the fundamental characteristics of the stock.

For statistical factors models, both factors and exposures are determined by statistical procedures, which arguably makes these models better in the sense that the model can better fit the data used to estimate them. However, it’s difficult to interpret the outcome as factors and exposures are difficult to relate to known market indicators.

Ali Chabaane

There are no available Videos from "Ali Chabaane"