The Sustainable Finance Disclosure Regulation (SFDR)

Keith Mullin

35 years: Capital markets editorial

In this video, Keith discusses the Sustainable Finance Disclosure Regulation (SFDR) and its impact on the financial sector. He explores the purpose of SFDR, which aims to enhance transparency and prevent greenwashing in ESG disclosure. He also outlines the different fund categories under SFDR and how asset managers have been affected.

In this video, Keith discusses the Sustainable Finance Disclosure Regulation (SFDR) and its impact on the financial sector. He explores the purpose of SFDR, which aims to enhance transparency and prevent greenwashing in ESG disclosure. He also outlines the different fund categories under SFDR and how asset managers have been affected.

The Sustainable Finance Disclosure Regulation (SFDR)

16 mins 40 secs

Key learning objectives:

Understand the purpose of the SFDR

Outline the various fund categories under the SFDR

Understand the impact of SFDR on asset managers

Overview:

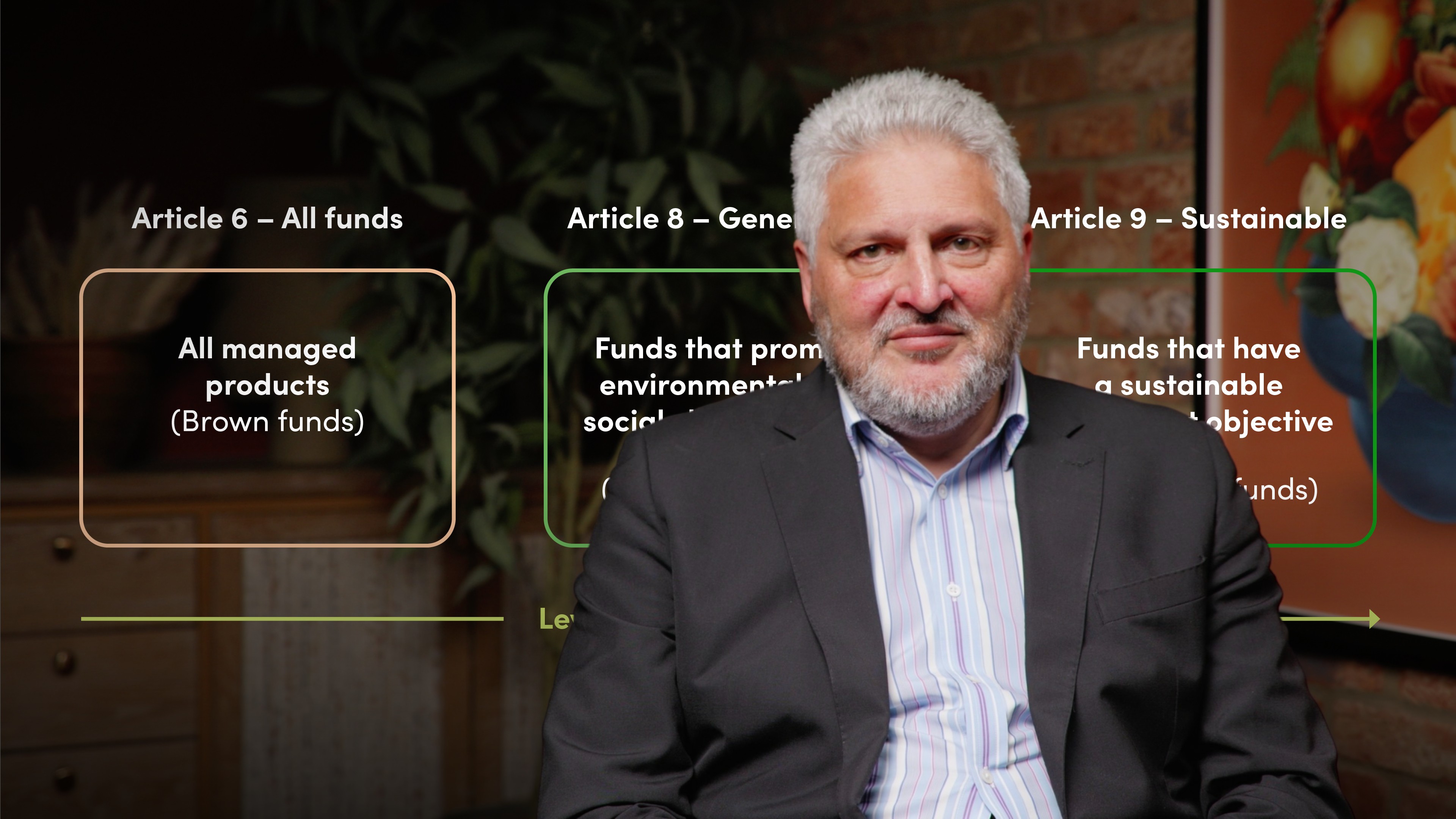

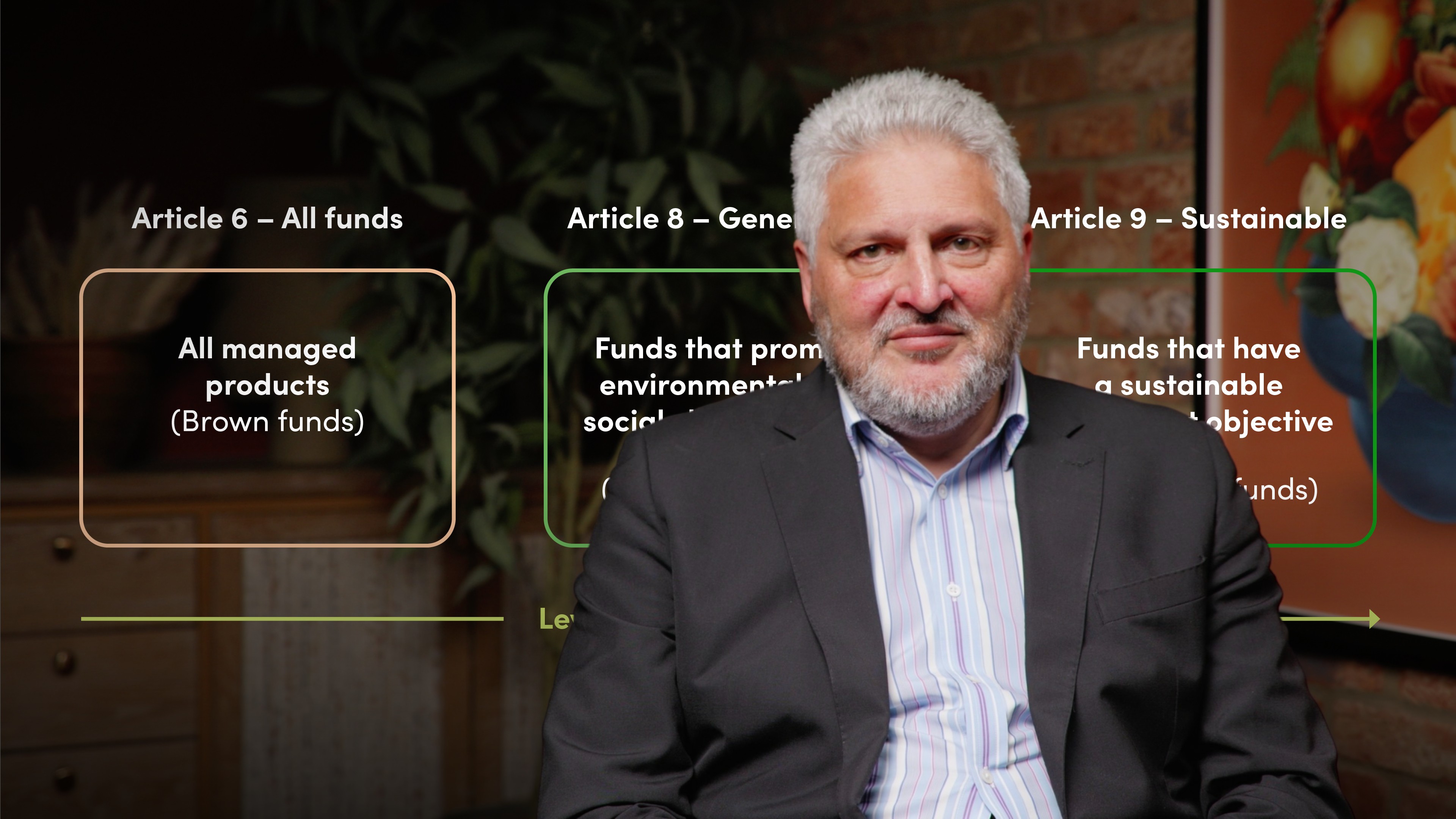

The Sustainable Finance Disclosure Regulation (SFDR) focuses on enhancing environmental, social, and governance (ESG) disclosure within the financial sector. It arose from the EU’s 2018 Action Plan for Financing Sustainable Growth, which aims to guide capital flows towards sustainable investments and foster transparency. SFDR is a harmonised set of rules mandating transparency for investment funds, aimed at preventing greenwashing and improving disclosure regarding ESG considerations. It has three main categories: Article 6, Article 8, and Article 9 funds, each referring to varying degrees of ESG integration in investment strategies. The SFDR, was published in 2019 and applied from March 2021. The binding technical standards that specify the content, methodology and presentation of information to be disclosed came in a Delegated Regulation in July 2022, with requirements applying from January 2023. The SFDR has impacted the asset management industry significantly, leading to a shift in the classification of funds, emphasising its role in promoting sustainable investments.

What is the purpose of the SFDR?

The purpose of the SFDR is to enhance transparency within the financial sector regarding ESG considerations. By establishing a harmonised set of rules, it mandates clear disclosure for firms manufacturing and marketing investment funds. The SFDR aims to prevent greenwashing by ensuring that claims made about a fund's ESG intentions are accurate and not misleading. It goes beyond existing investor protection regulations by setting clear standards for ESG disclosure and ultimately promotes the flow of capital towards sustainable investments, supporting the EU's broader climate and sustainability goals.

What are the various fund categories under SFDR and what do they mean?

Under the SFDR, funds are classified into three categories based on their level of commitment to ESG factors:

Article 6 funds consider ESG risks in their investment processes but do not claim any explicit environmental or social characteristics. While they acknowledge sustainability risks, they do not prioritise ESG factors in their investment decisions.

Article 8 funds promote certain environmental or social characteristics, but their core strategy is not centred on ESG investing. They must disclose how their ESG claims will be met and how any reference benchmark aligns with those characteristics.

Article 9 funds have a sustainable investment objective. These funds aim to contribute significantly to a sustainable investment objective and must provide clear information on achieving these goals. They actively incorporate ESG issues into their investment strategy and align with sustainability objectives, such as the goals of the Paris Agreement.

What has the impact on asset managers been so far?

The SFDR has had a significant impact on asset managers. It has required them to rethink their investment purpose for certain funds and to ensure that their claims regarding ESG factors are neither vague nor misleading. Due to changing rules, many asset managers have had to reclassify their funds under the SFDR’s fund categories, leading to a significant number of funds originally classified as Article 9, or those with a core sustainable investment objective, being downgraded to Article 8, those promoting certain ESG characteristics. According to data from Morningstar, this resulted in asset managers shifting approximately 40% of Article 9 funds to Article 8 in the final three months of 2022, equating to €170bn of assets. The SFDR has increased awareness among asset managers and institutional investors about the potential for mis-selling and greenwashing, demonstrating that the regulation is driving change in the industry.

Keith Mullin

There are no available Videos from "Keith Mullin"