What are the Different Asset Classes in Securitisation?

Francesco Dissera

25 years: Securitisation

In this video, Francesco explains the various types of assets where securitisation can be used. He'll also take us through new asset classes emerging in the ABS market.

In this video, Francesco explains the various types of assets where securitisation can be used. He'll also take us through new asset classes emerging in the ABS market.

What are the Different Asset Classes in Securitisation?

12 mins 28 secs

Key learning objectives:

What is RMBS?

What are commercial mortgage backed securities?

What key products are offered by the Speciality Finance Market?

Do corporates use securitisation?

Overview:

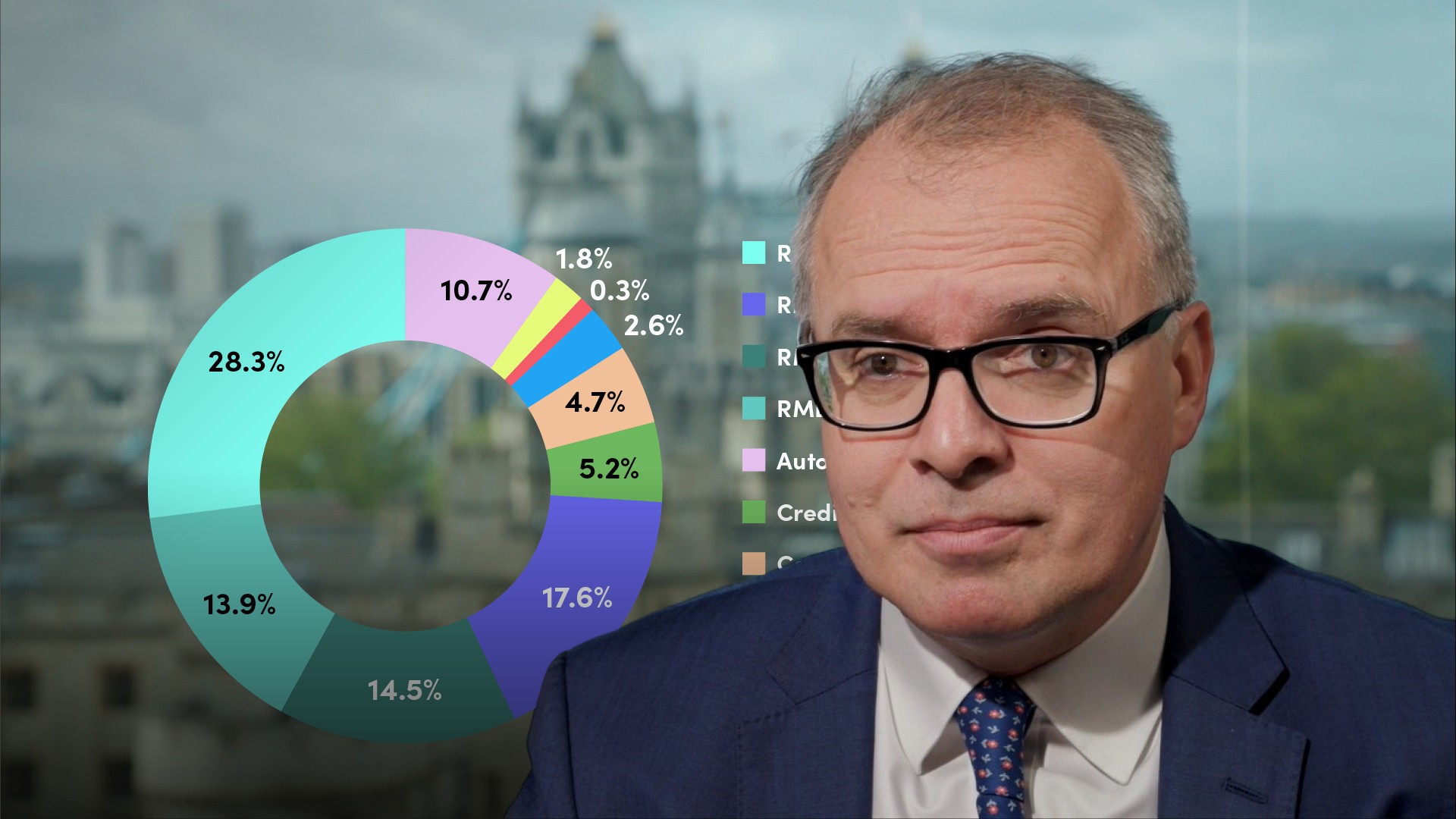

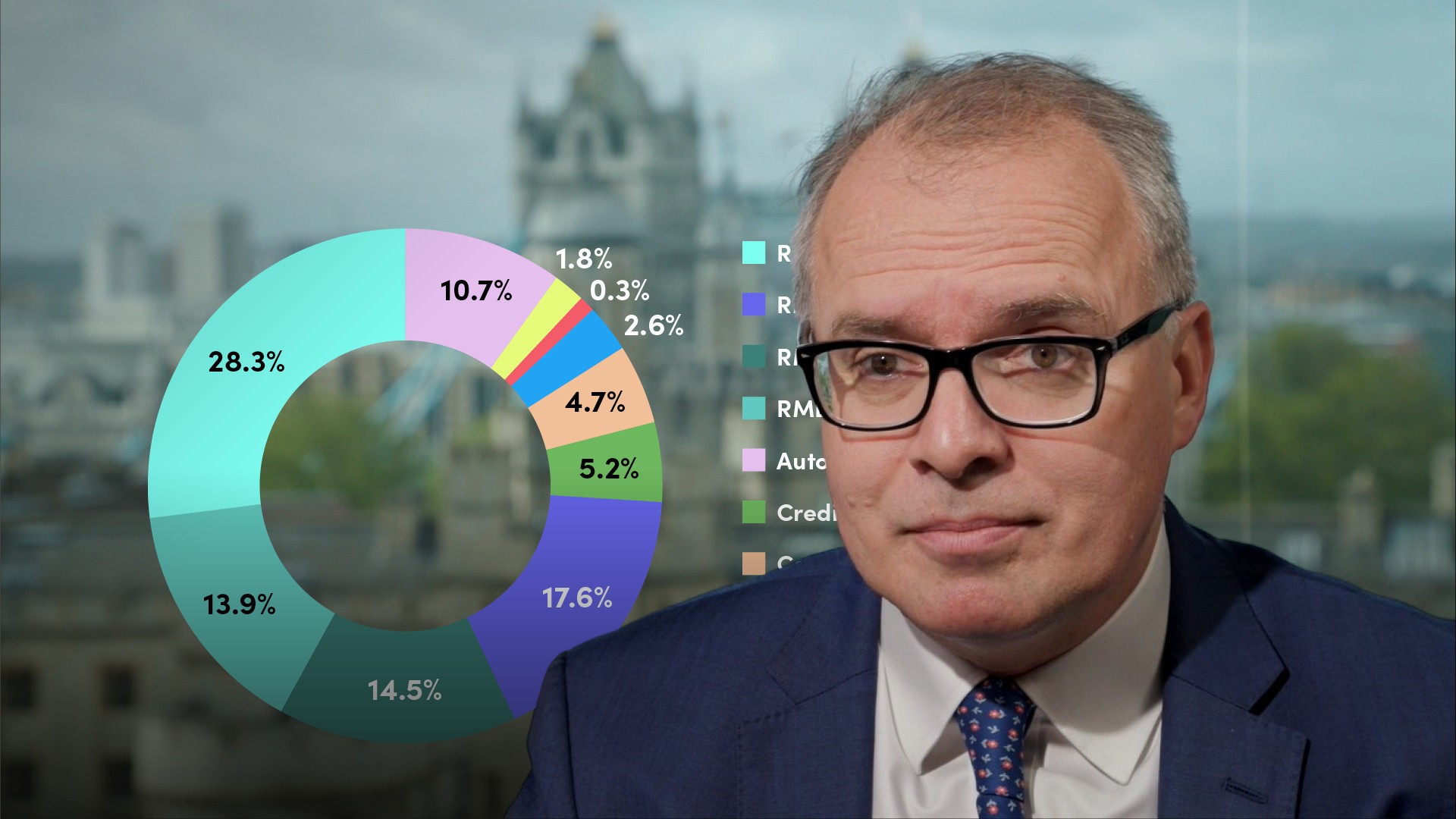

A variety of asset classes can be securitised: the sponsors vary from financial institutions, to alternative lenders to corporates: their motivation is often different, with often transactions executed by banks driven by both capital and funding, while new lenders are more focused in obtaining complementary financing. Corporates are keen to explore securitisation for funding purposes as well as off-balance sheet treatment.

What is RMBS?

Securitisation relies predominantly on residential mortgages and this is the market’s biggest asset class by far. RMBS are residential mortgage backed securities.

What are the characteristic features of RMBS?

- Backed by mortgages to borrowers with high credit scores

- Relatively low loan-to-value

- Typically residential loans with a balance greater than £750k,

- Properties that are relatively simple to value

- The portfolio is made by 100% performing receivables

What are non-conforming loans?

Another RMBS sub-segment consists of non-conforming loans. These are loans that typically lack some of the pristine characteristics of prime RMBS, such as performance or high loan to value ratios.

- Less stringent on the need for payslips

- They are for borrowers that have higher than average income multiples

- Loans where the lender has a subordinated claim on collateral are also called non-conforming

What are subprime loans?

If borrowers have previously had events impacting their credit score; such as prior defaults, missed payments, IVA (individual voluntary arrangements) or currently have unstable income, the RMBS are typically labelled as subprime.

What are the characteristics of the buy to let market?

- Where loans provided by banks and alternative lenders to individual and professional landlords backed by investment properties

- The loan is typically secured by income producing properties – typically a multi-tenanted house or a flat

What are commercial mortgage backed securities?

Commercial mortgage backed securities are transactions where the underlying exposures are loans to commercial property, including shopping centers, offices, retail, logistics, healthcare etc. CMBS are very sensitive to macroeconomic events – and are often correlated to investor confidence and global trade.

What tool can be used to manage NPE exposures through securitisation?

In Italy the framework is called GACS whereas in Greece it is defined as HAPS. As an example, in relation to the Italian GACS scheme, since its inception in 2016, at least Euro 74.8bn of NPL by gross book value has been securitised. GACS has enabled Italian banks to reduce their net NPL ratios from 4.91% in December 2015 to 1.20% at the end of 2020.

What are the characteristics of Alternative Lenders?

- They are typically institutions that are lightly regulated,

- Non deposit takers

- They are typically not subject to capital constraints

- Over the years the number of players has substantially increased

What key products are offered by the Speciality Finance Market?

- Second charge mortgages - up to 30 year loans can be secured by a second ranking charge against the borrower’s home

- Bridging loans - primarily short-term (<18-month) loans and are typically secured against residential property with a maximum LTV of 75% and typically 1% monthly interest rate

- Asset finance - it constitutes loans provided to SMEs to fund the purchase or refinance of equipment. The underlying equipment can be hard (i.e. machinery/vehicles) or soft (i.e. photocopiers/telephones)

- Unsecured consumer lending - entails Personal loans of up to £25,000 available to both prime and non-conforming borrowers. Within this, Prime lending is dominated by banks with non-banks focused on non-prime lending

- Point of sale finance - constitutes Unsecured credit provided to consumers at the point of making purchases with retailers. It tends to have the Best-in-class characteristics such as Strong retailer relationships, efficient automated scorecards and robust fraud prevention measures

- Auto finance - focuses on provision of finance for the purchase of new or second-hand cars with LTVs of 70%-100%. Auto finance contracts are uniquely characterised by voluntary termination rights and some providers are comfortable taking residual value, or RV risk

- Invoice finance - this comprises Short-term (<90 days) lending provided to businesses against the value of their unpaid invoices. This is dominated by banks and is unregulated

- Alternative SME Lenders. These involve short term unsecured loans to SMEs. Alternative SME Lenders are evidently unregulated.

Do corporates use securitisation?

Securitisation was originally used by corporates in the United States – and in particular in the context of the financing of trade receivables. In the normal course of business, corporates and SMEs sell goods and services, they issue invoices that are typically paid within 60-90 days from the issuance of the invoice. These are ideal receivables to be securitised because: They are short dated, they are definitely granular with a strong degree of diversification and, they are ideal for revolving securitisation.

Francesco Dissera

There are no available Videos from "Francesco Dissera"