Reporting Collateral Data II

Richard Comotto

30 years: Money markets

Richard discusses reporting further collateral data. Specifically, he looks at the different types of collateral, at a data field called the General Collateral Indicator, and at referential data about securities collateral and transactional data, such as prices and quantities of collateral.

Richard discusses reporting further collateral data. Specifically, he looks at the different types of collateral, at a data field called the General Collateral Indicator, and at referential data about securities collateral and transactional data, such as prices and quantities of collateral.

Reporting Collateral Data II

13 mins 6 secs

Key learning objectives:

Identify the different types of collateral

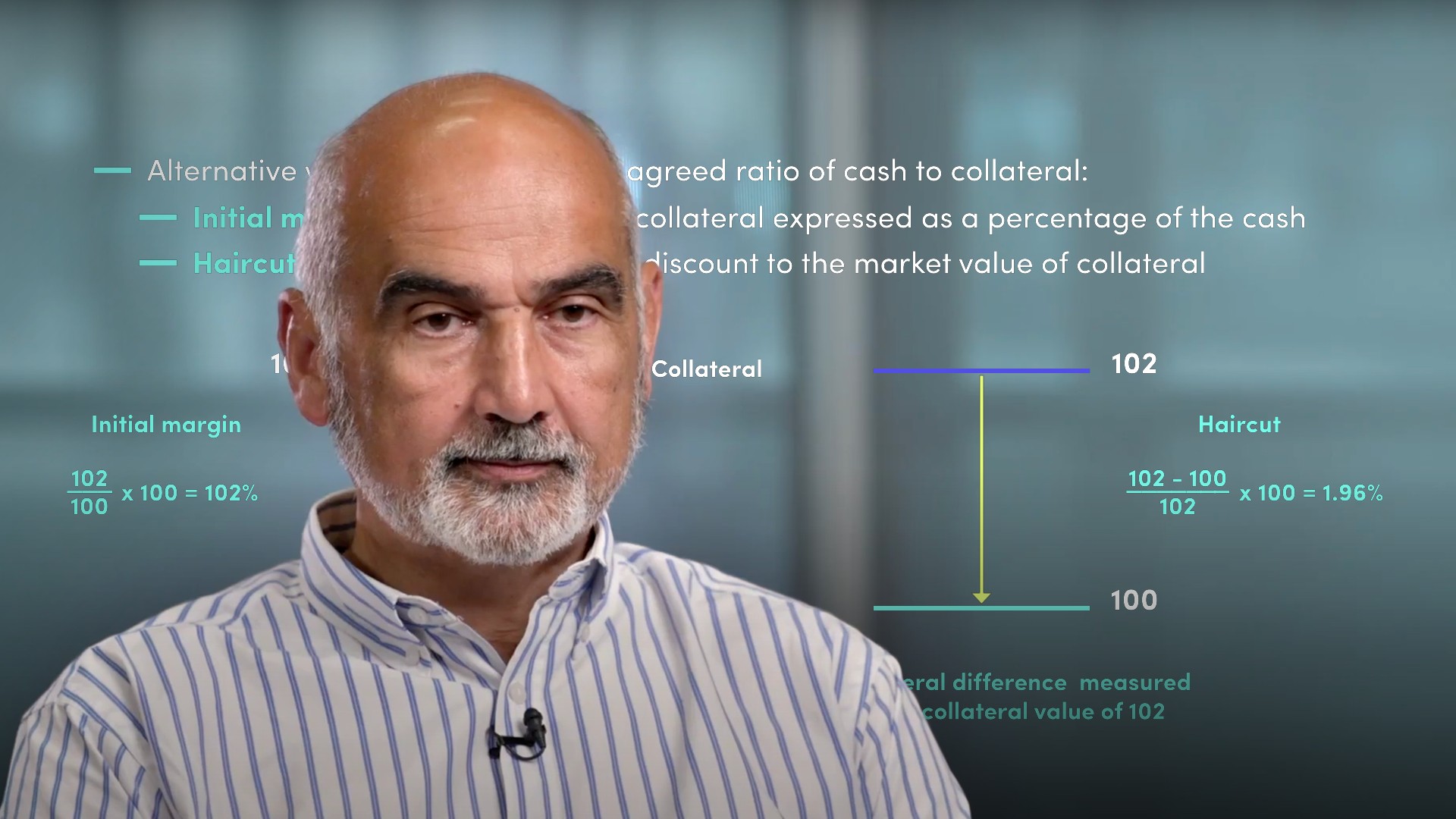

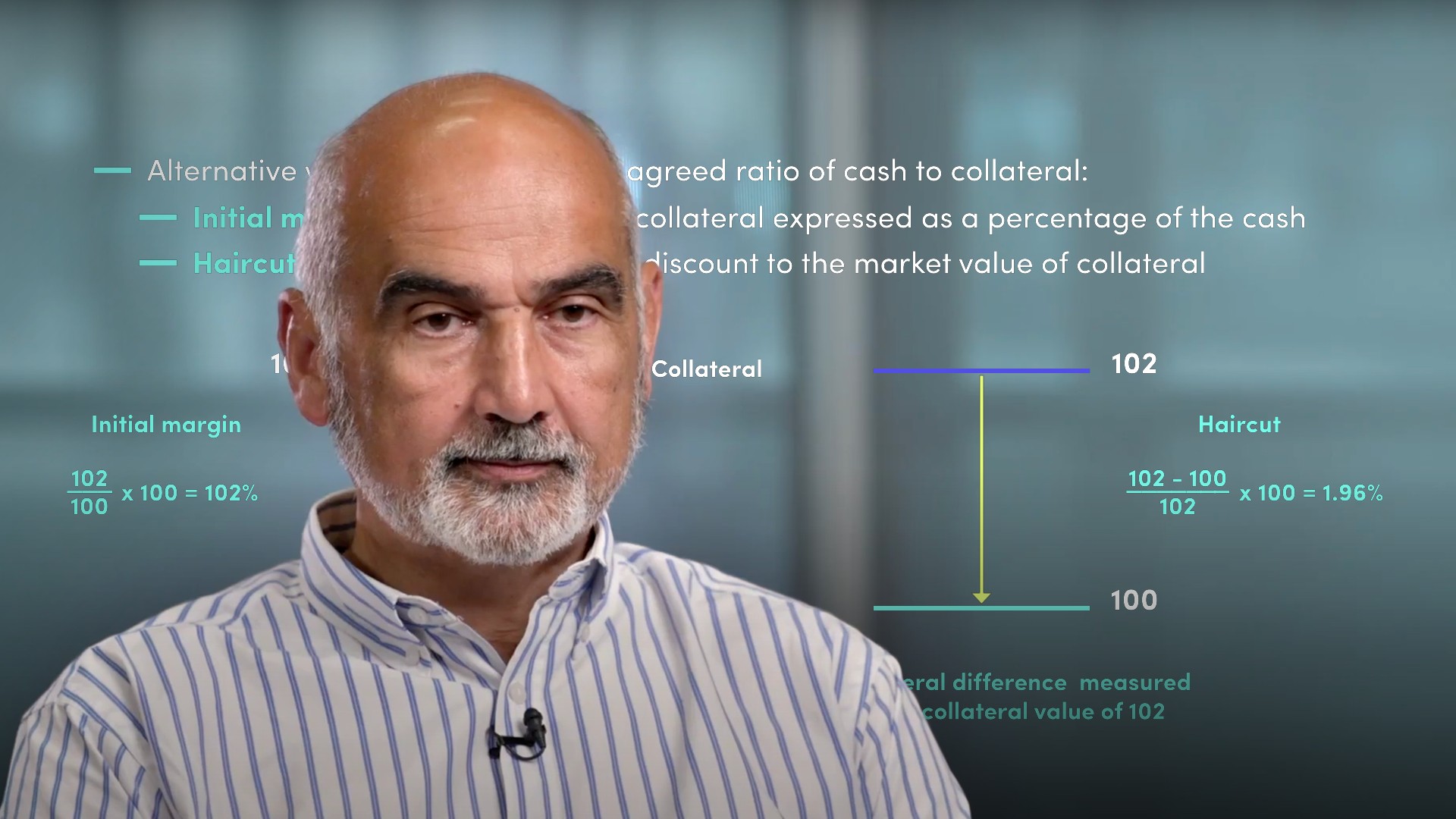

Explain how to report haircuts

Describe the General Collateral Indicator

Understand how to report referential data for securities

Outline the transactional data that is required for collateral

Overview:

SFTR is a major regulatory reporting requirement for anyone transacting repo and other securities financing transactions in the EU, no matter how limited their activity. The reporting requirements cover all aspects of these transactions, including life-cycle events and re-use of collateral, and are therefore complex. In order to meet the regulator’s demand for complete, accurate and timely data, firms are devoting considerable resources to the speedy remediation of rejected or unreconciled reports. It is likely that, at least initially, a high percentage of reports will be rejected or be qualified as incomplete or inaccurate, primarily due to poor drafting of the regulation and accompanying material. This course provides a systematic and detailed insight into reporting repos under SFTR that uniquely incorporates the results of the work by the industry (the ICMA SFTR Task Force) on interpreting the regulatory requirements, filling in the gaps and dealing with the contradictions and mistakes.

Richard Comotto

There are no available Videos from "Richard Comotto"