QE and the Money Multiplier Myth

Frances Coppola

25 years: Economic commentary & banking

In this video, Frances rectifies the myths related to Quantitative Easing, including who creates money, the money multiplier effect, the decreasing effects of interest rates, and increasing pressure on inflation.

In this video, Frances rectifies the myths related to Quantitative Easing, including who creates money, the money multiplier effect, the decreasing effects of interest rates, and increasing pressure on inflation.

QE and the Money Multiplier Myth

10 mins 21 secs

Key learning objectives:

Identify who and how money is created

Explain the money multiplier myth

What is the most widely used form of QE?

Overview:

In this video, Frances debunks the money multiplier myth, and instead suggests that commercial banks don’t need to have money available at the time that they make a loan. The most widely used form of QE is the large-scale asset purchases (LSAPs), which have the benefit of encouraging investors to diversify their risks. However, during the QE phases, there were some spillover effects, for example, raising prices of corporate bonds and equities.

Who creates money?

Many people believe that money is created by central banks. In fact, most money is created by commercial banks. Central banks issue banknotes, but nowadays these make up only a small proportion of money in circulation. In the UK, banknotes and coins are only 3% of money in circulation. The rest is electronic money created by banks when they lend.

How is money created?

When a bank makes a loan, it creates a new loan asset and a new customer deposit. This deposit is created “from nothing”: the bank does not transfer money from anywhere else to that customer’s account. That new deposit is called “broad money” or M1.

Central banks create bank reserves as well as issuing banknotes. Collectively, bank reserves and bank notes make up “base money” or MO. However, bank reserves are not counted in “broad money” as they are not in circulation, the general public never touches them.

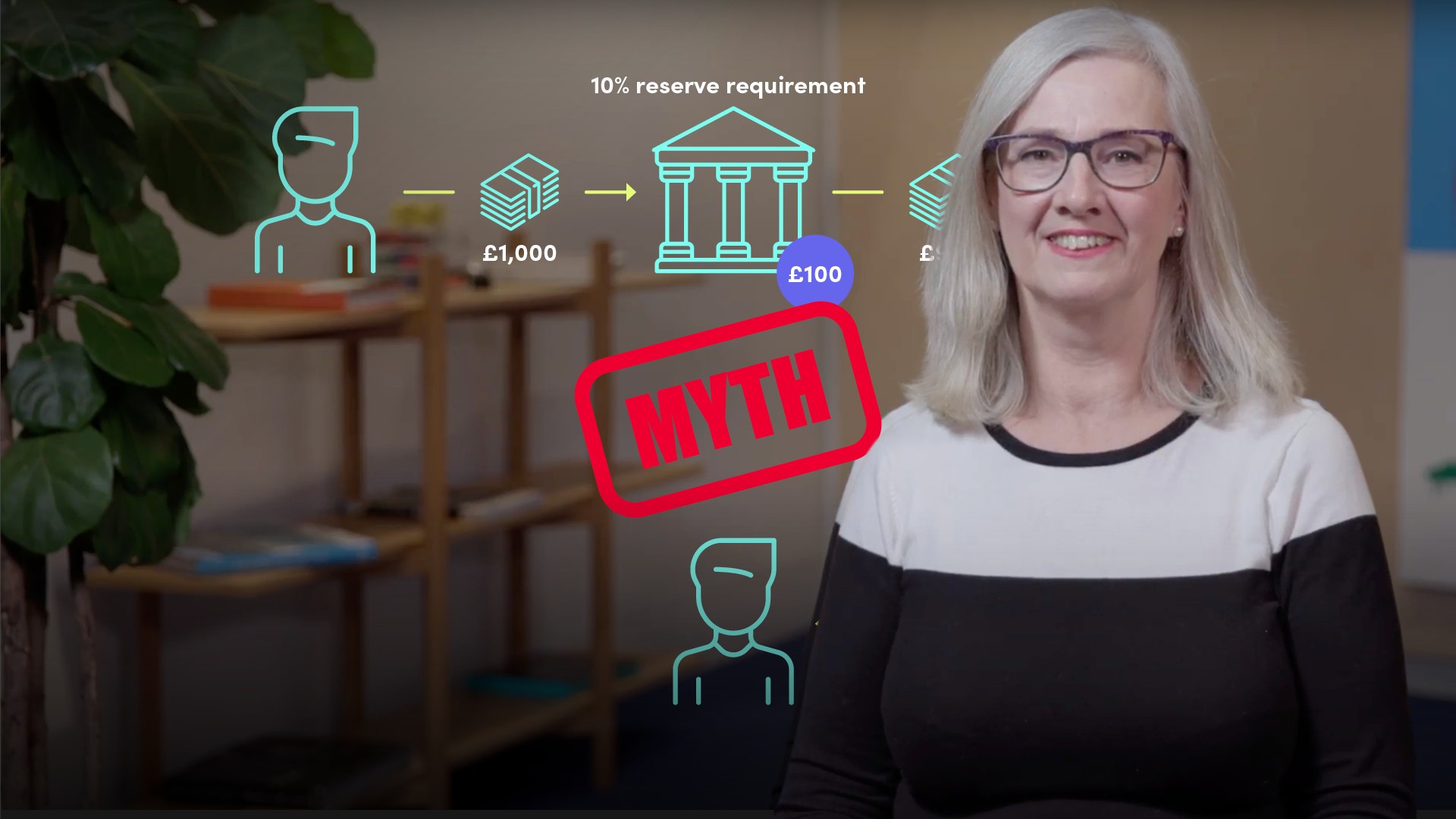

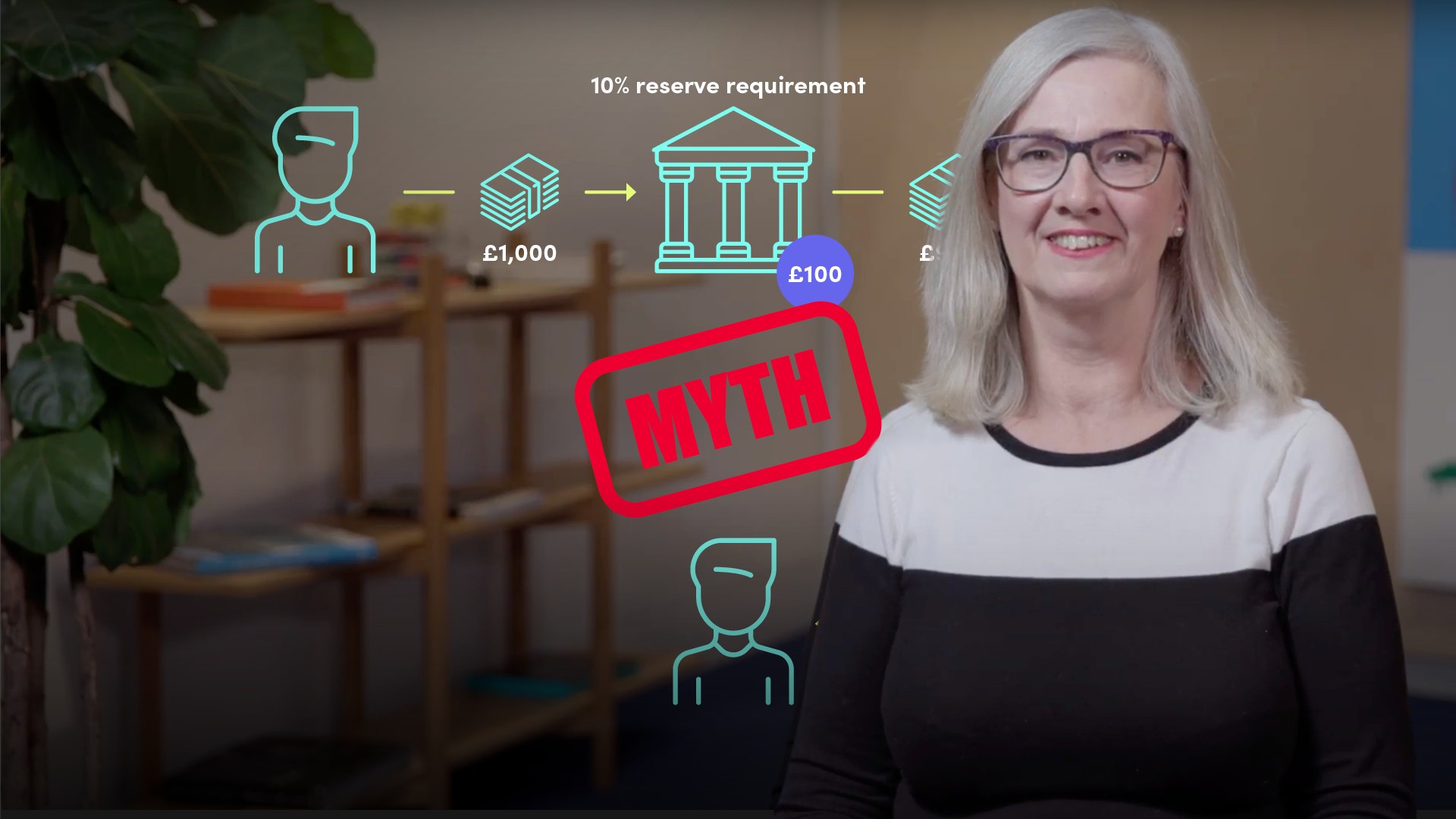

What is the money multiplier myth?

It is widely believed that there is an arithmetic relationship between bank reserves and bank lending. The theory suggests when a bank receives a customer deposit, it keeps 10% as reserves and lends out the 90%. This is known as the “money multiplier” and it is unfortunately a myth.

What is the relationship between bank lending and bank reserves?

Commercial banks don’t need to have money available at the time that they make a loan. But if they don’t, they will need funding when the loan is drawn down. To draw down a loan, the customer requests a deposit withdrawal. If the bank doesn’t have the reserves to settle this withdrawal, it must obtain them by borrowing, either from other banks that have excess reserves, or from the central bank. --- Banks create deposits when they lend, then borrow reserves to settle the drawdown of the loans.

What is the effect of a recession on bank lending?

When a recession hits, banks reduce lending as firms and households, faced with a gloomy economic outlook decide to delay purchases; or because banks themselves, equally scared of the future, decide to protect their own balance sheets. When banks stop lending, money creation stops, and this combined with defaulting loans, causes the supply of money in circulation shrinks.

What was the original purpose of QE?

When money created by commercial banks shrinks, central banks must replace it. When “there is no money left”, injecting new money into the economy should help restore confidence and encourage spending. However, this idea was disputed by Keynes as it creates a “liquidity trap”. The designers of QE initially thought the way to increase spending in the economy was to create new bank reserves, which would inevitably result in more bank lending. QE did cause an enormous increase in bank reserves, however, banks didn’t increase lending, under pressure from regulators, they restricted it.

Why did central banks in the 1930s never cut interest rates below zero?

They feared that if they cut them any further, people would start using physical cash instead of bank money. The belief in the ‘Zero Lower Bound’ problem was shown to be a myth. Several central banks are now using negative interest rates without there being a noticeable move into physical cash. But at the time, it influenced central bank policy, they looked for alternative ways of encouraging spending.

What is the most widely used form of QE?

Large-scale asset purchases (LSAPs) - Where central banks buy assets, mostly government bonds, paying with money created “from nothing”. This is a direct cash injection into the economy, which goes to investors who will spend it on other assets. LSAPs tighten the supply of assets purchased, raising their price, and thus reducing the yield on those bonds.

What is the benefit of LSAPs?

By reducing the yields on safer assets such as government bonds, LSAPs encourage investors to diversify into riskier asset classes where yields are higher. In the hope that investors would buy corporate bonds and equities, pushing their demand up and encouraging businesses to borrow and spend. The policy also helped to raise employment.

What were the negative spillover effects of QE?

- Raised the prices of corporate bonds, equities, commodities and real estate

- Higher housing costs and energy prices in developing countries, along with food shortages in those same developing countries

- Persistently low interest rates creating a bleak outlook for pension funds

- Short-term stimulus provided by low interest rates and QE may be paid for by poorer returns on savings over the long-term

Frances Coppola

There are no available Videos from "Frances Coppola"