Discounted Cash Flow Illustration (Uncertain Cash Flows)

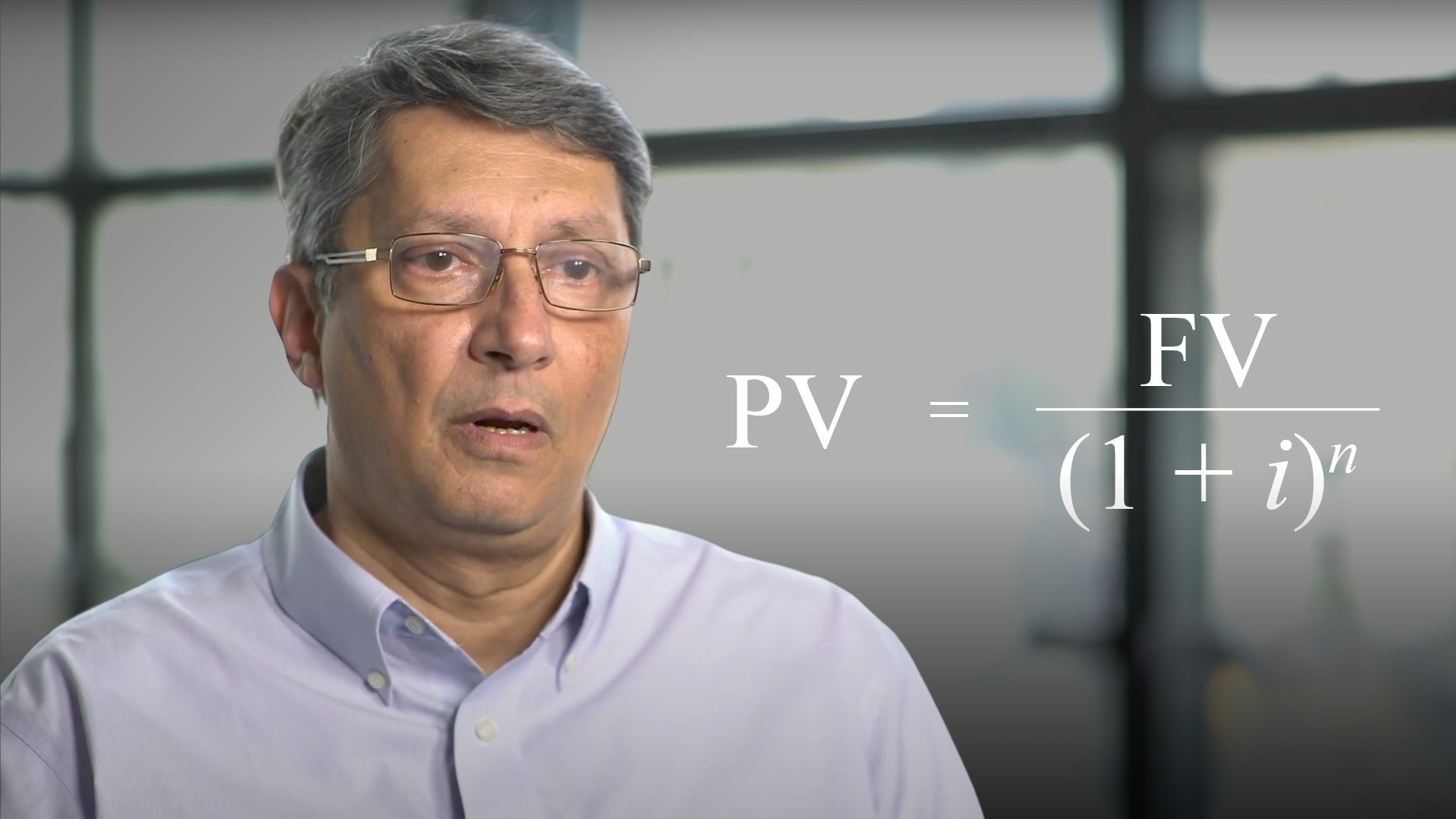

Abdulla Javeri

30 years: Financial markets trader

As they say: the secret of success is to buy low, sell high. In this video, Abdulla discusses techniques to reduce forecast errors when dealing with uncertain cash flows.

As they say: the secret of success is to buy low, sell high. In this video, Abdulla discusses techniques to reduce forecast errors when dealing with uncertain cash flows.

Discounted Cash Flow Illustration (Uncertain Cash Flows)

5 mins

Key learning objectives:

Identify the limitations of using DCF to establish a fair price

Learn how investors account for uncertainty

Overview:

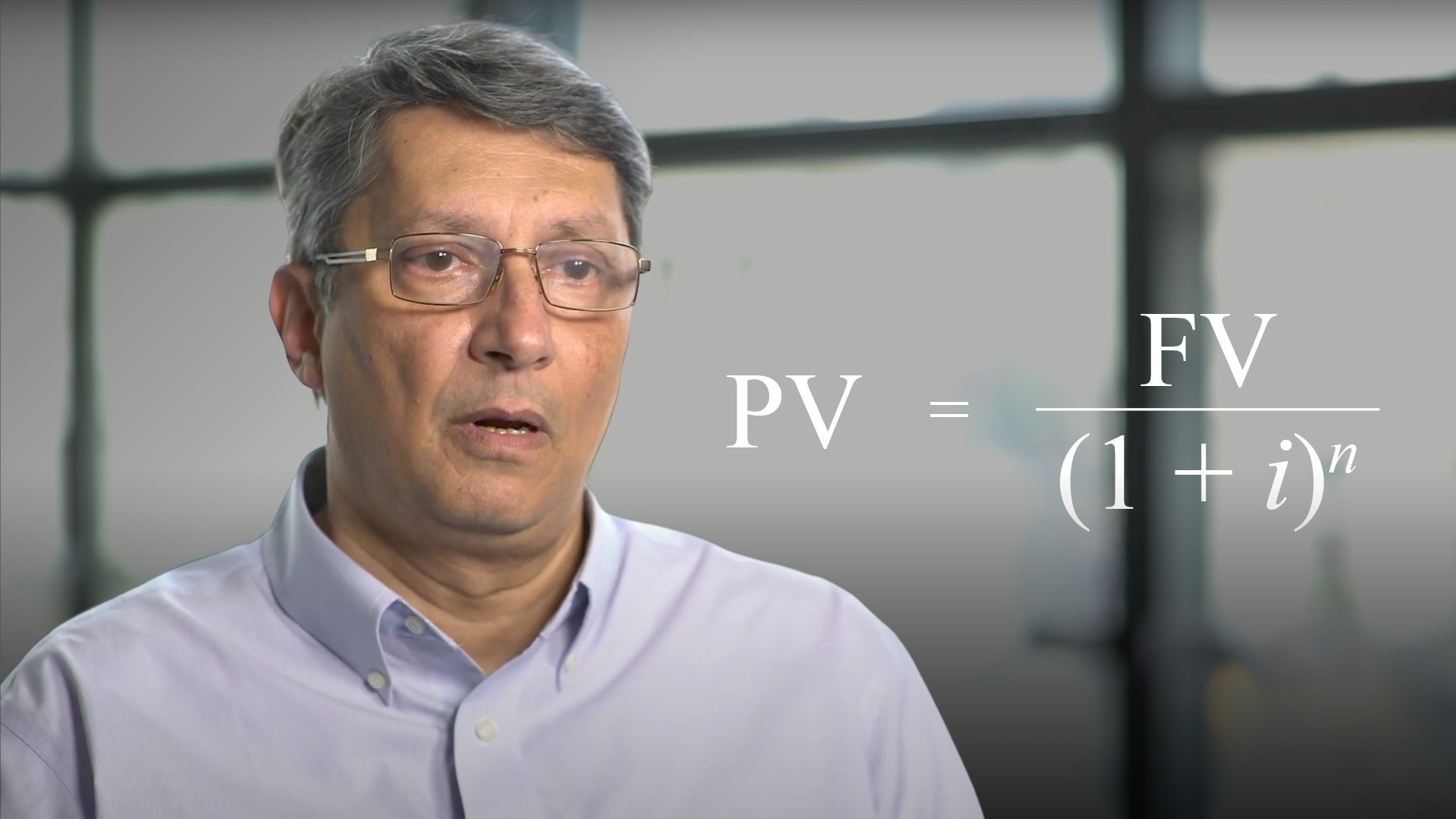

Discounted cash flow (DCF) valuation can be used to establish a fair price for an asset. It involves lining up future returns, discounting them at a required rate of return and adding them up. But there are some important nuances.

What are some of the limitations to using DCF to establish a fair price?

Discounted cash flow (DCF) valuation can be used to establish a fair price for an asset. It involves lining up future returns, discounting them at a required rate of return and adding them up. But future returns are based on assumptions, which are likely to be inaccurate. This could have negative or positive effects. Establishing the right discount rate is another challenge. Should investors use the same rate to discount cash flows on government bonds as they do to establish the value of a software development company?

How can investors account for uncertainty?

To account for uncertainty requires reducing forecast errors for more accurate valuations. One alternative is to take a conservative approach and apply a higher discount rate, reducing the asset value to account for some of the potential negative effects, although investors could lose out on opportunities if discount rates are too conservative.

An outcome that is better than forecast will lead to higher than expected returns and vice versa. One starting point could be to measure uncertainty in terms of an expected return and an associated standard deviation. In financial markets, that equates to risk or volatility. Working around uncertainty requires adjusting the discount rate. The higher the risk, the higher the discount rate.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"