The 2008 Financial Crisis

Richard Boardman

20 years: Sales & Trading

In this video, Richard explains the circumstances leading up to the infamous 2008 Financial Crisis. He provides a systemic overview of the crisis by focussing on the timeline of events and the financial ecosystem.

In this video, Richard explains the circumstances leading up to the infamous 2008 Financial Crisis. He provides a systemic overview of the crisis by focussing on the timeline of events and the financial ecosystem.

The 2008 Financial Crisis

34 mins 25 secs

Key learning objectives:

Define the 2008 Global Financial Crisis

Define the Keynesian market economy

Define the pre-crisis ecosystem

Identify the factors in the ecosystem that led to the crisis

Learn how the interaction of agents and factors sow the seeds of doom and lead to the crisis

Overview:

The financial crisis was a globally connected episode where confidence in and between banks evaporated, leading to a sharp and prolonged impact on public and private-sector balance sheets. The connectivity and interdependency between banks made the crisis escalate rapidly, leading to severe outcomes. Global growth went into reverse and no area of the world was spared. The eye of the storm was the collapse of Lehman Brothers and related events, but the seeds were sown many years before.

Define the 2008 Global Financial Crisis

The financial crisis was a globally connected episode where confidence in banks and between banks evaporated, leading to a sharp and prolonged impact on public and-private sectors balance sheets. The connectivity and interdependency between financial institutions made the crisis escalate rapidly, leading to severe outcomes. The eye of the storm was the collapse of Lehman Brothers and events anchored around autumn 2008, but the seeds were sown years before. The crisis was liquidity-driven: confidence (particularly between banks) was lost so liquidity i.e. the supply of funds, evaporated. The reduction in private-sector balance sheets, coupled with an explosion in government and central bank balance sheets, is key to how the financial crisis played out.

Define the Keynesian market economy

- Firms exist and draw in labour

- The combination of capital and labour produces goods

- Goods are purchased and consumed by households

- Wages depend on output; the production of goods has a relationship with labour

- To the extent that goods are imported, money flows out of the system (the economy) and vice versa with exported goods

- Governments have a balance sheet and their cashflows come into the economy through spending and investment and leave through taxation

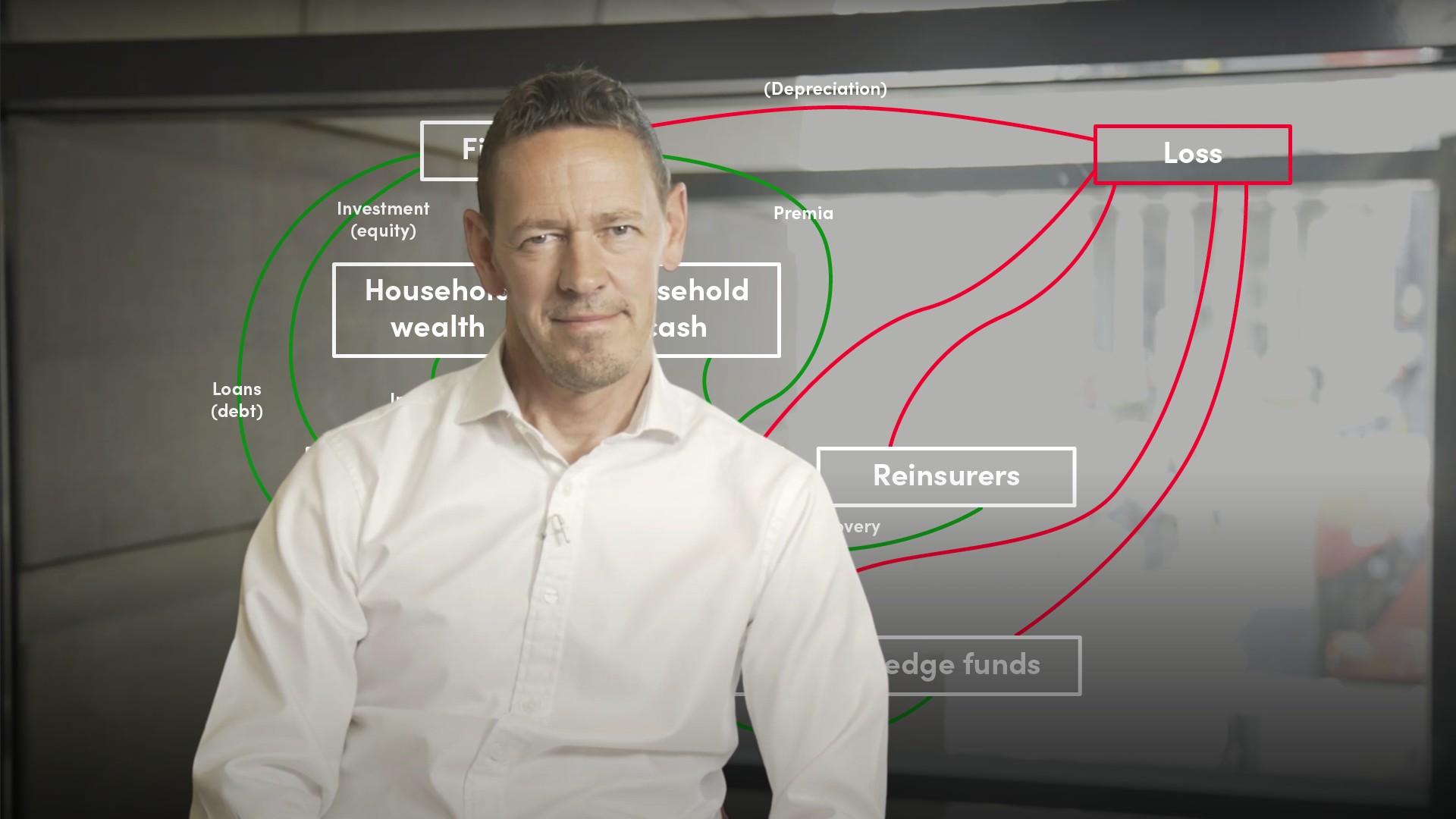

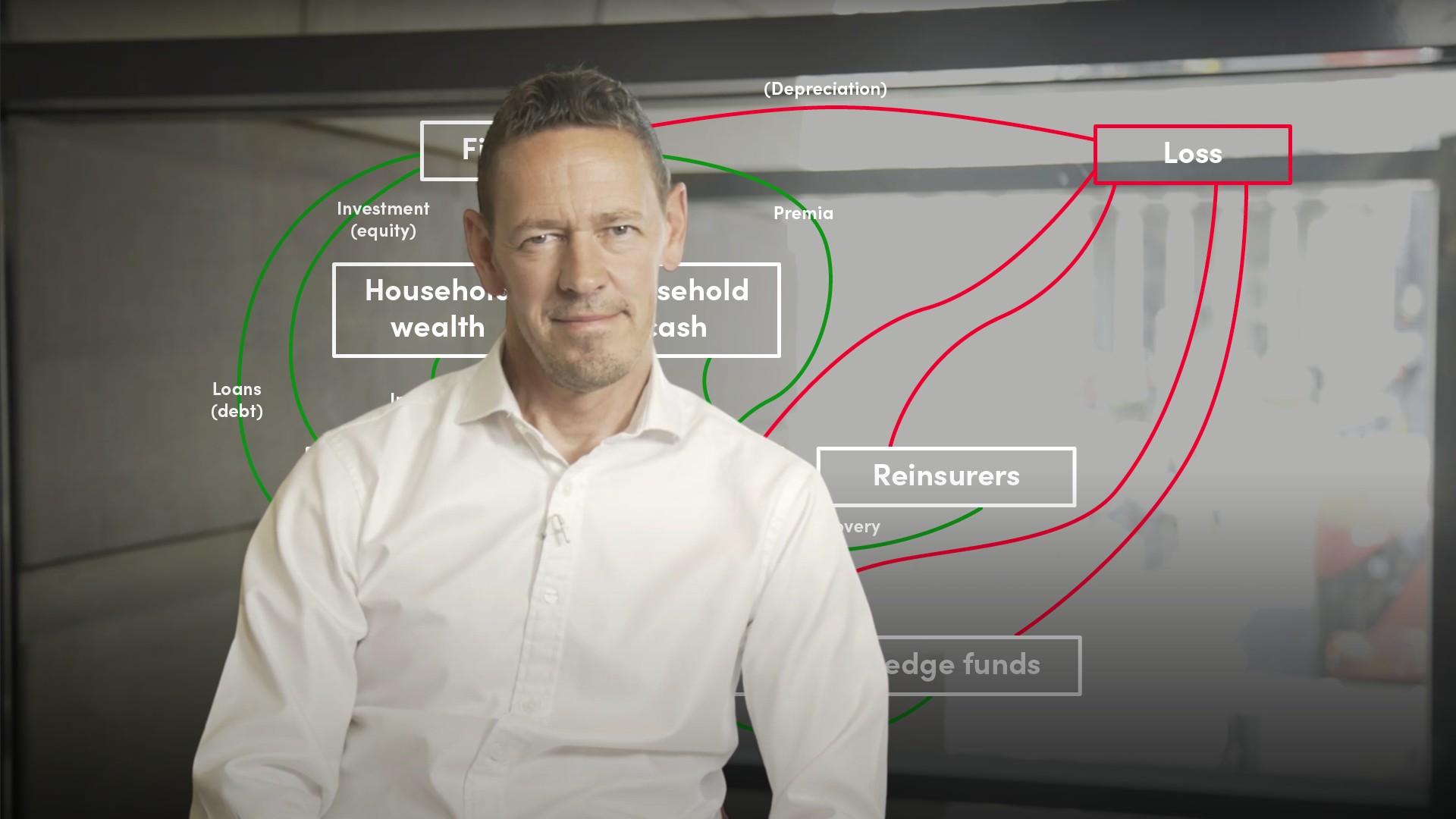

Define the pre-crisis economic ecosystem

- The economic ecosystem is formed by firms and households, and market players such as asset managers, banks, hedge funds, pension funds, endowments, insurers and reinsurers

- Firms construct their balance sheets from loans from banks and loans from households (in the form of deposits), and equity from asset managers and from households (in the form of investments)

- Firms and households pay risk premiums to insurers, which pool and tranche real economic risk

- Asset managers and insurers typically pass financial risk to banks

The concept of economic loss to firms and financial loss to providers of loans and capital allows us to accept that depreciation is constant. To stand still, economies require constant investing. Systemic equilibrium is reached when firms hire, households commit labour and investment, banks lend, and firms borrow and build to hire etc. Disequilibrium - households contracting balance sheets, banks not lending to other banks, players sharply re-pricing real economic and financial risk owing to a fear of loss - leads to financial crisis.

What were the factors in the economic ecosystem that led to the crisis?

Contributory factors:

- Seeds of doom, which led to the crisis and made it so destructive and prolonged

- State of panic: how did the seeds of doom lead the ecosystem into crisis?

- The outcome and the repercussions of the crisis

Agents:

- Governments (which bring about legislation)

- Financial regulators (which deregulated)

- Central Banks (which lowered interest rates)

- Market participants: commercial/retail and investment banks, credit rating agencies and credit reinsurers, and investors

- Homeowners and real estate assets, economic agents interacting with the financial system

Market tools:

- Easy credit

- Special Purpose Vehicles (SPVs) allowing banks to leverage their balance sheets to further grow assets per unit of capital

- The repo market allowing long-term assets to be funded short term, creating cash flow mismatches

- Credit products that existed or were created to grow beyond traditional boundaries of leverage and convert sticky and illiquid products into more liquid products by dissecting risk into compartments to suit a range of different investment tastes. This was for example done via securitisation and tranching, to create liquid products which differed based on risk and yield trade-off

How did the interaction of agents and factors lead to the crisis?

- Desire for economic expansion:

- Influenced the policy of government legislators

- Is underpinned by the mandates of central banks

- Requires easy credit

- Deregulation

- Government legislators flagged to regulators that they are relaxed with a lighter-tough model

- Regulators deregulated financial markets

- Central banks became more synchronised and interest rates drifted markedly lower

- Market developments

- Commercial/retail banks started to merge and align with investment banks

- Banks expanded their Alt-A and sub-prime loan books

- Investment banks innovated credit products to allow a smoother transfer, translation and transformation of sticky credit risk into moveable risk

- Moveable risk became accessible to investors

- Investment banks paid credit rating agencies to rate credit products

- Ratings made credit products accessible to a wider range of investors. As ratings looked better, risk-return trade-offs looked better and there is liquidity in the system to bid and offer the product

- Credit rating agencies began to rate credit insurers, which provided paper guarantees that wrapped and upgraded the creditworthiness of credit products

- Financial models allowed investors and other agents to view risk through a lens that did not allow for sudden and sharp market shocks

- Consequences

- Easy credit, required for economic expansion and permitted by central banks, fuels a housing bubble that draws in new homeowners

- Banks take risk off-balance sheet and securitise credit through SPVs

- SPVs are rated and typically allow the banks to remove mezzanine risk to improve its ability to add more leverage

- Banks finance longer-dated assets in the repo market, which is much shorter term

- Market panic

- Market panic is caused by a freezing of normal market conditions

- Credit product moves from being an unknown unknown to a known unknown to a known known

- Homeowners panic and investors panic sell, crystallising deep mark-to-market losses

- Fears of deflation led to a further fall in bond yields, a collapse in equity markets and recession

- Private-sector balance sheets retrench

- This is partially offset by yawning central government deficits and burgeoning central bank balance sheets

Richard Boardman

There are no available Videos from "Richard Boardman"