Social Impact Investment & Social Lending Introduction

Stuart Sweeney

35 years: Risk management & social finance

Social investment is the use of money to achieve both a social and financial return. In this video, Stuart provides an introduction to social investment, explaining what it is, the difference between loans and grants and how charities sustain loans.

Social investment is the use of money to achieve both a social and financial return. In this video, Stuart provides an introduction to social investment, explaining what it is, the difference between loans and grants and how charities sustain loans.

Social Impact Investment & Social Lending Introduction

15 mins 25 secs

Key learning objectives:

Define some core social investment products

Understand the concept of social investment

Describe some of the different types of social lending

Identify some of the key challenges of lending to charities

Overview:

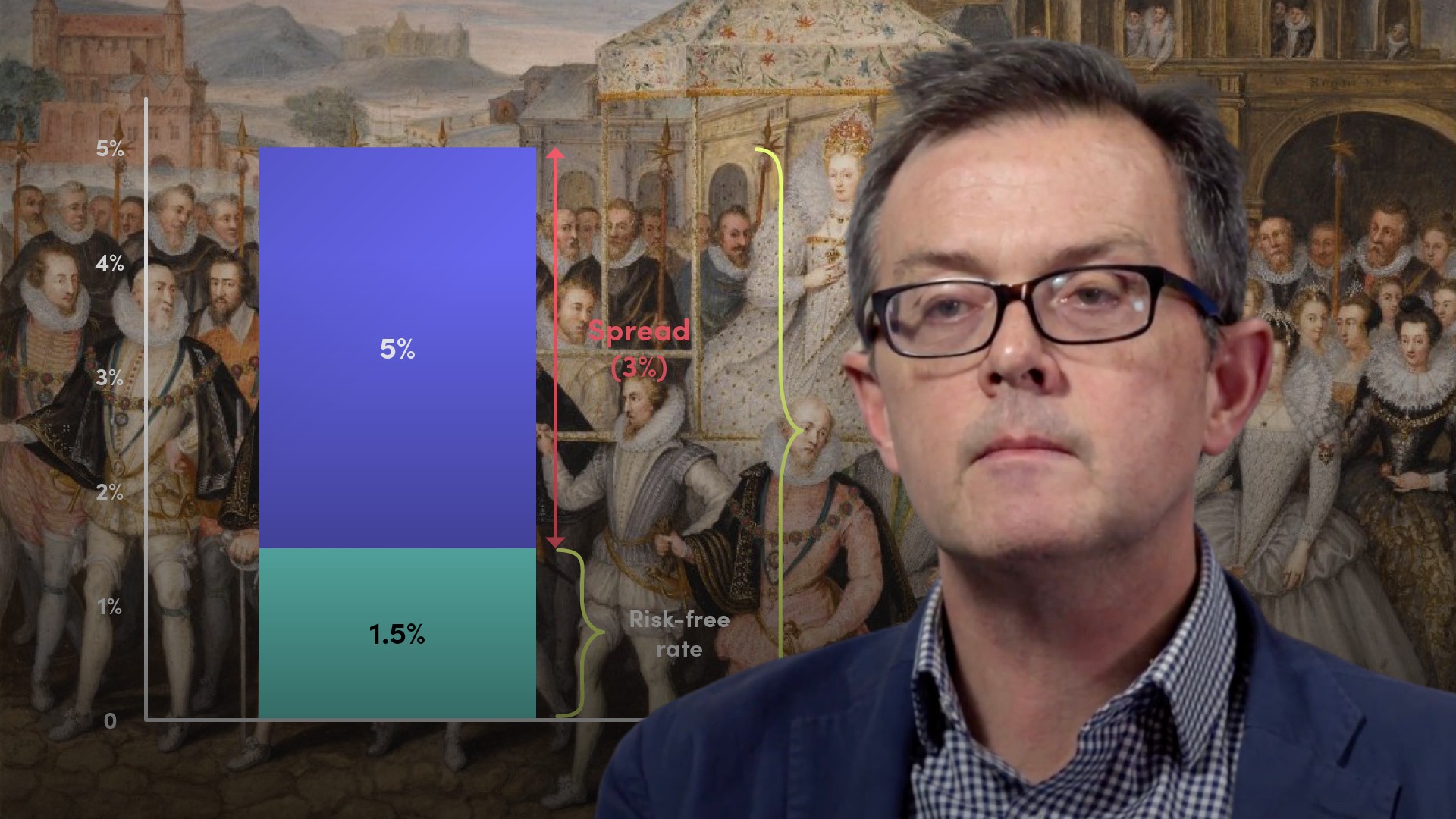

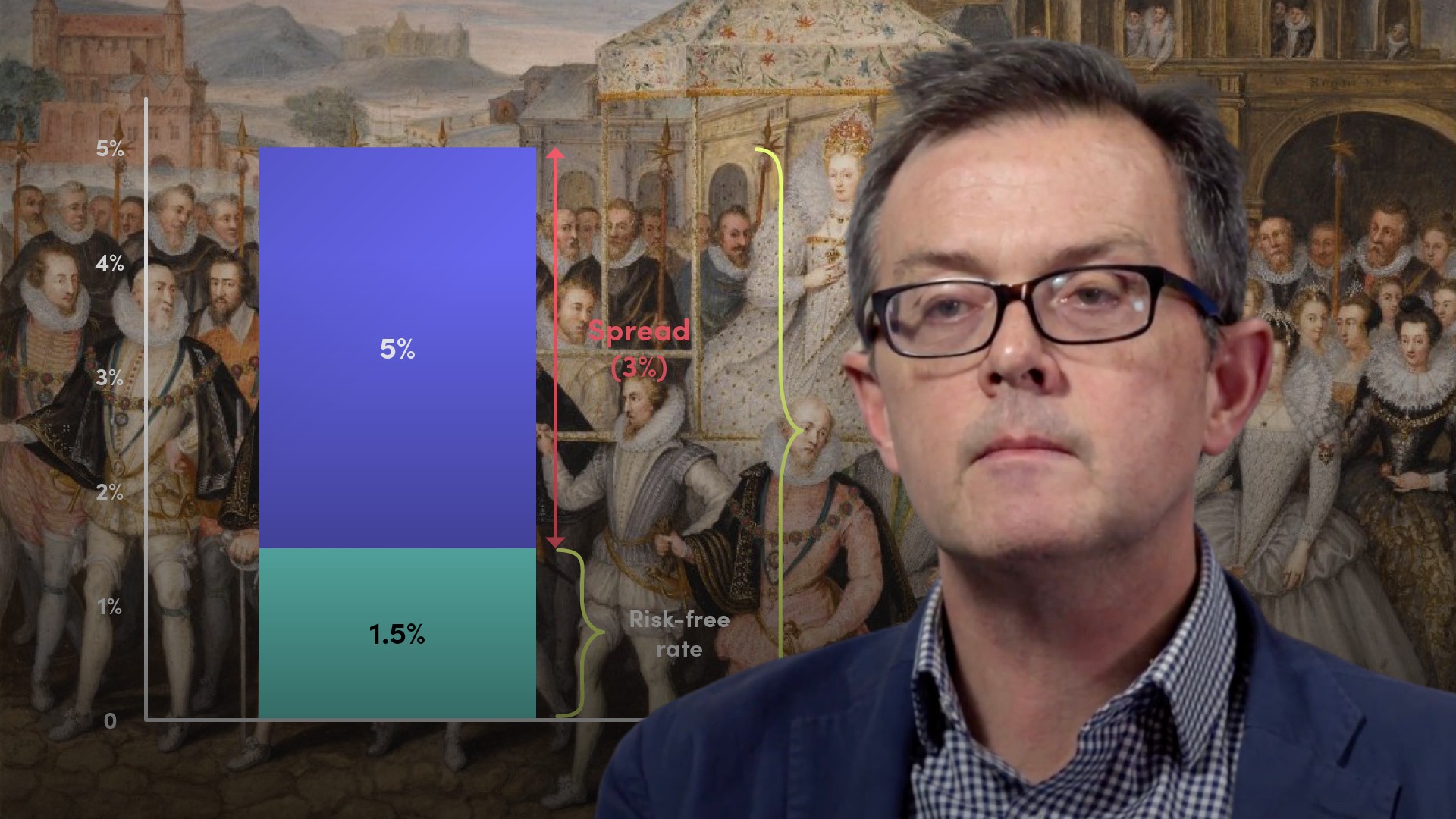

Social investment seeks to achieve a social and financial return. The financial return is measured using a conventional approach. Social impact is added to that financial return to allow an overall comparison with the risk incurred. Social investment is an attractive source of funding for social organisations that struggle to access finance from banks due to their lack of assets that can be secured. It comes with many standard and bespoke formats.

What is social investment?

Social investment looks to achieve a social and financial return instead of just a financial return. The financial return is measured using conventional approaches. A return from the social impact is added to that to allow an overall comparison with the risk incurred.

Impact measurement metrics will vary but funds look at the extent to which the investment is additive in terms of well-being.

Social investment is an attractive source of funding for social organisations that struggle to access bank finance due to a lack of assets that can be secured. Lending can be used for cash flow support, refurbishments, transition to new business models, property and other asset acquisitions and occasionally financial rescues. Terms and conditions will often be more flexible than standard finance. Covenants may well be more forgiving to reflect the social impact and the small size of some of the borrowers

What forms of social lending are there?

Social lenders lend on traditional terms and conditions: interest, some light financial and other covenants and the requirement to repay at the end of the loan. This is more onerous than grant funding but it has advantages:

- It imposes financial rigour on the charity that may allow it to become more sustainable

- The charity can use this discipline to identify reliable service-related cash flows

- This allows them to budget for debt service and principal repayment

Grants will often have debt-like characteristics:

- When financing an asset purchase e.g. a property, providers will often have a security interest

- There can be clawbacks e.g. the grant must be repaid if the service is not adequately delivered

- This would tend to include failure to deliver through insolvency. Grant providers will often sit at the senior creditors’ table

What are some of the challenges of lending to charities?

The damage caused by making poor credit decisions is amplified by the impact on vulnerable people, who may lose their entire support mechanism.

Charities typically have weaker credit profiles than companies and they have no means of raising conventional equity so rely on building up reserves through surpluses or by attracting grant funding. But they are reticent to build substantial reserves as this can inhibit future grant funders from giving. Charities will often maintain property valuations at historical book levels to disguise real reserves.

Charities may have less continuity of cash flows than companies. Contract payments from local authorities are uncertain and commissioners are prone to cancel contracts unexpectedly.

In bidding to provide traditional welfare services from local authorities, some lenders have incurred onerous defined benefit pension obligations in local authority pension schemes.

In small and medium charities where the impact for investors can be greatest, the profile and experience of the CEO and key trustees is indispensable. Continuous financial scrutiny at the board level and the charity’s philanthropic profile can temper worries around leverage and cash flows

Define some core social investment products

- Senior debt: a charity can incur senior secured or unsecured debt, from short-term working capital facilities to 40-year mortgages on properties

- Subordinated debt: sits below senior debt; repayment only after senior debt has been settled.

- Charity bonds: like corporate bearer bonds with annual coupons, standard bond documentation (including generic covenants) and sometimes security.

- Social Impact Bonds (SIBs): Returns linked to the success of the project (an arrangement called Payment by Results [PBR]). Commissioners (typically local authorities, government departments or institutions like the Big Lottery Fund) define project outcomes; delivery partners (charities or social enterprises) seek to provide improved outcomes; investors will analyse the lending vehicles in terms of integrity of contracts and deliverability of outcomes.

- Development Impact Bonds (DIBs): Similar to SIBs using PBR in the context of development projects. Commissioners might be supranational development banks.

- Community Share Issues (CSI): Equity units issued by ‘community benefit societies that allow individuals and institutions to invest in local enterprises, using a crowd-funding platform. Revenue Participation Agreements (RPAs): Loans whose return is based on a performance milestone (typically revenue based).

Stuart Sweeney

There are no available Videos from "Stuart Sweeney"