What are the benefits of high yield bonds?

High yield bonds offer investors excellent risk-adjusted returns and an attractive means of diversifying their portfolios. From an issuer’s perspective, the high yield bond market is a means for non-investment grade rated companies to access debt financing in the capital markets, reducing their reliance solely on bank financing.

What criteria do credit agencies use to rate bond issues?

A high yield bond refers to those bonds that have at least one rating that is “non-investment grade”. These bonds are also referred to as “speculative grade bonds” or “junk bonds”. The rating agencies use a variety of criteria to evaluate the creditworthiness of a bond issue, including: financial profile; integrity or market value of assets; access to liquidity; size; history; quality of management; governance and shareholders; business strategy; competitive position; and so on. The two key headline ratios that the agencies and investors tend to focus on are EBITA/Interest Expense and Debt / EBITDA. EBITA / Interest is a measure of the company’s ability to pay interest on its total debt. Debt / EBITDA is a leverage ratio using cash flow as the basis, since the agencies and high yield investors consider this a much more accurate reflection of an issuer’s leverage than balance sheet ratios.

Who are the drivers of the high yield market?

High yield bonds provide non-investment grade rated companies with access to an alternative source of financing other than bank loans and equity placements. Private equity firms are undoubtedly one of the largest users of the high yield market. Financial sponsors frequently turn to the high yield market to provide financing for new leveraged buyouts, or LBO’s. Issuers comprise a broad cross-section of industries. Capital intensive sectors or industries that require significant investment in infrastructure to grow their revenues are massive issuers of high yield debt.

There are three key categories of investors in high yield: pension funds, insurance companies and mutual funds. In a nutshell, high yield bonds offer attractive returns for the risk they entail.

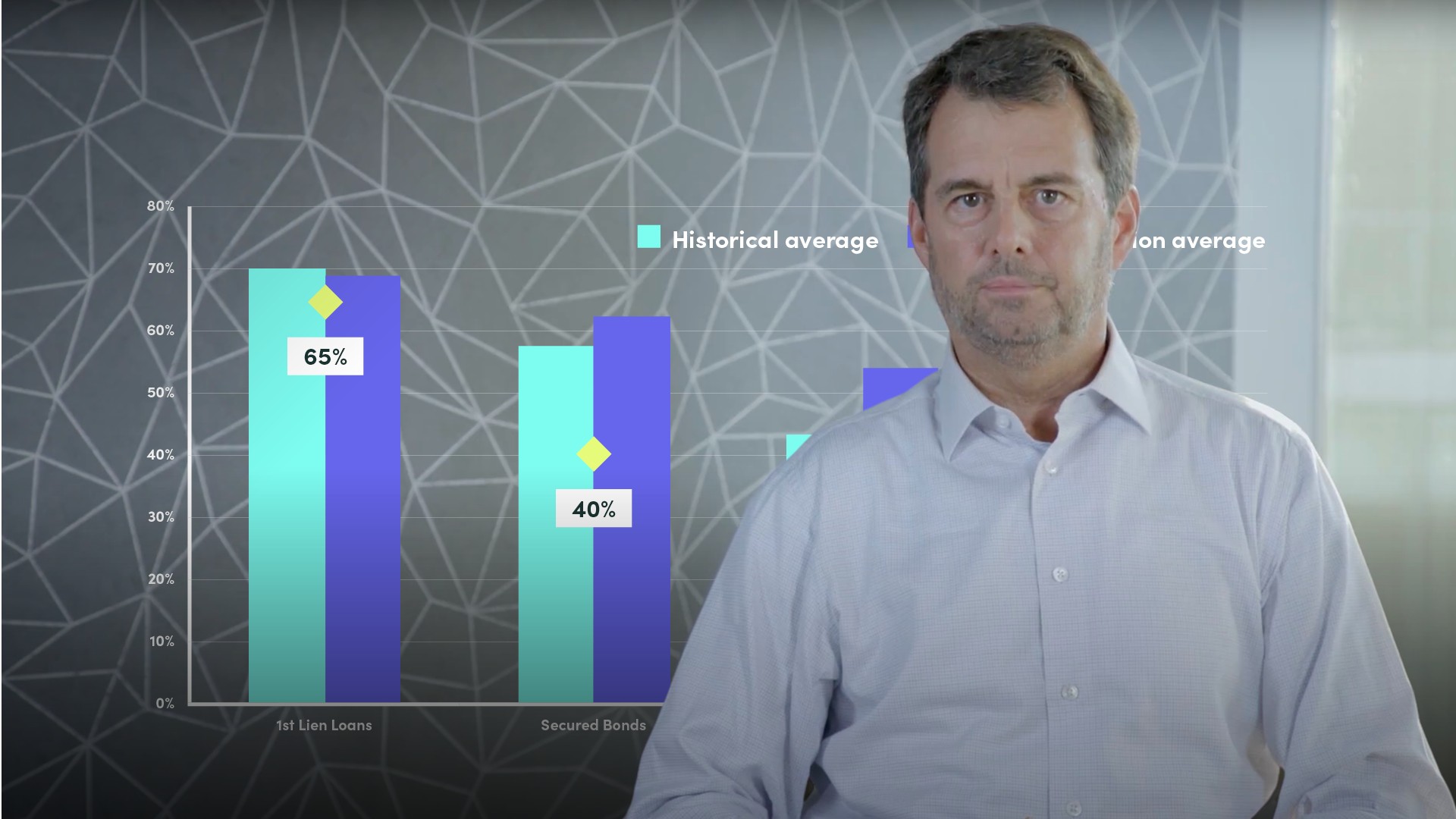

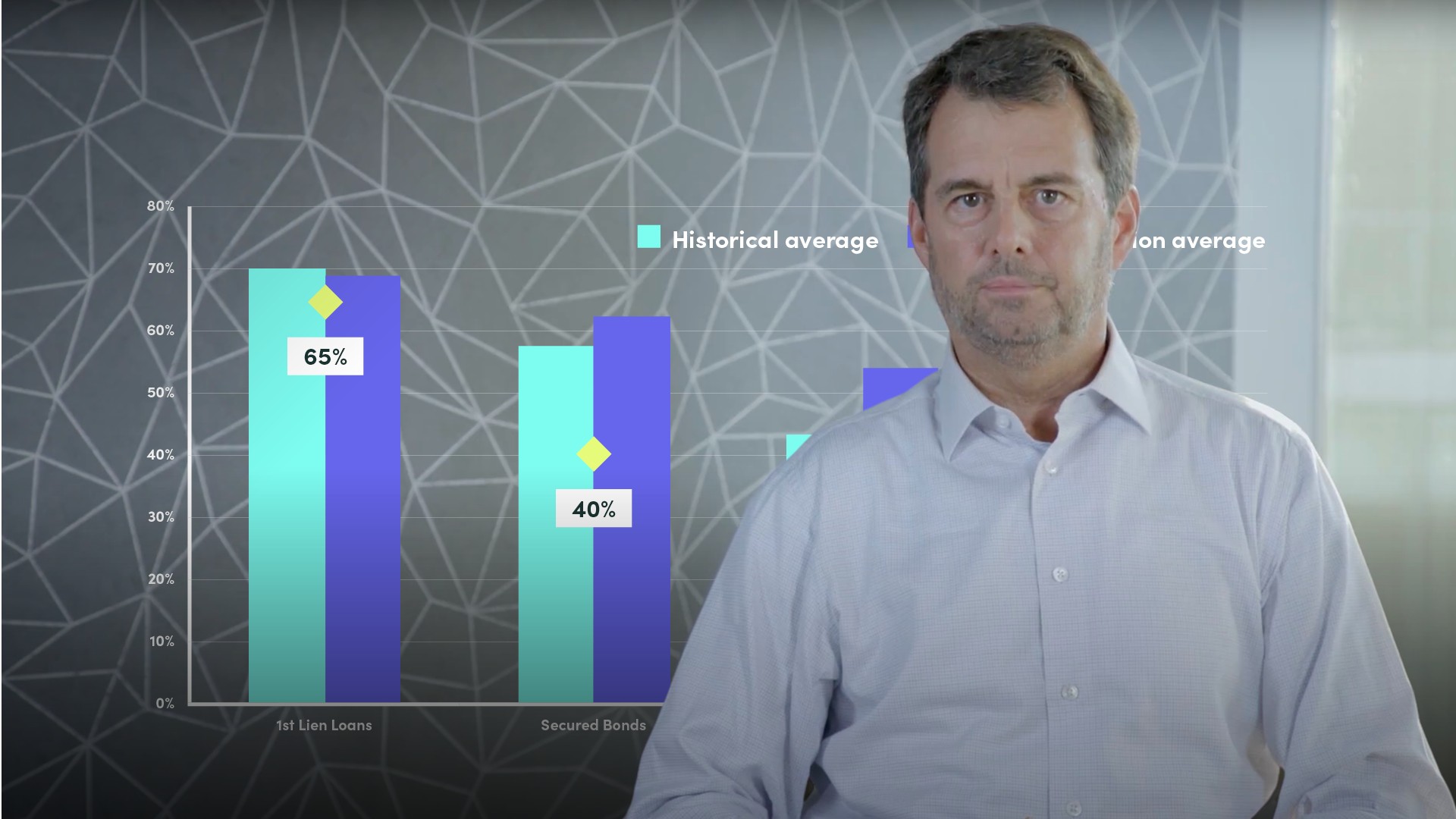

What are the default and recovery rates of high yield debt?

According to Moody’s, the average default rate for high yield for the last 30 years or so has been around 4.8%. However, default rates have varied dramatically over time, very much in line with the business cycle, and typically peaking one year or so after the trough of the recession. Leveraged loans have historically recovered around 70 cents on the dollar, which reflects their “top of the capital structure” secured position. Much of the high yield market is a senior unsecured and senior subordinated market, where recoveries have been well below 45 cents on the dollar.

What are some characteristics of high yield debt?

High yield has a more rigid maturity schedule (normally 7 or 10 years), contains optional call provisions (whereas most investment grade debt is non-call life), includes financial covenants, and can be issued in smaller amounts. But the major difference is in the way each bond is executed. Investment grade bonds often have more standardised (and less onerous) disclosure and can issue intraday.

The major difference between leveraged loans and high yield bonds is that leveraged loans tend to be floating-rate, whilst high yield bonds are normally fixed rate. High yield bonds have a much less issuer-friendly call protection than leveraged loans, making them especially attractive to private equity-sponsored companies that might wish to refinance.

How is the high yield team positioned?

In US banks, high yield banking is often embedded in a leveraged finance team, in which both leveraged loans and high yield bonds are discussed with potential issuers by one team. Other banks, particularly those that are not as active in high yield or in leveraged finance, often position the high yield capital markets / origination team in the Debt Capital Markets team. This might make more sense in Europe, where LBO’s and similar sponsor-driven transactions are perhaps less prevalent than in the US.

What conclusions can we draw on the high yield market?

Market volatility and uncertainty can cause volumes to diminish, and we have had two or three periods of very high volatility in the equity markets. Since the high yield market often takes its cues from the equity market, volatility generally unsettles high yield investors. This also makes senior secured leveraged loans look safer at this point of the cycle than unsecured high yield bonds.

In conclusion, high yield is an interesting asset class bursting with potential for issuers and investors alike. However, it is a cyclical asset class and is therefore prone to gyrations in yields, default rates and new issue volumes based on global investor sentiment. High yield investors appreciate the analytical challenges of evaluating credit even in difficult circumstances.