Equity Placements, Open Offers and Rights Issues

Rupert Walford

25 years: Capital markets

In the second video of his series Rupert explains the main equity capital raising options that are available to listed companies. He outlines what a ‘Placing’ is, who can participate in them, alongside their main advantages and disadvantages. In the final chapter Rupert unravels what an open offer is, the period it is open for and when it is typically used.

In the second video of his series Rupert explains the main equity capital raising options that are available to listed companies. He outlines what a ‘Placing’ is, who can participate in them, alongside their main advantages and disadvantages. In the final chapter Rupert unravels what an open offer is, the period it is open for and when it is typically used.

Equity Placements, Open Offers and Rights Issues

13 mins 36 secs

Key learning objectives:

Define Placing

Describe an Open Offer

Describe a Rights issue

Overview:

A Company has decided that it wants to issue equity capital, what options does it have? The main driver of the choice of transaction structure is how much money the company needs to raise.

What is Placing?

An issue of shares that is not offered solely to existing shareholders, sometimes also referred to as a placement, a follow-on offering or a capital increase.

What are the advantages of placing?

- Speed of execution and therefore low market risk

- Low cost due to the short timetable and a more limited marketing process

- Reduced documentation requirements due to less onerous listing authority requirements

- Simple structure

- Usually do not require shareholder approval

- Flexibility of allocation

What are the disadvantages of placing?

- Dilutive to existing shareholders who do not participate

- Short timetable makes it difficult to carry out extensive marketing

- There is no transaction certainty as it is not usually underwritten

What is known as a conditional placing?

When a company wishes to undertake a placing which is larger than the non-pre-emptive threshold. It will need to seek shareholder approval to carry out such a placing.

What is an Open Offer?

It is an offer of shares solely to existing shareholders at a fixed subscription price. Open offers are almost always combined with a placing. The effect of this is that in the event that the open offer does not achieve full take-up, the places in the conditional placing will take up the shortfall. Another reason for combining a placing with an open offer is to give existing retail shareholders more time to be able to participate.

What are the advantages of Placing and Open Offers?

- Flexibility of allocation

- Reasonable certainty of funds provided by the conditional placing element

- Fairly quick process

- The 10-day subscription period allows more extensive marketing

What are the disadvantages of Placing and Open Offers?

- Not fully preemptive

- More complex than a straight placing

- A listing prospectus will be required

- Size and discount restrictions can restrict flexibility

- May require shareholder approval

- Involve increased process, cost and timetable compared to a non-pre-emptive placement

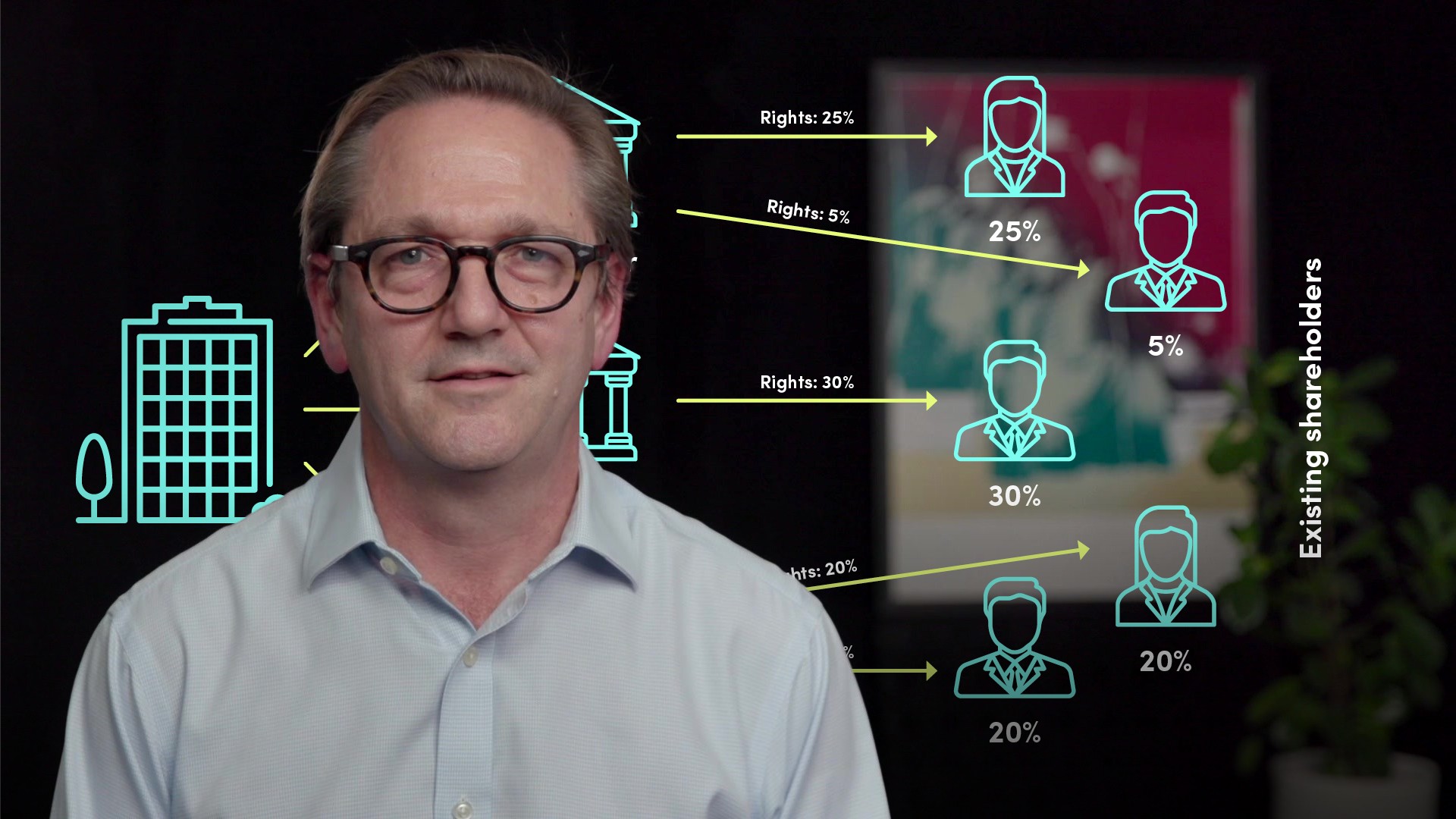

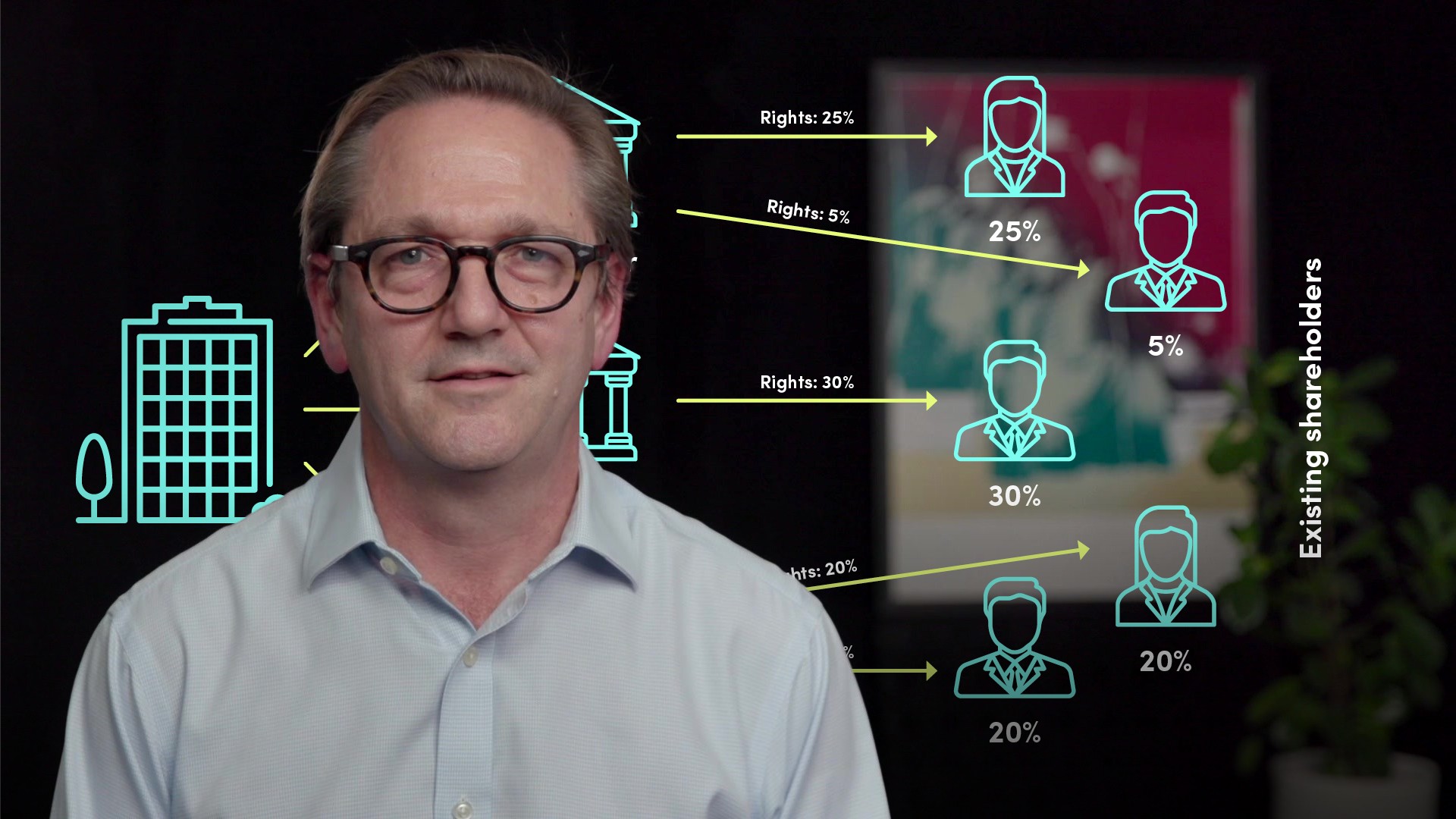

What is a Rights Issue, and when are they required?

A rights issue is an offer of shares made via the issue of rights to subscribe for the new shares to existing shareholders. They are required:

- For larger capital raises

- Where the company needs certainty of funds via underwriting

What are the advantages of Placing and Open Offers?

- Certainty of funds

- Fully pre-emptive

- Existing shareholders are incentivised and rewarded through their tradable rights

- No size or discount restrictions

- Longer timetable allows extensive marketing

What are the disadvantages of Placing and Open Offers?

- Limited or no flexibility of allocation

- Quite complex transactions

- A listing prospectus will be required

- Negative perception of a deep discount

- Greater market risk

- May require shareholder approval

- Highest cost and process

Rupert Walford

There are no available Videos from "Rupert Walford"