Post Pandemic Inflation Cycle I

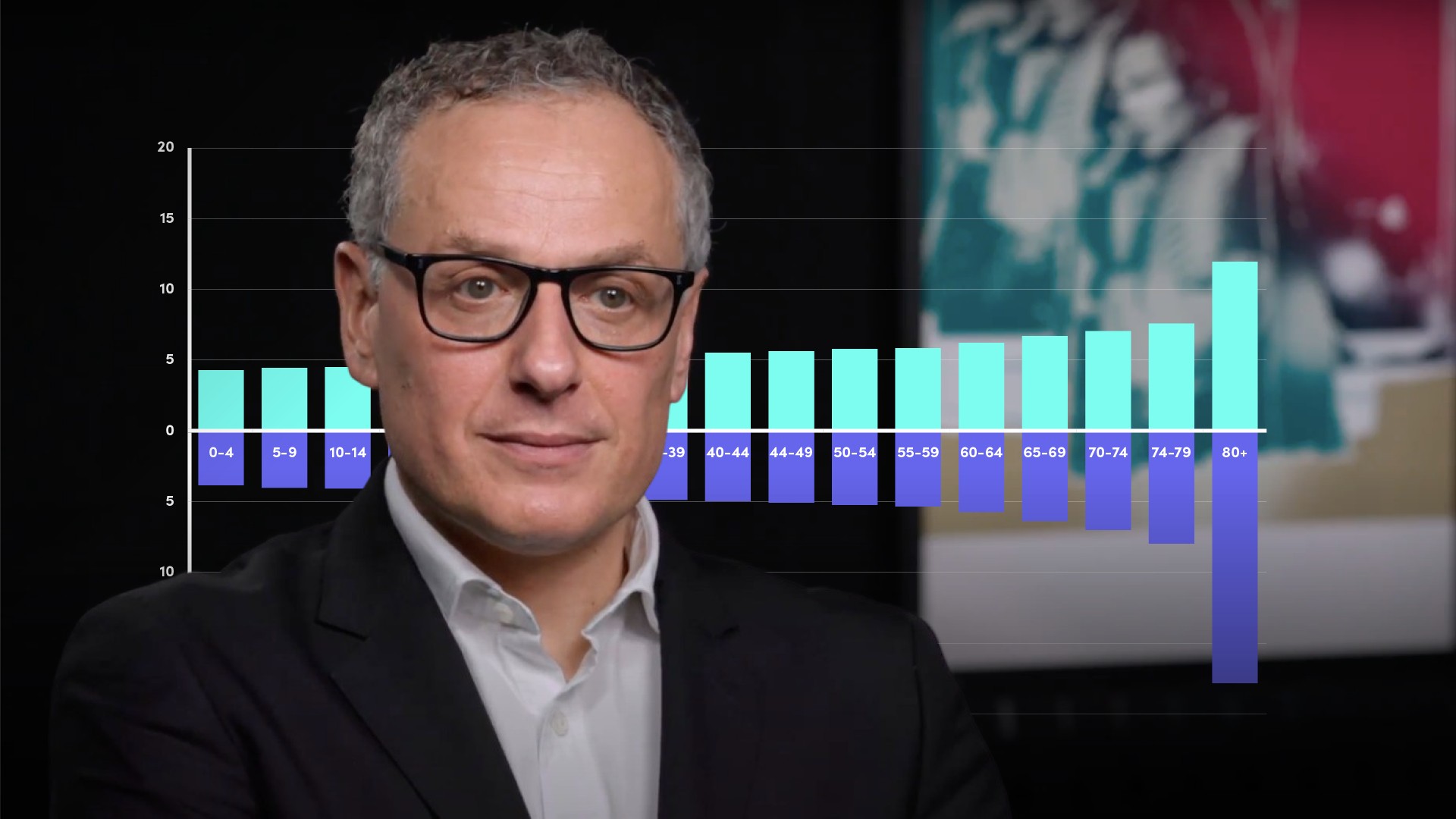

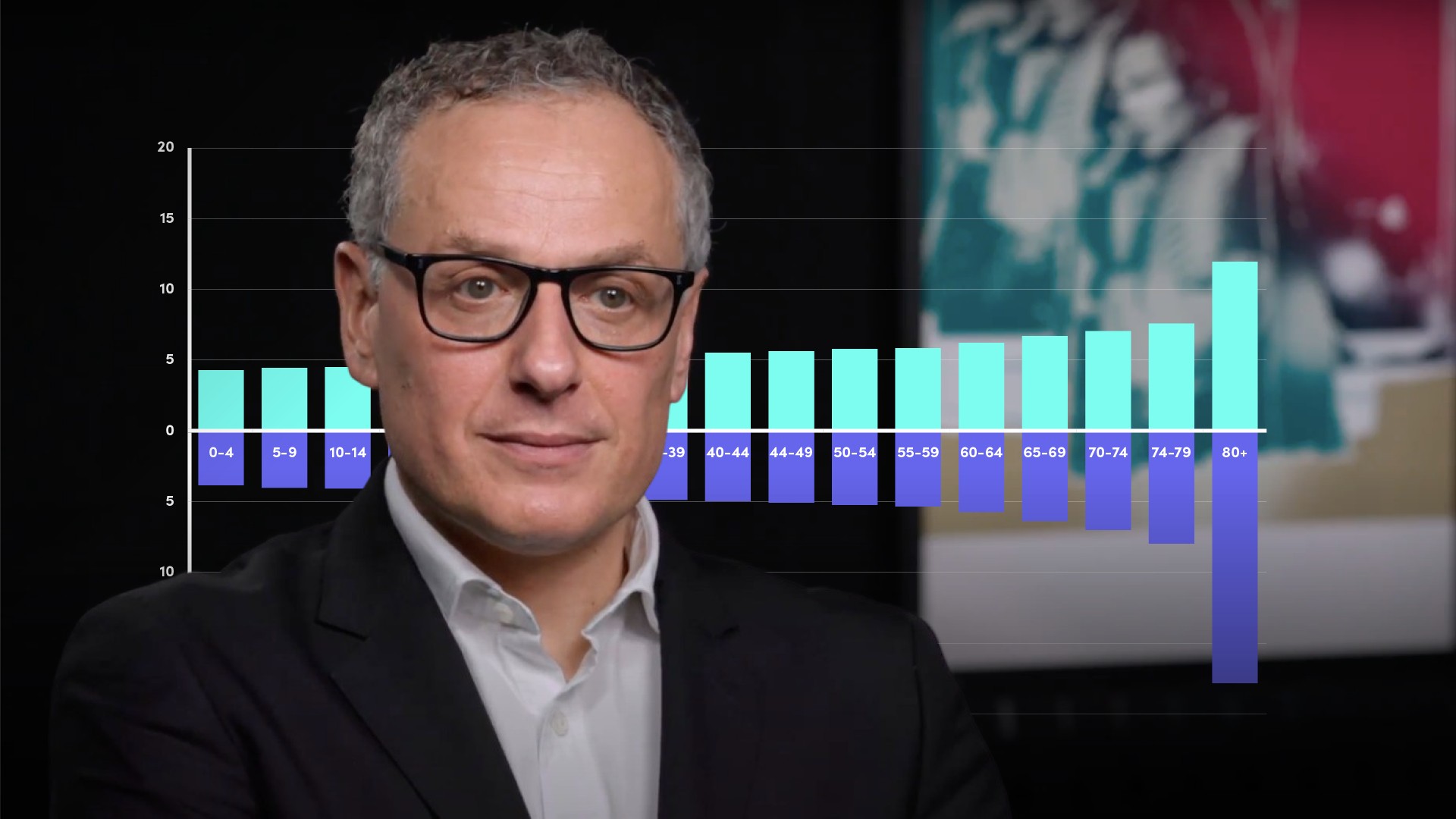

Thanos Papasavvas, CFA

30 years: Asset management

In this video, Thanos talks about the history of inflation and how it has been battled in the past. He also briefly touches upon the absence of inflation and the impact of deflation.

In this video, Thanos talks about the history of inflation and how it has been battled in the past. He also briefly touches upon the absence of inflation and the impact of deflation.

Post Pandemic Inflation Cycle I

7 mins 12 secs

Key learning objectives:

Understand the background and recent history of inflation

Understand why deflation is equally as bad as inflation

Outline the learnings from the deflationary spiral of Japan

Overview:

The greatest nightmare of the 20th century – inflation – sparked not only a loss of buying power, mass unemployment and social turmoil, but also the seeds of the socio-political crisis that contributed to the rise of nationalism and World War II.

What is the background and recent history of inflation?

Inflation has been a big problem for much of the last century. The last inflation increase was during the oil crisis of the 1970s and early 1980s, when inflation rose to 25% in the United Kingdom in 1975. In the US, inflation peaked at 14% in 1980, before monetarist thought became more widespread, and the concept of rising interest rates to minimise demand and inflation expectations was more acceptable across central banks.

Paul Volcker, Chairman of the Federal Reserve spearheaded this battle against inflation in the 80s by raising interest rates and committing to the battle against inflation, he built investor credibility and lowered forward-looking expectations.

More recently, however, the absence of inflation has been a concern for policymakers and central bankers – particularly after the recent Global Financial Crisis, which, despite stimulus, has seen prices drop. The reason for no inflation in the aftermath of the GFC was partially due to the 'global labor market arbitrage' where manufacturing jobs fled the costly West to cheaper manufacturing in the East.

Why may deflation be equally as bad as inflation?

- Adversely impacts consumer sentiment and economic growth

- Central bankers don't know how to fight it and reverse it

What can we learn from the deflationary spiral of Japan?

Japan has been in a deflationary spiral for a while, having seen poor or negative growth since the early 1990s. It was attributed to political errors made by Japanese governments to increase taxes on a variety of occasions at a time when the economy was beginning to show signs of an optimistic turnaround.

This is a lesson for current policymakers battling the imbalances triggered by the Covid-19 pandemic: avoid tax hikes too fast, or else risk the economy collapsing into a deeper recession with major socio-political implications.

Thanos Papasavvas, CFA

There are no available Videos from "Thanos Papasavvas, CFA"