The Role of Credit Ratings

Moorad Choudhry

35 years: Banking and Capital Markets

Investors in a company’s debt rely on the company’s credit rating to determine whether the risk is worth taking. In this video, Moorad explains what a credit rating is, how a formal credit rating is calculated and how it is used to determine the level of risk of holding a particular debt issue.

Investors in a company’s debt rely on the company’s credit rating to determine whether the risk is worth taking. In this video, Moorad explains what a credit rating is, how a formal credit rating is calculated and how it is used to determine the level of risk of holding a particular debt issue.

The Role of Credit Ratings

6 mins 26 secs

Key learning objectives:

Define credit rating

Understand what credit ratings are applied to

Outline the two methods investors employ in measuring credit risk

Overview:

Investors in a company’s debt rely on the company’s credit rating to determine if the risk that such debt represents is one that they would wish to take, in return for the expected reward that holding the debt issue should bring. Hence, having a high credit rating is of great importance to issuers of debt.

What is a credit rating?

A credit rating is a formal opinion given by a rating agency of the credit risk for investors in a particular issue of debt securities.

What are credit ratings applied to?

- Ratings are given to public issues of debt securities by any type of entity, including - governments, banks and corporates

- They are also given to short-term debt such as commercial paper as well as bonds and medium-term notes

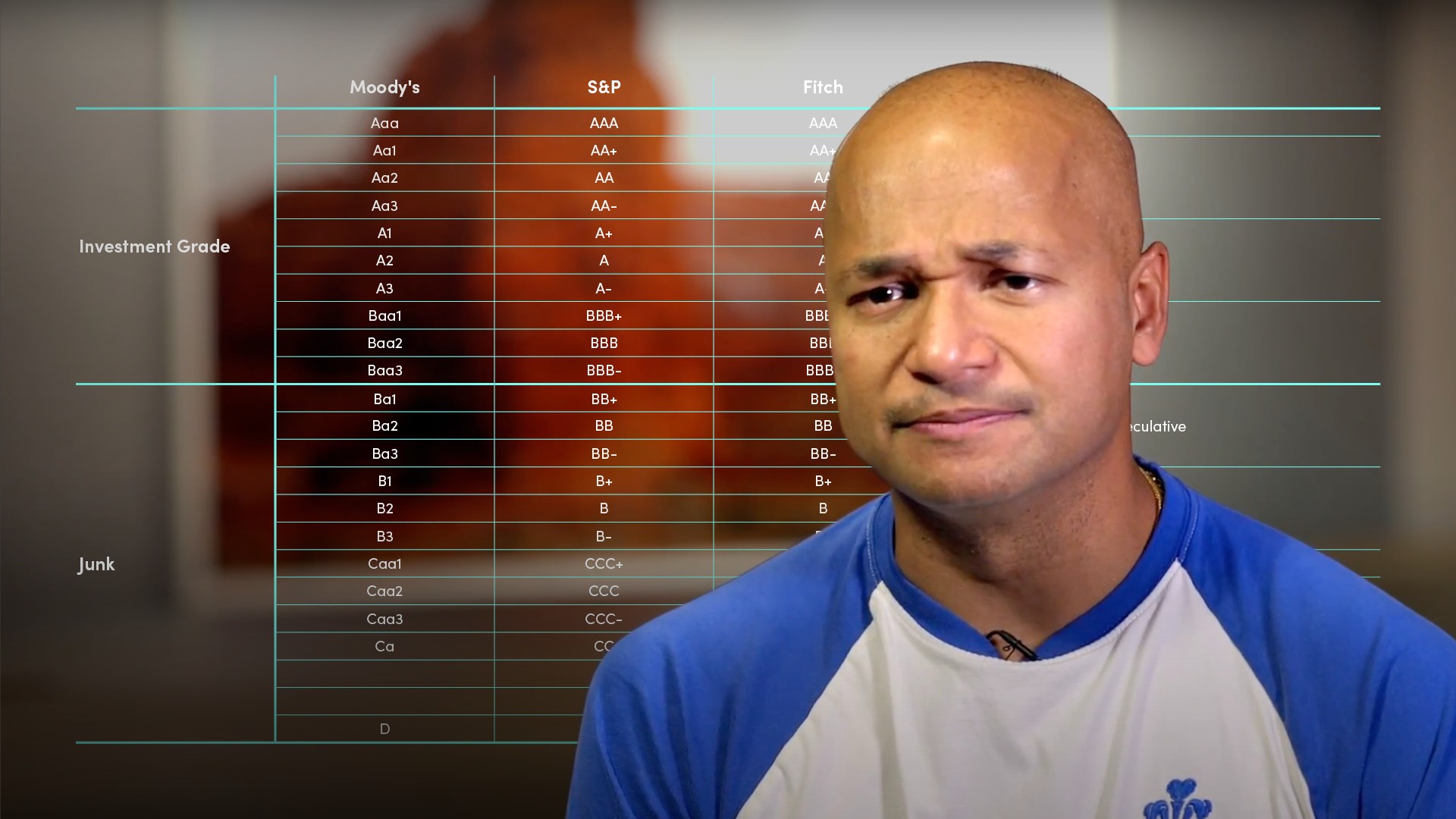

In what format are credit ratings assigned?

- Credit ratings are typically assigned in an ‘alphanumeric’ format. For example, AAA or Aaa is the highest possible rating that can be assigned to a debt security

- At the opposite end of the spectrum, are debt securities rated ‘D’; this essentially means the debt security has suffered a default

What two methods do investors employ in measuring credit risk?

Credit assessments take time, and also require the specialist skills of credit analysts. However, given it is costly and time-consuming to assess every issuer in every debt market, investors employ two methods when making a decision on the credit risk of debt securities:

- Name recognition

- Formal credit ratings

What is name recognition?

When the investor relies on the good name and reputation of the issuer and accepts that the issuer is of such good financial standing that a default on interest and principal payments is highly unlikely. An investor may feel this way about Microsoft or Boeing, for example.

Why is it not wise to rely solely on name recognition?

The tradition and reputation behind the Barings name in 1995 had allowed the bank to borrow at Libor or indeed occasionally at sub-Libor interest rates in the money markets, which put it on par with the highest-quality clearing banks in terms of credit rating. However, name recognition needs to be augmented by other methods to reduce the risk of unforeseen events, as happened with Barings.

What are formal credit ratings?

Credit ratings are provided by specialist agencies. The major credit rating agencies are:

- Standard & Poor’s

- Fitch and Moody’s

- The request for a rating comes from the organisation planning the issue of bonds.

- The rating is applied not to an organisation itself, but to specific debt securities that the organisation has issued, or is planning to issue

- It is common for the market to refer to the creditworthiness of organisations themselves in terms of the rating of their debt

- The rating for an issue is kept constantly under review, ad if the credit quality of the issuer declines or improves, the rating will be changed accordingly

What is a credit watch?

An agency may announce in advance that it is reviewing a particular credit rating, and may go further and state that the review is a precursor to a possible downgrade or upgrade. When an agency announces that an issue is under credit watch, the price of the bonds may trade lower in the market as some investors may sell their holdings.

How do credit ratings vary between agencies?

- In higher investment-grade ratings the credit risk is low, and lower quality speculative-grade ratings, the credit risk is greater

- High-yield bonds are speculative-grade bonds and are generally rated no higher than double-B, and a triple-B rating is still occasionally awarded to a high-yield bond

Moorad Choudhry

There are no available Videos from "Moorad Choudhry"