The Changing Role of Cash in the Economy

Sir Mark Boleat

40 years: Executive leadership & banking

The British public is using cash less, preferring to take advantage of new digital payment methods. In this video, Sir Mark Boleat explains trends in the use of cash and analyses issues arising from the move towards a cashless society.

The British public is using cash less, preferring to take advantage of new digital payment methods. In this video, Sir Mark Boleat explains trends in the use of cash and analyses issues arising from the move towards a cashless society.

The Changing Role of Cash in the Economy

10 mins 53 secs

Key learning objectives:

Understand how the way people pay for goods and services has evolved

Understand what has driven the change in the way people pay for goods and services

Outline the advantages of digital payments to consumers

Understand how LINK has addressed the issue of wholesale cash distribution

Overview:

The market is changing rapidly. Within a few years many people will carry no cash and many more retailers will not accept cash. The appropriate policy response is to seek to ensure access to cash for those who need it and to help remove the barriers to using electronic means of payment for those reluctant to use them.

How has the way people pay for goods and services evolved?

- Alternative payment forms introduced by banks, retailers and card companies, in turn each heavily influenced by technological developments.

- Wider societal changes about how people live their lives, heavily influenced by rising real incomes.

- Changing preferences. Some are quick to adopt new payment methods, while others tend to stick with what they know for as long as possible.

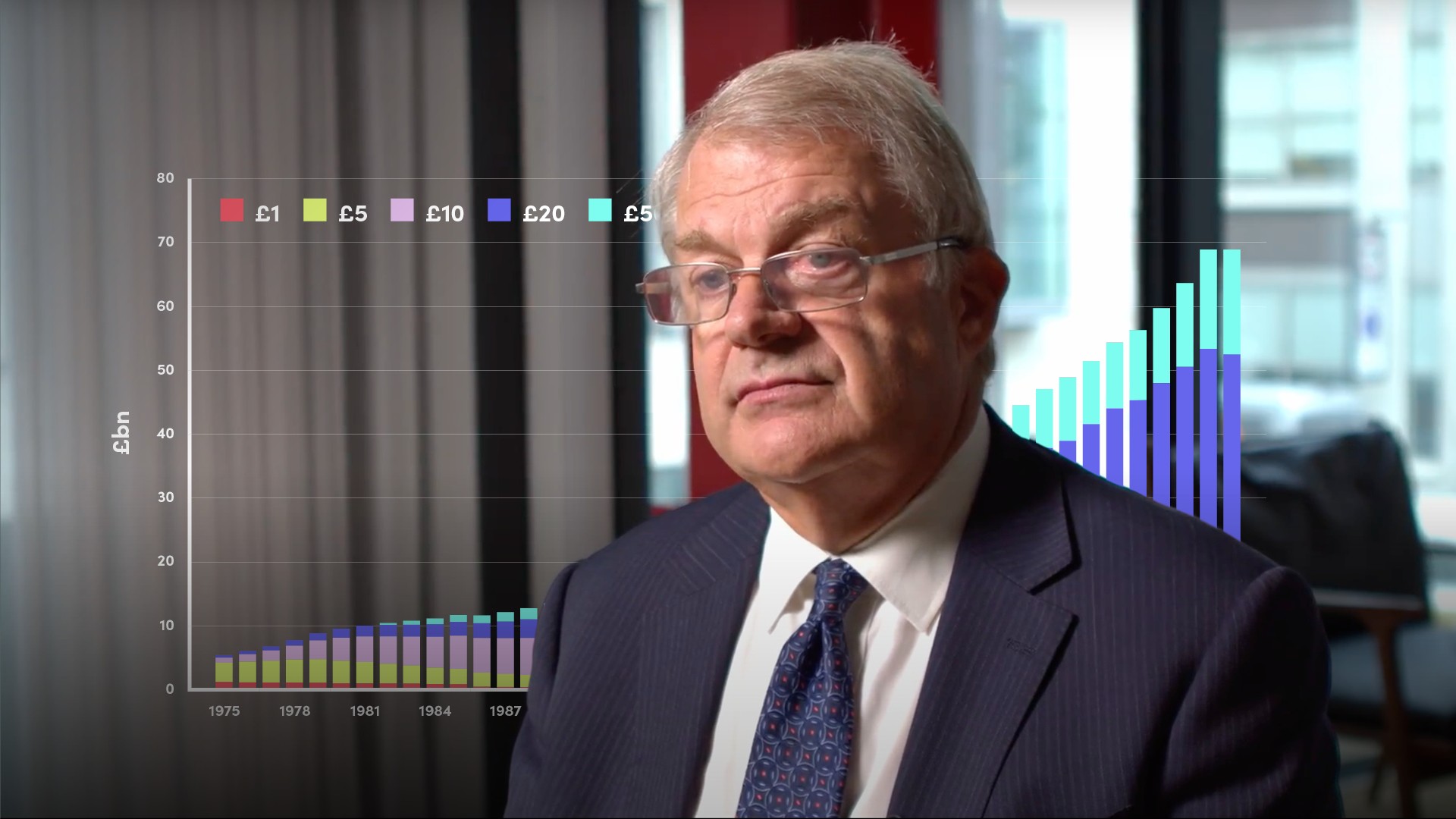

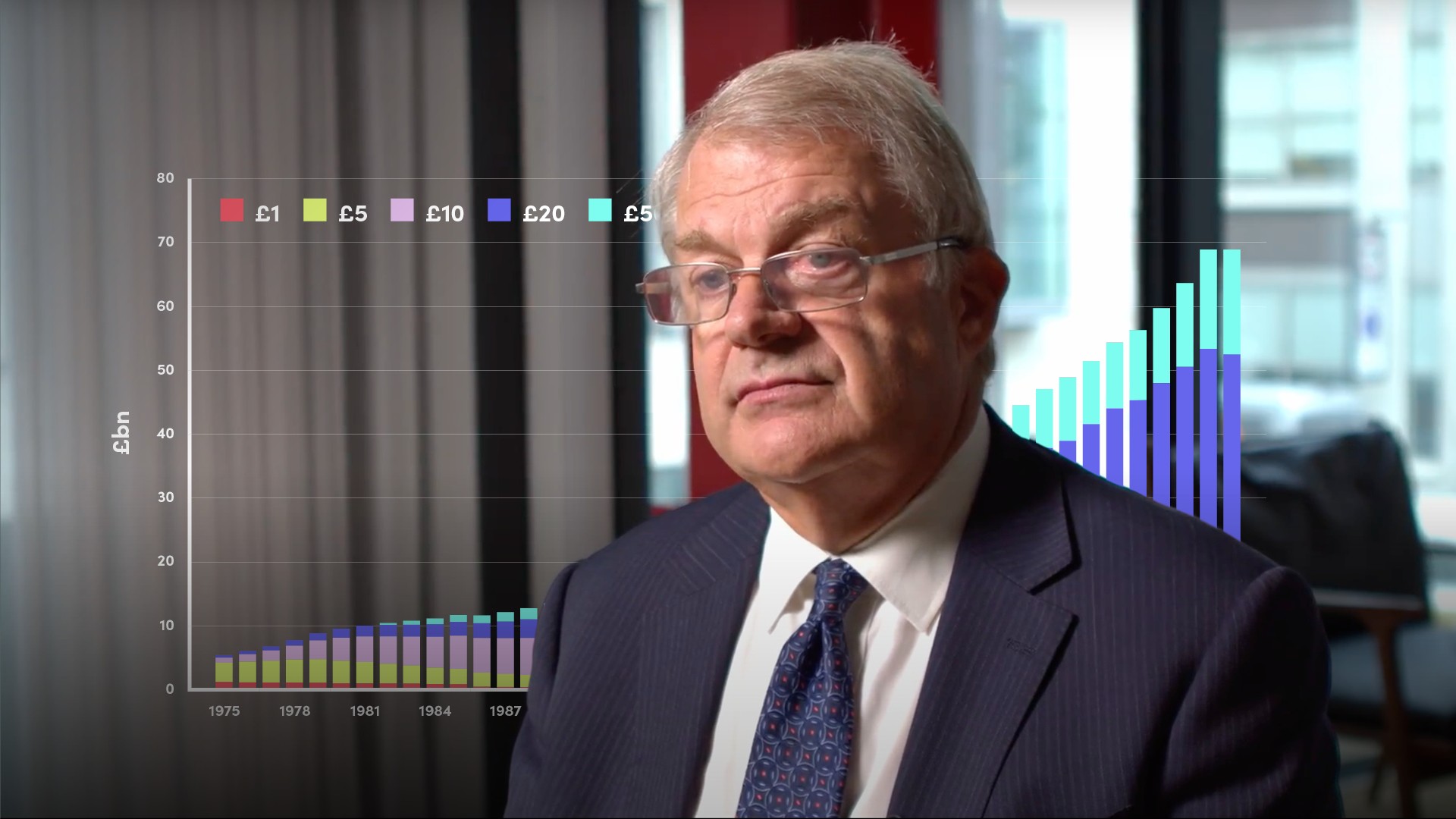

Using statistics, how has the method of UK payments changed over time?

- In 2008, there were 23bn cash payments, 5bn direct debit payments, 2.5bn credit card payments and 5bn other types of payments (standing orders, cheques and direct payments).

- By 2017, debit cards caught up with cash - 13bn payments by each method and 3bn credit card payments.

- UK Finance, forecast that in 2028, there will be just 4bn cash payments and 22bn credit card payments, a complete reversal of the position 20 years earlier. Credit card payments are forecast to increase over 4bn, exceeding cash payments.

What has driven the dramatic change in the way people pay for goods and services?

- Contactless payment cards, combined with a sharp reduction in the cost to retailers of installing the necessary equipment and ongoing costs of accepting payments.

- More recently, alternative payment systems have been introduced i.e. Apple Pay, which works with finger-print or facial recognition.

- The advent of internet shopping has spurred the use of non-cash payments. Goods cannot be purchased over the internet using cash.

- The use of cash is not costless. In round terms, handling cash costs £5bn a year, most of the cost initially being borne by retailers, although ultimately all costs are borne by consumers.

What are the advantages of digital payments to consumers?

- Speed in making payments

- Less need to carry cash

- Increased security - no risk of losing cash or having it stolen, and in practice, even a lost card means no loss to the consumer

- New payment methods automatically provide and retain full details of every transaction

What are the issues arising from the declining use of cash?

- Some people are reliant on cash, either because they do not trust new payment methods, or they are on very low incomes and budget through cash. Similarly, those seeking to hide the nature of transactions and to avoid tax are reliant on the use of cash. However from a public perspective, this move away from cash is welcomed.

- Major banks have sharply reduced the number of their branches, new banks have been established operating entirely electronically, and in the last few years, the number of ATMs has begun to fall. Since 2017, the total number has fallen by 10%.

How has LINK addressed the issue of wholesale cash distribution?

- Increasing the payment that card issuers make to ATM operators for low volume ATMs in more remote areas.

- Directly commissioning ATMs in places where they are needed.

- Formed an alliance with the Post Office which provides free access to cash in all of its 11,000 branches.

- LINK has produced an ATM locator app showing the location of all ATMs, including whether they are free-to-use or charging, whether they issue 35 notes etc.

Sir Mark Boleat

There are no available Videos from "Sir Mark Boleat"