The Arithmetic Mean

Abdulla Javeri

30 years: Financial markets trader

Following an overview of the mean, the median and the mode. Abdulla focuses on the arithmetic mean to determine its value as an appropriate measure.

Following an overview of the mean, the median and the mode. Abdulla focuses on the arithmetic mean to determine its value as an appropriate measure.

The Arithmetic Mean

4 mins 16 secs

Key learning objectives:

Understand the arithmetic mean

Apply the arithmetic mean to finance

Overview:

The arithmetic mean is a simple yet important calculation. Using this calculation requires the cognisance of outliers and the best method to most accurately represent the data.

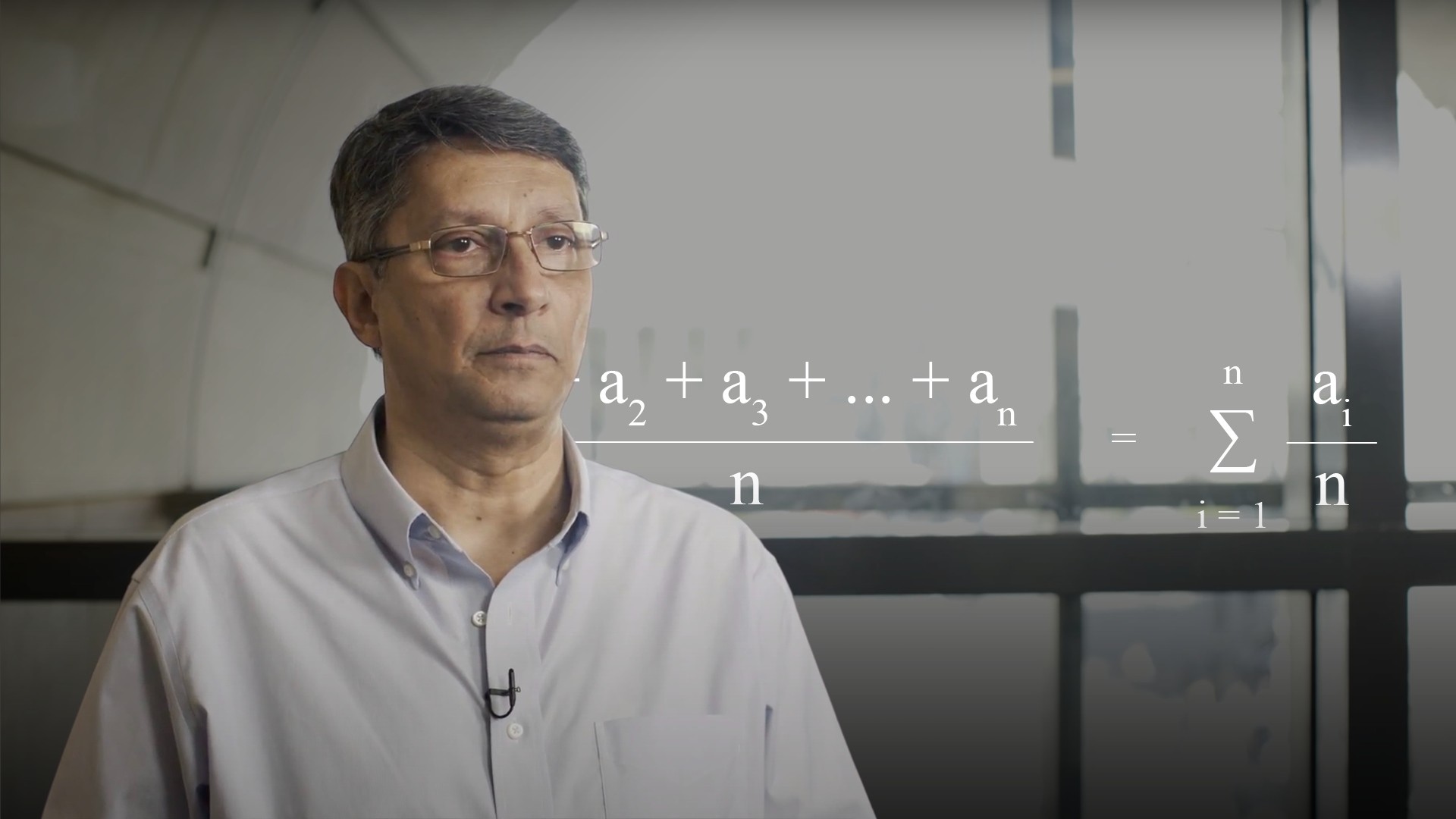

What is the Arithmetic mean?

Arithmetic means are very popular because they are easy to understand and to calculate. All you do to calculate them is to take a set of numbers, 10, 6, and 15 in this case, add them up, divide by the number of numbers you have, which is 3, and you’ve got your average of 10.33.

What is an Example?

We’re going to conduct a survey here of the average salary of people who work in the financial markets. and we’ve almost completed the survey. We just need one more data point. The current average and median are 35,714 and 36,000 respectively. We don’t have a mode because all these numbers are unique.

Someone comes along and we ask them “would you mind telling us how much you earn?” and the reply is one million. This brings the average to 156,250. If we report that the average salary in the financial markets is around 156,000 a year, that’s going to come as a bit of a shock to 7 out of 8 people who work there because that’s nowhere near what they earn.

So we’ve got to look at maybe adjusting this measure or looking at one of the other measures. We don’t have a mode, so let’s just give ourselves a mode by changing a couple of these numbers, 2000 is the mode. We could as a matter of fact report that more people earn 2000 than any other salary, but as a measure of central tendency it clearly looks incorrect.

Because the numbers are so far apart we could get rid of the outliers and calculate a trimmed mean. A cynical way of looking at it is to say let’s get rid of the inconvenient numbers. Let’s remove the million, and the 2000, and that brings the mean back down. But then we have a closer look and say well actually the remaining 2,000 is now an outlying number so let’s get rid of that as well.

At some point you are going to ask yourselves a) how many of these do you need to take out? and b) by taking them out, are you actually making the numbers meaningless? The reason being, because you’re in danger of manipulating the data.

When we value financial assets, our valuations are heavily dependent on some sort of central expectation of future returns. Clearly, if we pick the wrong numbers, we’re going to get incorrect valuations. It is fair to say that although the arithmetic mean is simple to calculate and can very often be a useful measure in our calculations, we need to keep sight of other factors to inform our decision making.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"