Incremental Value of Social Bonds

Keith Mullin

35 years: Capital markets editorial

In the last video to this series of Social Bonds, Keith discusses the concept of social additionality, the idea whereby positive outcomes accrue solely because of the issuance of social bonds, and that the true investment in the social economy is inflated due to refinancing. If only new projects were included in market volumes, the gross size of the market would reduce dramatically.

In the last video to this series of Social Bonds, Keith discusses the concept of social additionality, the idea whereby positive outcomes accrue solely because of the issuance of social bonds, and that the true investment in the social economy is inflated due to refinancing. If only new projects were included in market volumes, the gross size of the market would reduce dramatically.

Incremental Value of Social Bonds

5 mins 19 secs

Key learning objectives:

Understand additionality in the context of social bonds

Understand how the social bond market would look if only new projects were included in market volumes

Overview:

Additionality refers to the positive outcomes of social or environmental projects that accrue solely because of the issuance of social, sustainable or green bonds; i.e. they wouldn’t have happened otherwise.

What is additionality in the context of social bonds?

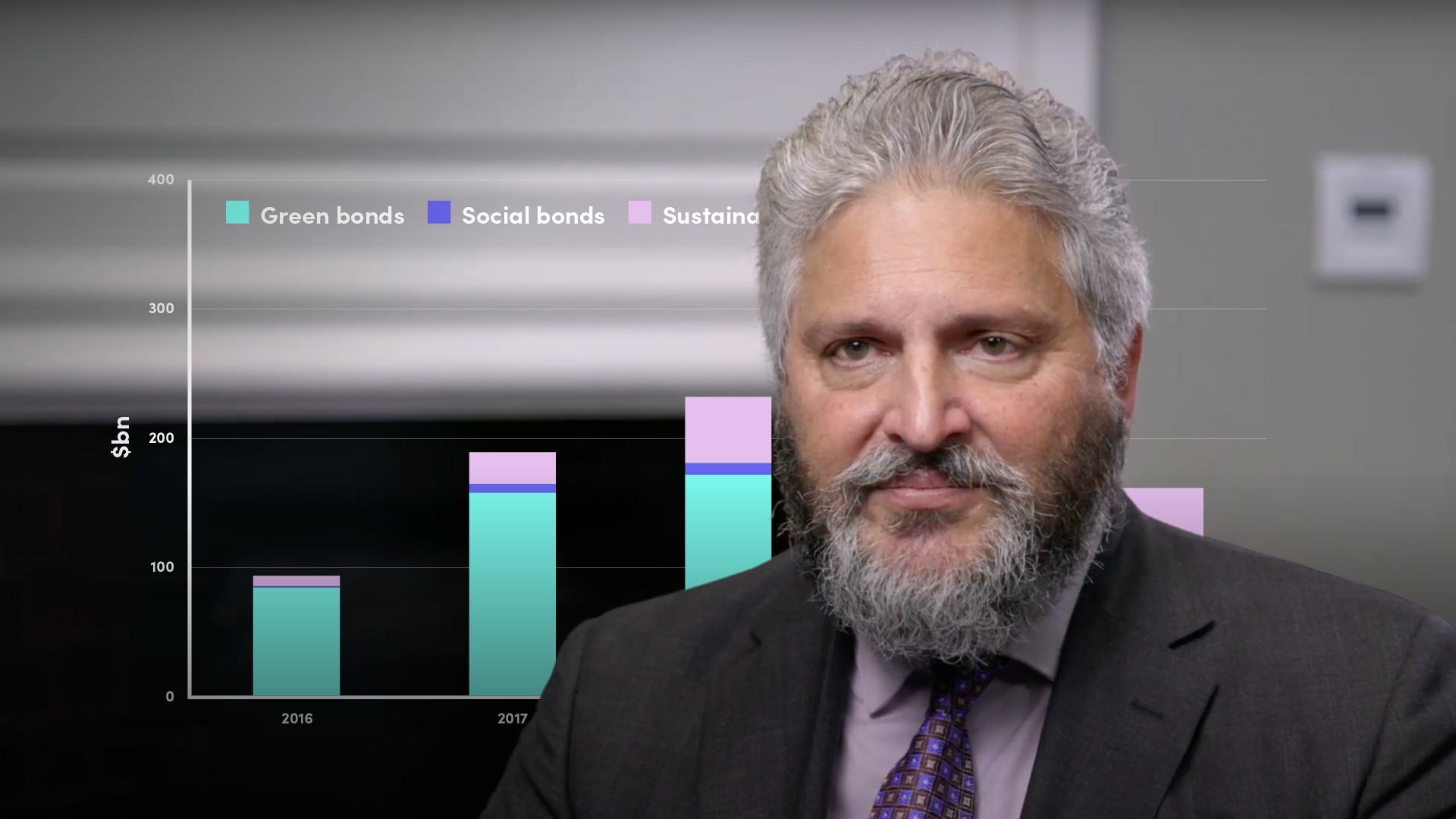

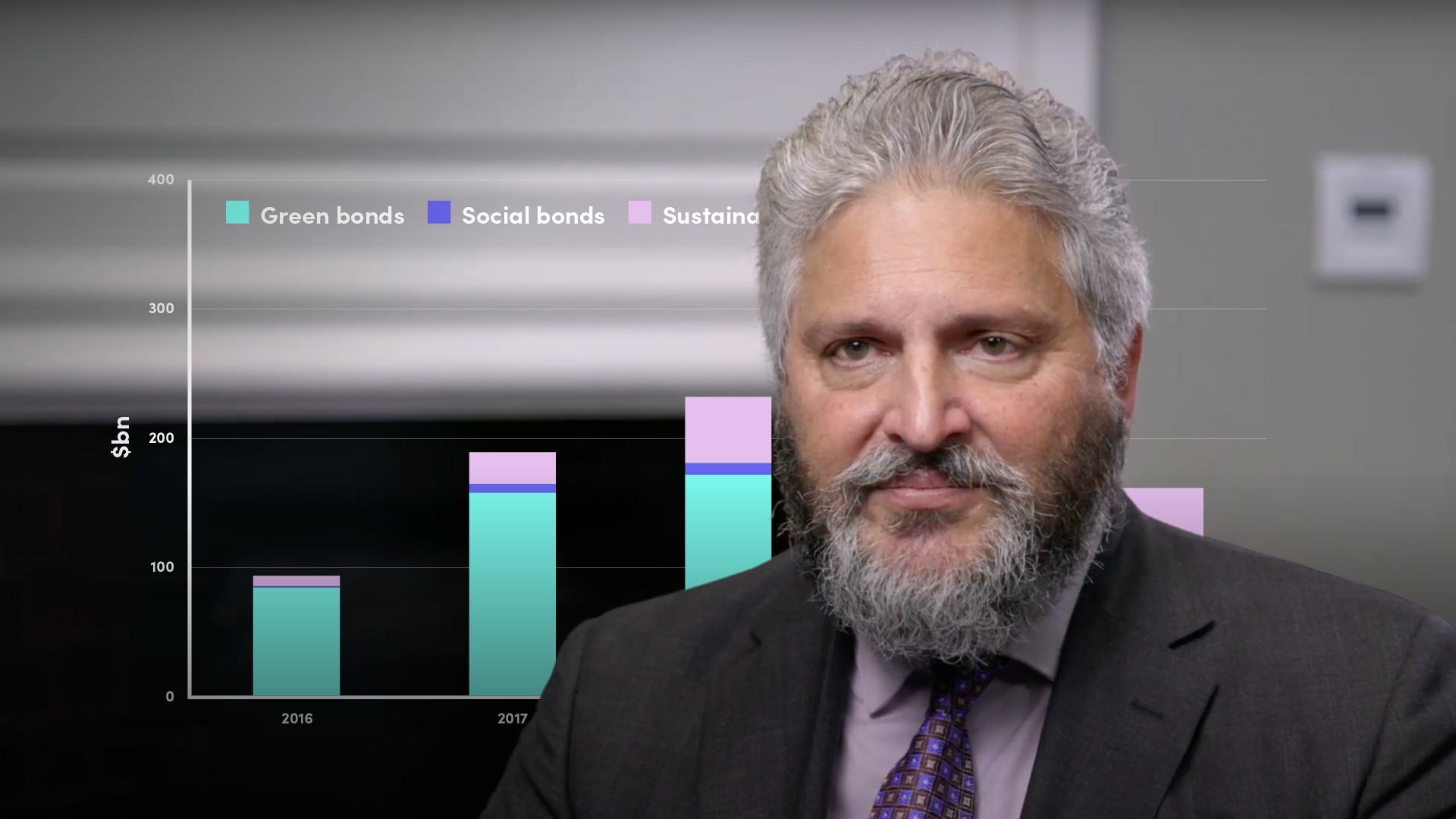

Additionality refers to the positive outcomes of social projects that accrue solely because of the issuance of social bonds i.e. they wouldn’t have happened otherwise. It defines the net positive contribution of the labelled ESG capital markets. The gross volume of social bonds doesn’t tell us much because most do not finance new projects; they refinance existing ones. A $500m social project financed with short to medium-term debt and refinanced twice can be counted as $1.5bn invested into the social economy. But two-thirds of that is merely replacing existing financing. The true investment in the social economy is $500m. Some would say a basic principle of labelled green and social bonds should be that only proceeds that are allocated to new projects should count as this is capital that is additional.

Additionality is the bridge that takes us from a general principle that financing and investing in social projects is generally a good thing to a reality where social projects are driving fundamental change in how issuers think about their businesses, business models and balance sheets at the same time as investors are driving real social impact. Closing the funding gaps that exist across the green and social sphere won’t happen through business-as-usual zero additionality refinancing.

How would the social bond market look if only new projects were included in market volumes?

- Counting only new projects would dramatically reduce the gross size of the social bond market and would render issuance more episodic

- True social bonds would only emerge once issuers had sufficient project portfolios to finance. On the plus side, financing a portfolio that’s already been mapped out would accelerate ramp-up periods

- No additionality = no new proceeds allocated to the green or social economy

- If zero additionality = business-as-usual, some would say that equals social-washing

Keith Mullin

There are no available Videos from "Keith Mullin"