ESG Ratings & Sustainability Linked Bonds

Stephanie Sfakianos

35 years: Sustainable finance & banking

In this video, Stephanie outlines the drawbacks of relying on ESG scores & ratings, and instead suggests ESG disclosure should be improved to help smaller companies. She further goes on to introduce the idea of a Sustainability linked bond, before finally providing concluding remarks on what the breakdown of market activity will look like in a year's time.

In this video, Stephanie outlines the drawbacks of relying on ESG scores & ratings, and instead suggests ESG disclosure should be improved to help smaller companies. She further goes on to introduce the idea of a Sustainability linked bond, before finally providing concluding remarks on what the breakdown of market activity will look like in a year's time.

ESG Ratings & Sustainability Linked Bonds

10 mins 13 secs

Key learning objectives:

Identify how ESG scores are measured

Understand if ESG ratings really matter

Outline the ongoing international efforts to improve standards

Define sustainability-linked bond

Understand how successful have efforts been to ‘green’ financial markets

Overview:

ESG ratings providers are going to be subjected to a great deal more scrutiny, with accreditation schemes being set up, starting in Europe. However, there are still challenges in how ESG scores are analysed and measured. Smaller companies are finding it difficult to keep up with their larger counterparts, who have dedicated team members focused on ESG efforts.

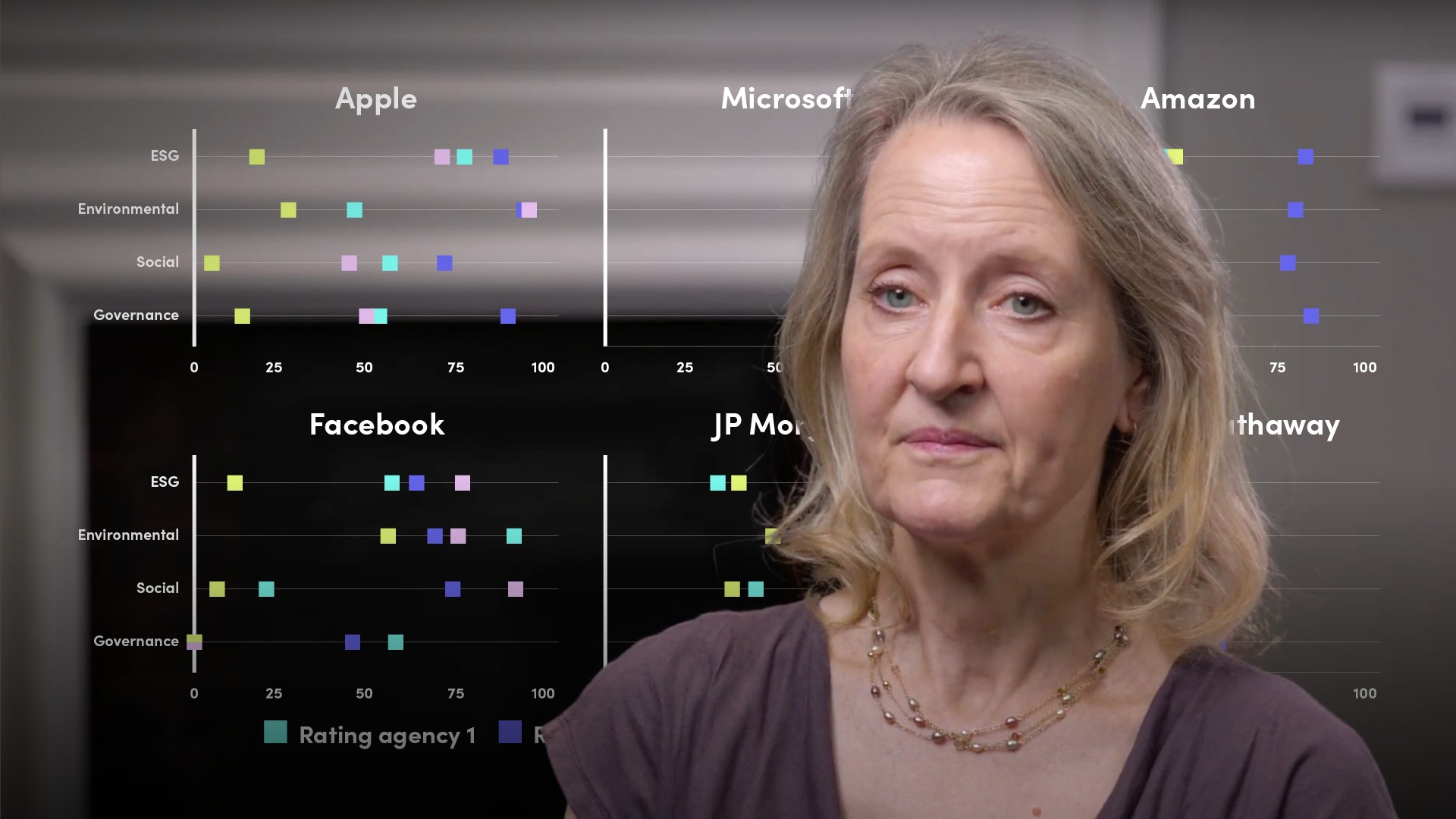

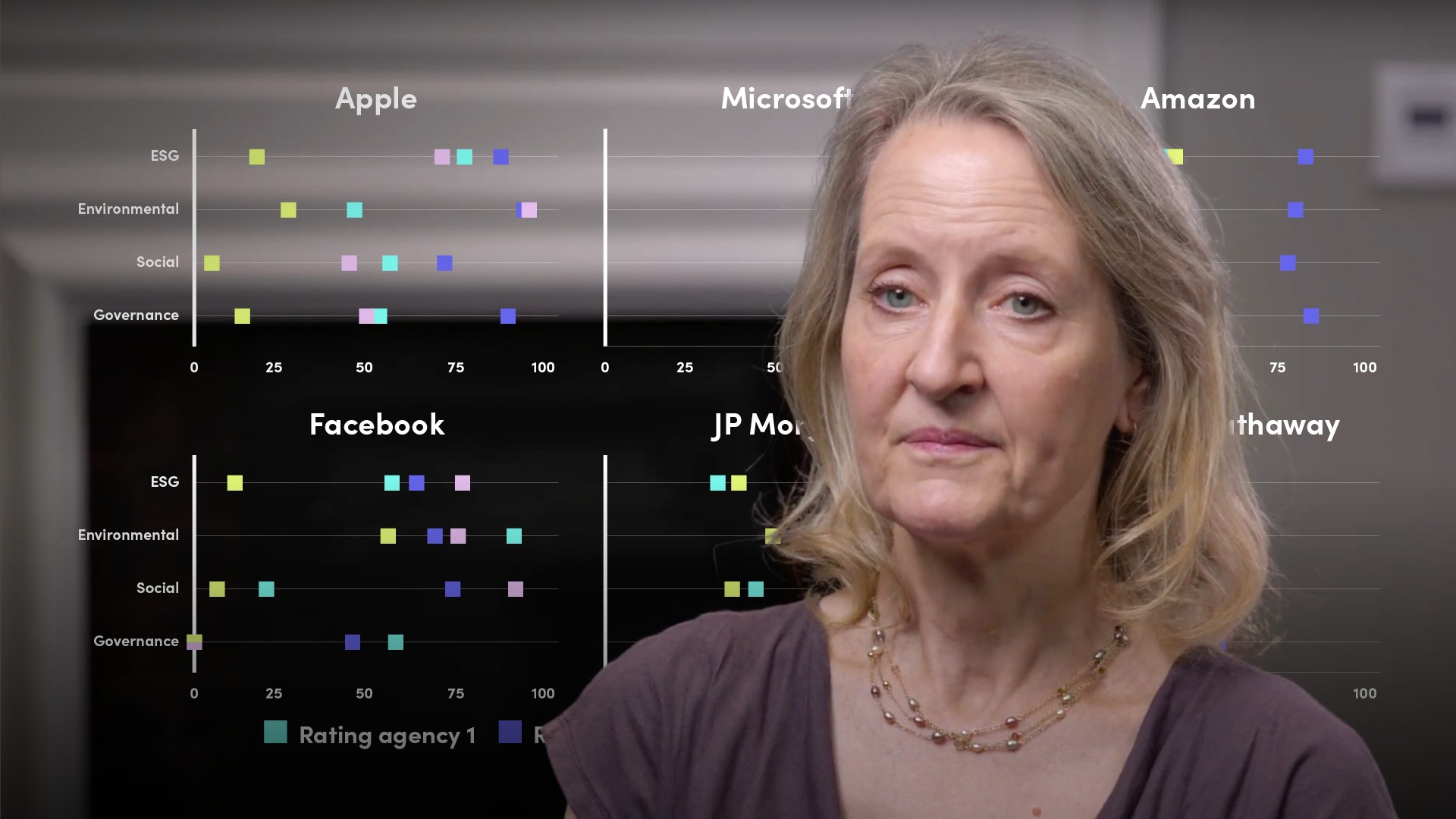

How are ESG scores measured?

Different providers look at different metrics. They weigh them differently and use different algorithms to reach their conclusion. They differ in how they take account of missing data; one might mark a company down for failing to disclose one of their preferred metrics while another gives an industry average. It is clear how differences, and confusion can arise, and how large company bias can result where the rating agency’s response is to mark a company down for failing to provide information. Small companies without dedicated teams can’t provide anything like the level of disclosure available to the largest listed companies, but a failure to disclose may not always mean poor performance.

Do ESG ratings really matter?

- Almost all the large fund managers will tell you that they don’t use these ESG ratings, or at least they don’t rely on them exclusively

- They mainly buy the raw data from a range of providers and do the analytical work themselves according to their own priorities. But with more and more investors claiming to integrate ESG considerations into their decision making, there is understandably some nervousness about quality of ESG analysis as well as quantity

- A recent survey of global assets owners, conducted by FTSE Russell, found that 58% of them expect to apply sustainability criteria in 2020, compared with 44% in 2019

- Another survey, by BNY Mellon, tells us that more than 90% of global public investors such as central banks and sovereign wealth funds either have, or are developing, ESG investment strategies

What International efforts are there to improve standards?

- France has continued to demonstrate leadership in tackling the quality problem, with the government, the central bank and financial markets regulator calling for minimum standards for funds marketing themselves as ESG funds

- The three European Securities Markets regulators, as part of an EU consultation process on the Sustainable Finance Action Plan, have expressed concern about market confusion caused by discrepancies and lack of transparency in non-financial rating agency methodologies and scoring mechanisms and are calling for providers to be regulated

- The European Fund and Asset Management Association wants the European Commission to establish a “single, freely accessible ESG database”

- In Japan, the US$1.6 trillion Government Pension Investment Fund, which is outsourced to external managers, announced it would be scrutinising ESG ratings and index providers in the same way it would asset managers

What is a sustainability linked bond?

The Sustainability Linked Bond breaks with the widely adopted Use of Proceeds model pioneered by the Green Bond Principles. Instead, it is modelled on an approach refined and much used in the loan market, where the money raised or lent is used for general corporate purposes but where the sustainability goal takes the form of a corporate level goal. Examples in the market include Solvay’s greenhouse gas emissions reductions, employment target for L&Q Housing Corp, or meeting the criteria for a recognised external benchmark such as the Global Real Estate Benchmark, which was applied by Thames Water.

How successful have efforts been to ‘green’ financial markets?

The bond market requires a greater degree of transparency, which is essential to prevent green and social washing. Although not universal, there is definitely a groundswell of support for transactions which can demonstrate both ambition in setting a target, and a willingness to incur a meaningful penalty in the event of non-delivery. I understand that working groups convened under the auspices of the Green Bond Principles have brought together a record number of participants, which demonstrates the interest in developing new solutions for greening the financial markets.

Stephanie Sfakianos

There are no available Videos from "Stephanie Sfakianos"