The Geometric Mean

Abdulla Javeri

30 years: Financial markets trader

Abdulla outlines how to use and calculate the geometric average or geometric mean, also referred to as CAGR- the compounded average growth rate.

Abdulla outlines how to use and calculate the geometric average or geometric mean, also referred to as CAGR- the compounded average growth rate.

The Geometric Mean

4 mins 41 secs

Key learning objectives:

Understand the geometric average

Identify the situations in which the geometric average is more appropriate than the arithmetic average

Overview:

The Geometric Mean is also known as the compounded annual growth rate. The example below shows how to use the geometric mean to calculate the return on a portfolio. It is important to understand that the geometric average should be used instead of the arithmetic mean in the context of a time-series calculation.

What is the Geometric Mean?

The Geometric Mean is also referred to as CAGR, the compounded average growth rate.

How do we calculate the Arithmetic Average?

An example of a portfolio’s return over two years:

In the first year you double your money, and in the following year you lose 50%. If you work out the arithmetic average, you’ll get an annual average growth rate of 25%. That is, 100% minus 50% divided by two. Compounding up at 25% a year should result in a growth in the portfolio value of about 56% over two years, using the formula in the graphic below.

Why is the Arithmetic Average inapplicable in the example?

The reality is, there’s been zero growth in the portfolio. If you go from a starting value of 100, and you double your money in year one, you’ll get to 200. If you then lose half of that in year two, you’re back to 100 again.

Clearly we need a different average, enter the geometric average.

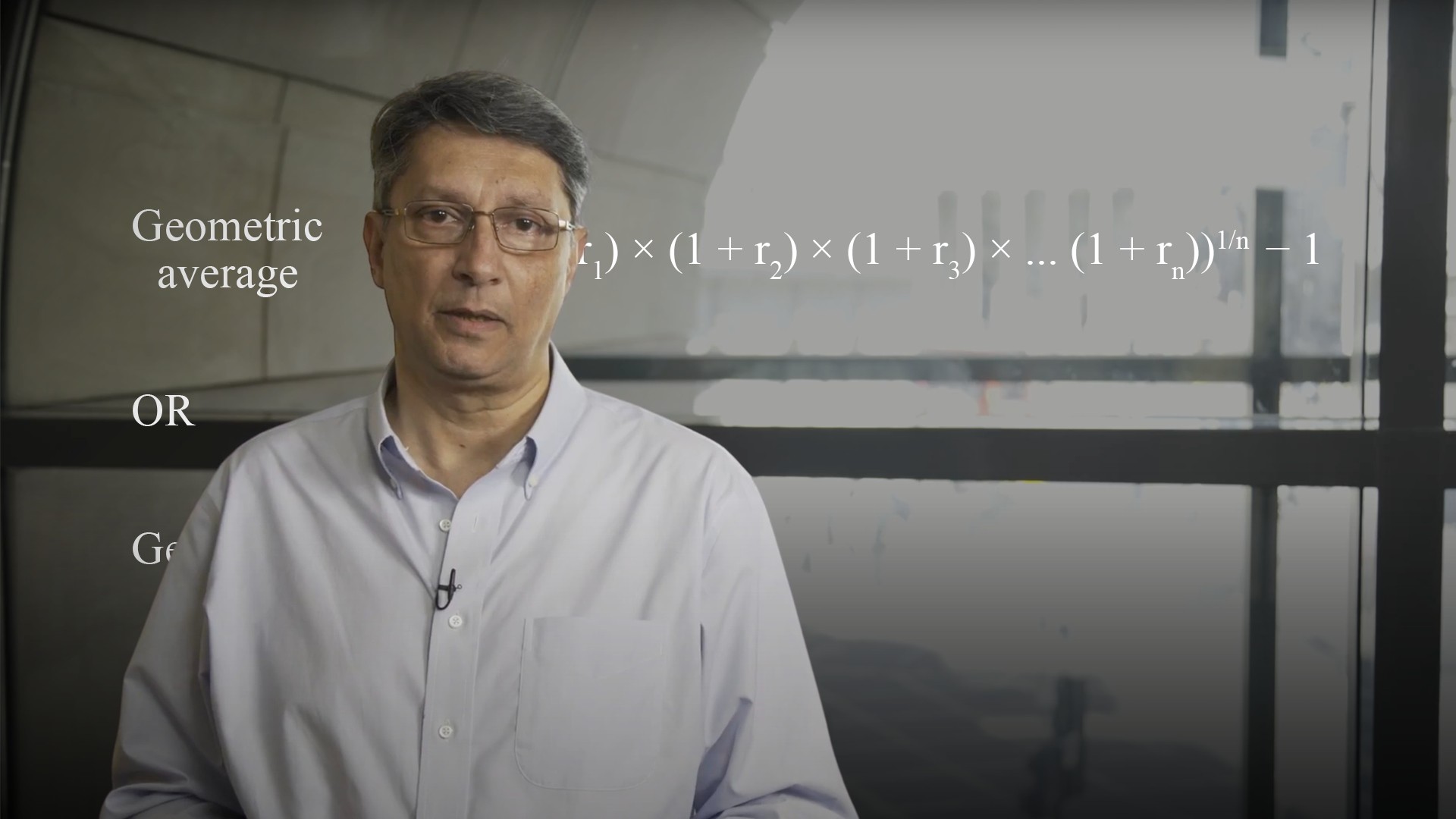

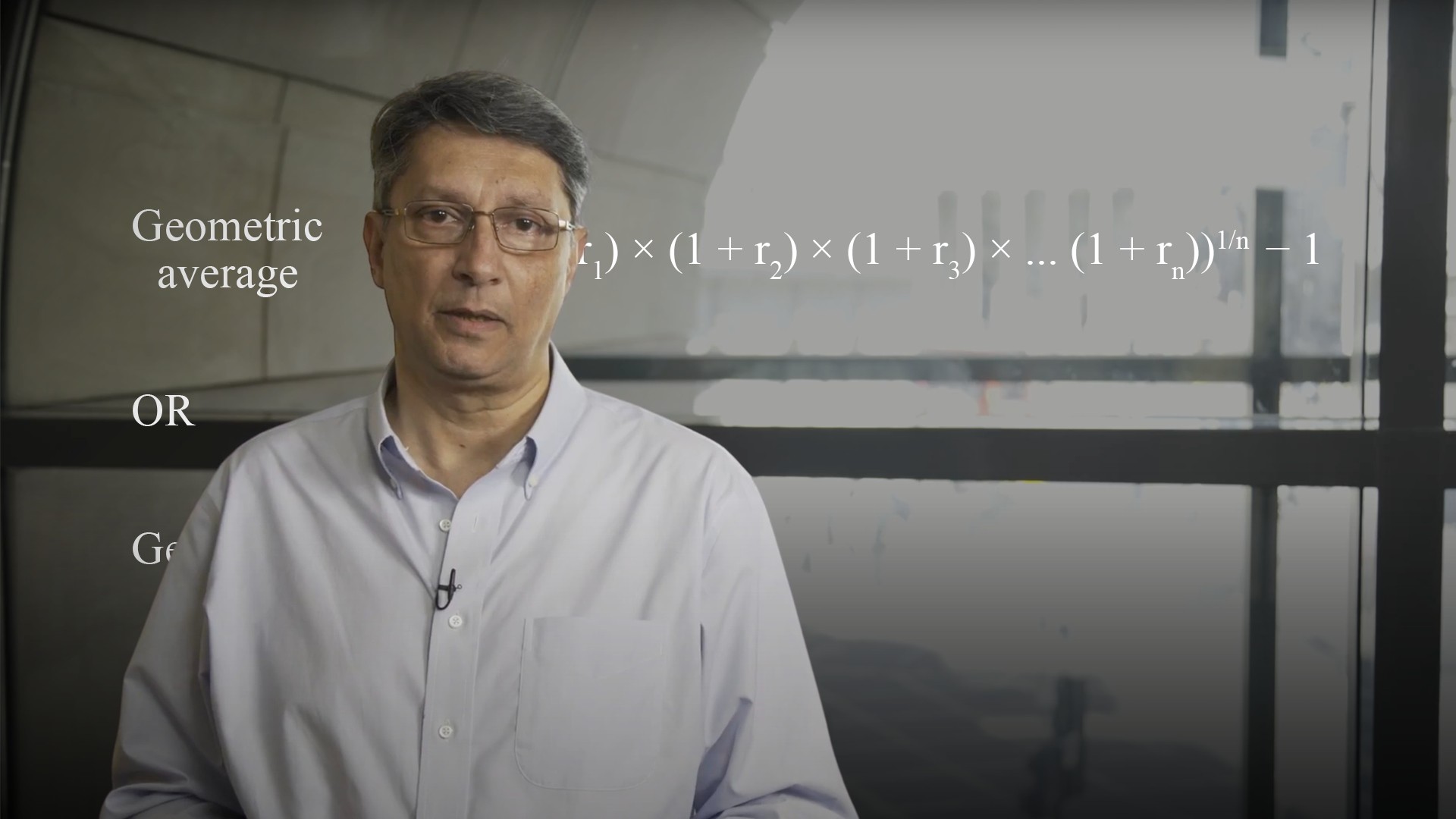

How do we calculate the Geometric Average?

You take 1 plus your annual return for year one, multiply it by 1 plus your annual return for year two, and so on for an ‘x’ amount of years. The next step is to root the result down by the number of years that you’re measuring, take away the 1, and that will give you the geometric average. The reason for using 1 plus the annual returns is to ensure we only have positive numbers in the calculation, you can’t get roots of negative numbers.

Which measure is more useful when looking at a time series?

For a time series, the arithmetic average is probably going to be wrong, and thus, we need to use the geometric average if we want to find out some sort of constant compounded rate of return over that time period.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"