The Role of Hedging

Lindsey Matthews

30 years: Risk management & derivatives trading

Another market we've only briefly touched on is the hedging markets. In this video, Lindsey expands on what we've already covered on the FX market and also introduces the derivatives markets, which can be used to hedge or to gain exposure. Lindsey also covers structured credit and securitisation, which allows banks to sell their balance sheet exposures as investments.

Another market we've only briefly touched on is the hedging markets. In this video, Lindsey expands on what we've already covered on the FX market and also introduces the derivatives markets, which can be used to hedge or to gain exposure. Lindsey also covers structured credit and securitisation, which allows banks to sell their balance sheet exposures as investments.

The Role of Hedging

12 mins 18 secs

Key learning objectives:

Understand how securitisation and structured credit can allow for the flow of capital whilst reducing the lenders exposure

Outline the purpose of the hedging markets and derivatives

Overview:

Capital can flow through the financial system through the banks, and through the securities and money markets, however there are more complex flows of capital through other markets and instruments. Securitisation and structured credit are examples of how capital can flow indirectly through the financial markets. We also have the hedging markets which allow risk to be transferred from one party to another, a component of that being the derivatives market which allows for the trading of exposure to a whole range of underlyings.

How does securitisation and structured credit allow for the flow of capital?

Securitisation is a process by which banks take exposures that they have built up on their balance sheets and sell them as investments. If a bank has a portfolio of loans, they can sell these loans to raise money that can be invested in new business, lending money to other customers. A bank would ‘sell’ the exposures it has built up (e.g. loans) to an investment vehicle that will sell securities to investors, the investors then receive returns as payments on the underlying exposures are made.

Structured credit takes this one step further and divides, or tranches, the portfolio of loans and sells securities to investors that have different risk levels. Investors can choose to invest in the riskier component and potentially earn a higher return, but they’ll also be first in line to take any losses on defaults.

How can the hedging markets facilitate the flow of risk within the financial markets?

Hedging markets allow risk to be transferred from one party to another without them investing or raising capital. They are markets which allow participants to take on risk exposure, or hedge out their risk exposure, without paying out or receiving capital.

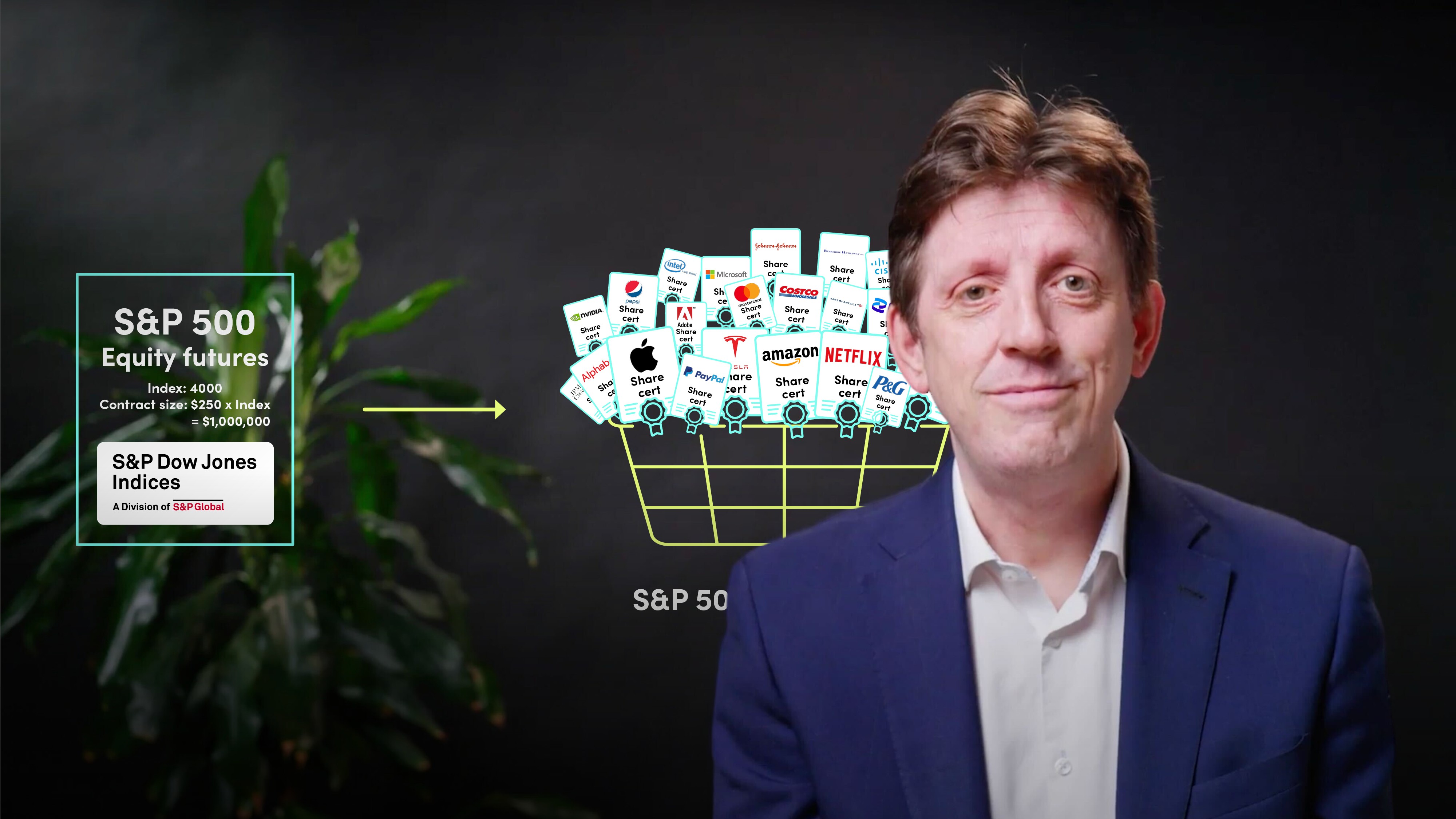

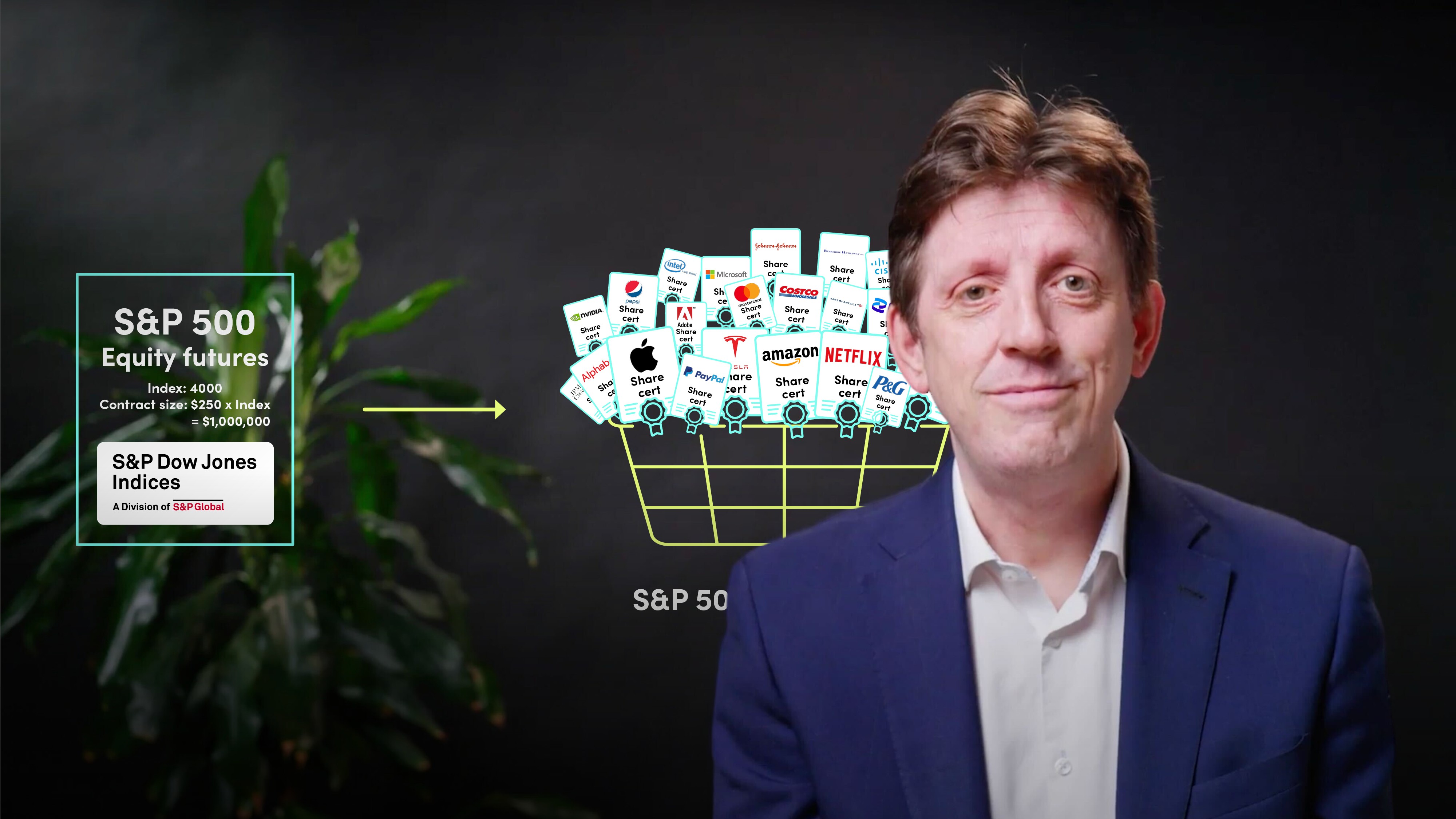

The FX markets are a subset of the hedging markets as well as the derivatives market. Derivatives allow market participants to exchange the risk on a particular asset without trading the actual asset.

Broadly, market participants might use the derivative transactions to hedge or to invest. Hedging involves reducing exposure, e.g. you might enter into a forward contract to lock in a future price. Whereas others use derivatives to invest by taking on exposures that they are seeking, in the hope of earning a return.

Lindsey Matthews

There are no available Videos from "Lindsey Matthews"