Risk Management in Securities Lending

Richard Comotto

30 years: Money markets

In this video, Richard explains the risks and risk mitigants associated with securities lending. He covers the various risks involved in securities lending, including counterparty credit risk, settlement risk, liquidity risk, and tax risks. He further explains how careful counterparty and collateral selection, indemnification, accurate pricing of collateral, and frequent variation margining can help mitigate these risks.

In this video, Richard explains the risks and risk mitigants associated with securities lending. He covers the various risks involved in securities lending, including counterparty credit risk, settlement risk, liquidity risk, and tax risks. He further explains how careful counterparty and collateral selection, indemnification, accurate pricing of collateral, and frequent variation margining can help mitigate these risks.

Risk Management in Securities Lending

11 mins 39 secs

Key learning objectives:

Understand the key risks involved in securities lending as well as the key mitigants

Understand the purpose of variation margining

Overview:

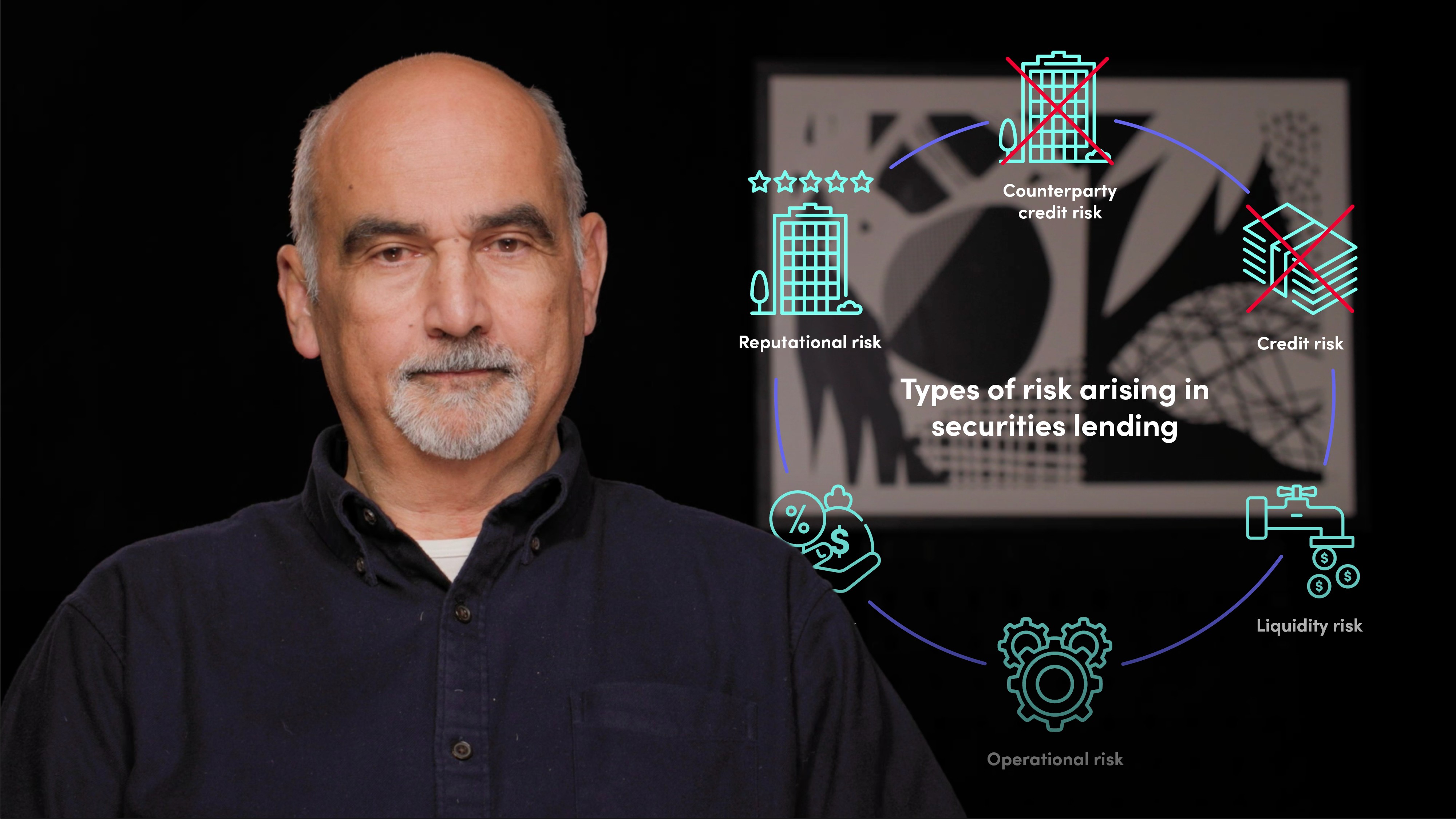

The key types of risks in securities lending includes counterparty credit risk, credit risk on fixed obligations, settlement risk, liquidity risk, operational risk, mispricing risk and reputational risk. The principal risk mitigants in securities lending are counterparty selection, collateral selection, indemnification of clients by agents, accurate pricing of collateral, margin maintenance through variation margining, and transparency. The GMSLA provides for variation margining or margin maintenance, which involves the repeated realignment of the market values of loaned securities with the market values of collateral to eliminate current exposure.

What are the key risks associated with securities lending?

The key risks associated with securities lending are counterparty credit risk, credit risk on fixed obligations, settlement risk, liquidity risk, operational risk, tax risks, and reputational risk.

Counterparty credit risk arises from the possibility of losses being incurred when collateral is liquidated or when trying to replace loaned securities.

Settlement risk is significant in securities lending since exchanges of loaned securities and collateral are rarely simultaneous.

Liquidity risk arises from the possibility of the borrower terminating the loan and recalling cash collateral, which could be challenging to liquidate investments in the money market.

Operational risk is a significant concern in securities lending due to the intricate life cycle of a securities loan.

The use of non-cash collateral and different tax regimes can lead to material tax risks.

Beneficial owners in securities lending are vulnerable to reputational damage due to negative comments in the media about the risks associated with securities lending and its ties to short-selling.

What are the key risk mitigants in securities lending?

Counterparty and collateral selection are the most important risk mitigants in securities lending, as careful selection can reduce the possibility of default and avoid many tax risks.

Indemnification of clients by agents against the risk of a borrower default is also a critical risk mitigant.

Accurate pricing of collateral, initial margins or haircuts, frequent variation margining, and diversification enforced through the use of collateral concentration limits are important on a day-to-day basis.

Robust legal documentation that ensures close-out netting and efficient default management procedures are also essential if a counterparty defaults.

Liquidity risk can be minimised through clear and prudent reinvestment guidelines, while operational risk can be eliminated by automation allowing straight-through-processing (STP) and outsourcing to competent agents.

What is the purpose of variation margining in securities lending?

Variation margining, also known as margin maintenance, is a process of adjusting the amount of collateral by transfers between parties to realign the market values of loaned securities with the market values of collateral to restore any initial margin or haircut agreed by the parties.

The primary aim of variation margining is to eliminate current or mark-to-market exposure in securities lending, and it is usually performed against the net exposure of the whole portfolio of loaned securities and collateral outstanding between two parties.

Variation margining is triggered by differences between two quantities: Posted Collateral and Required Collateral Value. Parties may agree on thresholds below which margin will not be called, and the calculation of variation margin will apply separately to lending and borrowing transactions with the same counterparty.

Richard Comotto

There are no available Videos from "Richard Comotto"