The Asset Management Life Cycle

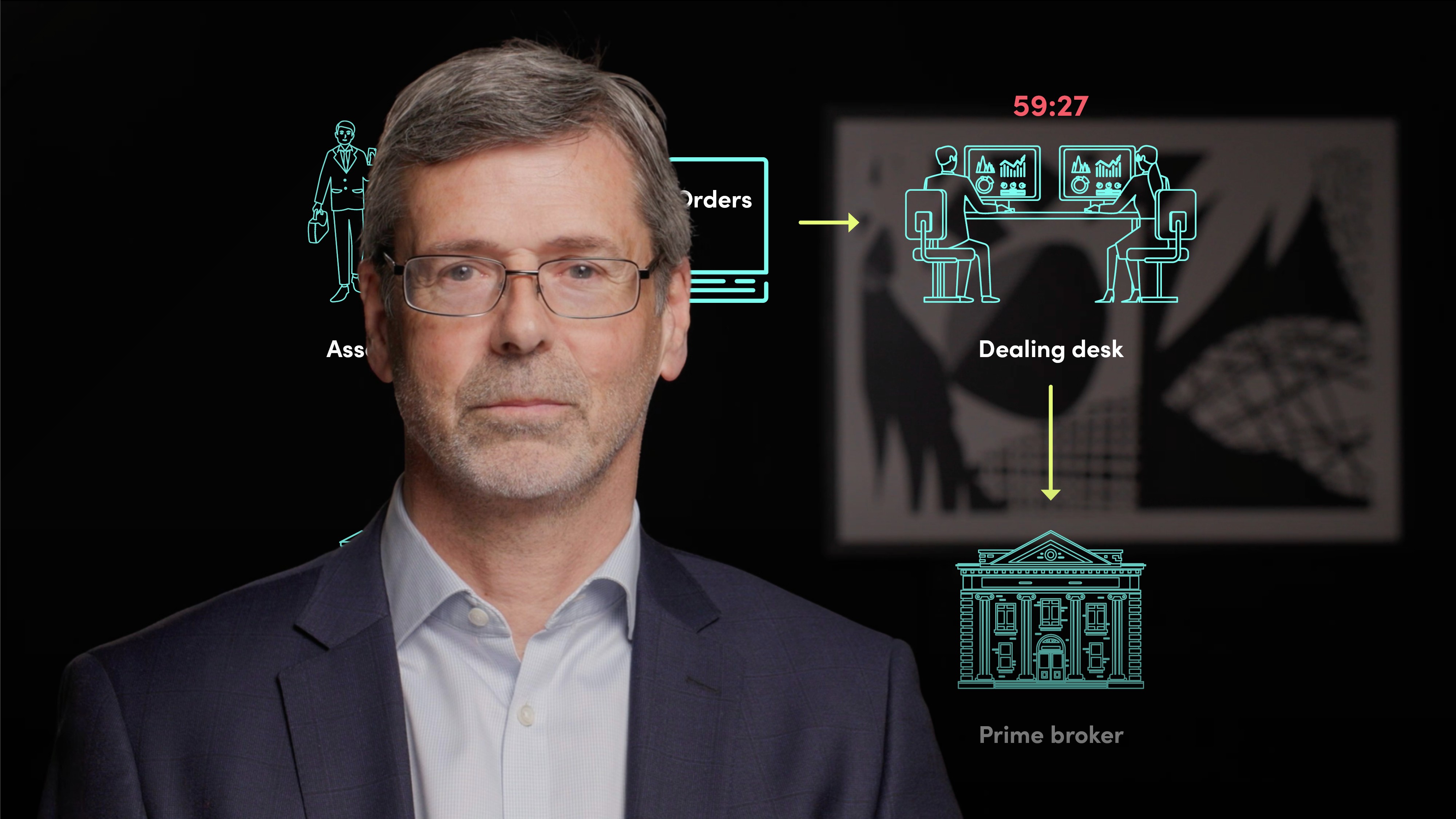

Mark Doran

40 years: Fund management

In this video, Mark explores the ins and outs of the asset management life cycle, including how mutual funds and hedge funds differ from one another.

In this video, Mark explores the ins and outs of the asset management life cycle, including how mutual funds and hedge funds differ from one another.

The Asset Management Life Cycle

11 mins 54 secs

Key learning objectives:

Understand how a mutual fund is created

Outline the lifecycle of a mutual fund

Understand how a hedge fund is created and its goals

Overview:

Although the asset management life cycle of different types of investment funds may be similar in some respects, they also have a number of differences. It is essential that the people working in this area perform their duties accordingly so that their respective funds can operate as effectively as possible for their investors. There are differences in how the funds are set up, managed and their end objectives.

How is a mutual fund created?

Creation of a mutual fund starts with a sponsor, the entity who initiates the creation of a mutual fund, they will approach the local regulator for authorisation and subsequent registration.

The sponsor will then appoint an Asset Management Company to manage the investors money, they will handle the day-to-day operations and money management.

The sponsors then establish a trust and appoint trustees, who are the entity authorised to act on behalf of the trust. Once the trust is registered, it will become known as a mutual fund.

What is the life cycle of a mutual fund?

Once the asset management company has been appointed, a portfolio investment manager is employed to make the day-to-day investments of the fund. They will work alongside a specific person or team of people called asset managers who are responsible for making investment decisions. Their role is to either track or outperform a specific benchmark, and they charge management fees for this service.

The asset management company is split into front, middle and back office. The front office side (asset managers) generate revenue for the company. The middle office must ensure that positions are correct, as well as checking trade confirmations and monitoring settlement activity. The back office is the area made up of non-client-facing administration and support functions. Settlement of units bought and sold in the fund itself and record keeping of what assets the fund owns must be undertaken by this part of the company. They are also responsible for ensuring compliance with any regulatory frameworks. Back office also deals with the creation of financial statements on valuation, as well as corporate actions, and keeping an up-to-date record of ownership within the fund.

What is the life cycle of a hedge fund?

Hedge funds are often domiciled in countries such as Grand Cayman, which have very low income tax for foreign investors. The investment managers can be anywhere, but usually based in London, New York or Singapore.

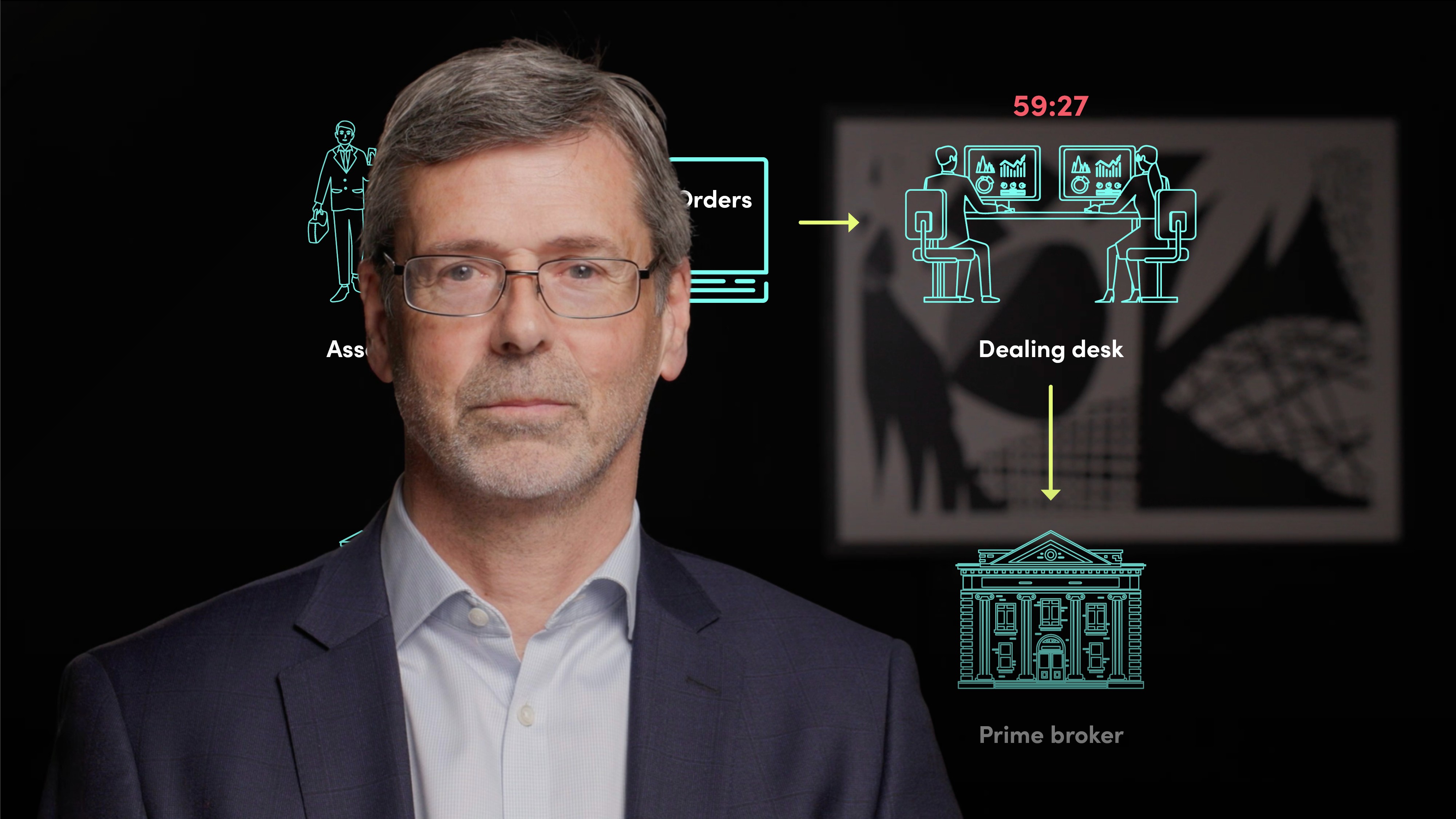

Hedge funds use prime brokers (banks) to fulfil the necessary roles such as trading, settlement, safekeeping, risk management, cash borrowing, stock borrowing, derivatives trading and so on.

Hedge funds are closed-ended companies and only accept investors who suit their investment strategy. Minimum investments vary from $50,000 - $1,000,000 and redemptions are infrequent, making hedge funds illiquid investments.

Strategies of hedge funds are often complex, and investments can only be sold to professional investors.

Hedge fund managers can close the funds in unfavourable market conditions and re-open when the market has improved.

Mark Doran

There are no available Videos from "Mark Doran"