UK Economic Outlook Autumn 2022

Kemar Whyte

Leading Economist on Carbon Tax Modelling

In this video, Kemar discusses the current state of the UK economy and the near-term macroeconomic outlook.

In this video, Kemar discusses the current state of the UK economy and the near-term macroeconomic outlook.

UK Economic Outlook Autumn 2022

9 mins 20 secs

Key learning objectives:

Understand the current state of the UK economy and the ‘terms of trade’ shock

Outline how the UK’s GDP is trending

Outline how the UK’s inflation rate is trending

Overview:

The UK economy is suffering from a ‘terms of trade’ shock, causing high inflation and below-trend growth. Policymakers must manage the adjustment to a lower real income level without inducing a recession. The central forecast suggests no UK recession, with GDP expected to be 4.6% higher in 2022 than in 2021. However, there is a 55% probability of a recession in 2023 due to ongoing political turmoil and the war in Ukraine leading to rising food and energy prices. The Bank of England raised interest rates in November 2022 and is expected to continue to do so, though the Monetary Policy Committee has suggested that the market's expectations are higher than necessary. Underlying inflation is rising and is expected to fall only to 5.6% by the end of 2023 and back to the Bank of England target by mid 2025.

What is the current state of the UK economy and what is a terms of trade shock?

A ‘terms of trade’ shock is a situation where a country's prices for exports fall relative to the prices it pays for imports, resulting in a deterioration of the trade balance and potentially leading to lower economic growth. Such a shock requires a fall in real income for the economy, which means a period of high inflation and below-trend growth.

Currently, the UK economy is facing several challenges, including Brexit-related uncertainty and the lingering effects of the COVID-19 pandemic as well as macroeconomic impacts from the war in Ukraine. The Bank of England projects a sluggish economic recovery in the near term, but with some potential for improvement as vaccination efforts progress and economic conditions normalise.

What is the trend of the UK’s GDP?

The UK's GDP rate has seen an increase in the second quarter of 2022, up to 0.2%. The GDP growth in the fourth quarter of 2022 has been revised down to 0.5% due to the reversal of tax cuts and political turmoil. However, it is not expected to lead to a recession and is predicted to be 4.6% higher in 2022 than in 2021. The outlook for 2023 and 2024 is expected to show GDP growth of 0.7% and 1.7% respectively, though there remains some possibility of a recession in 2023.

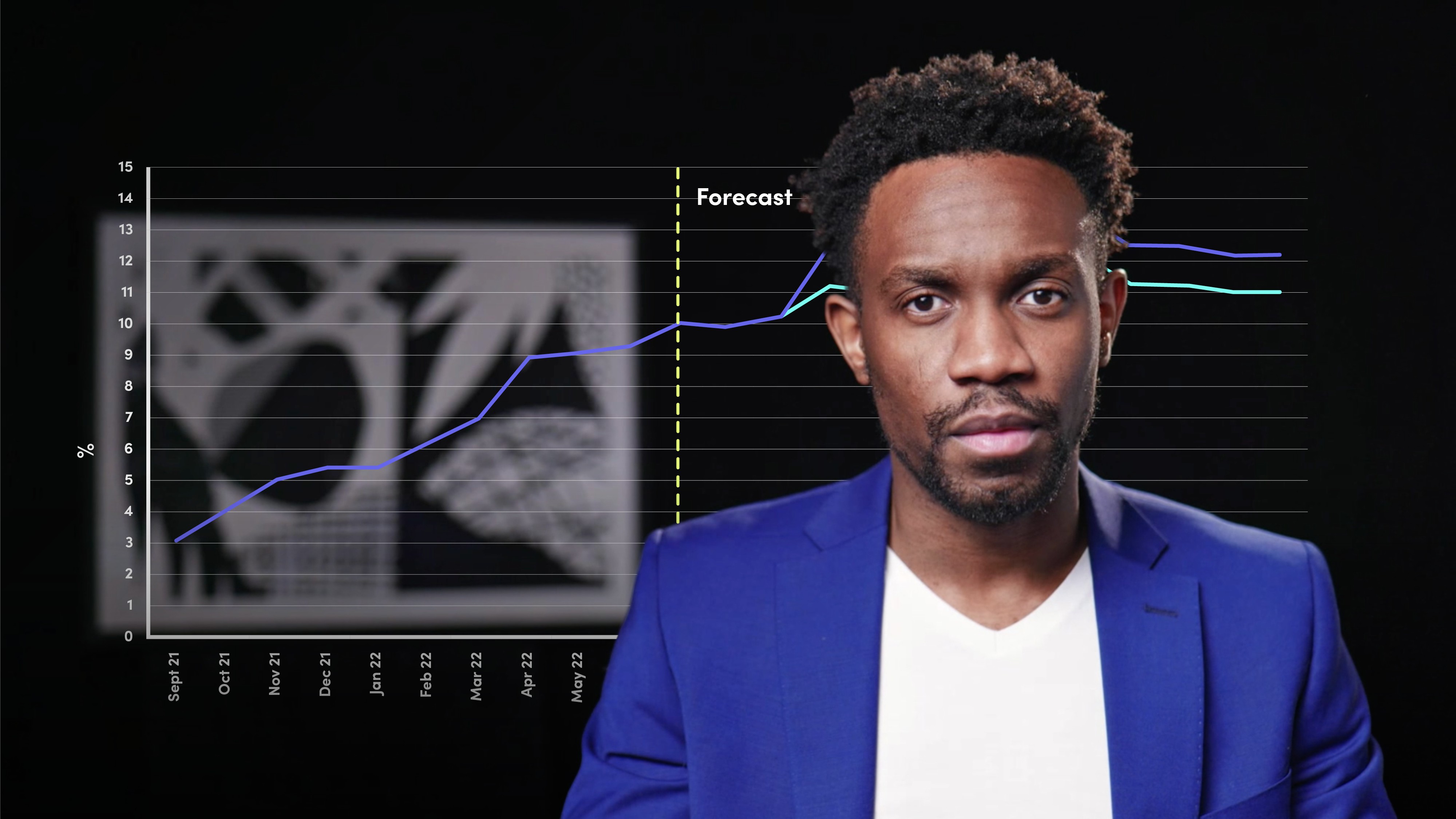

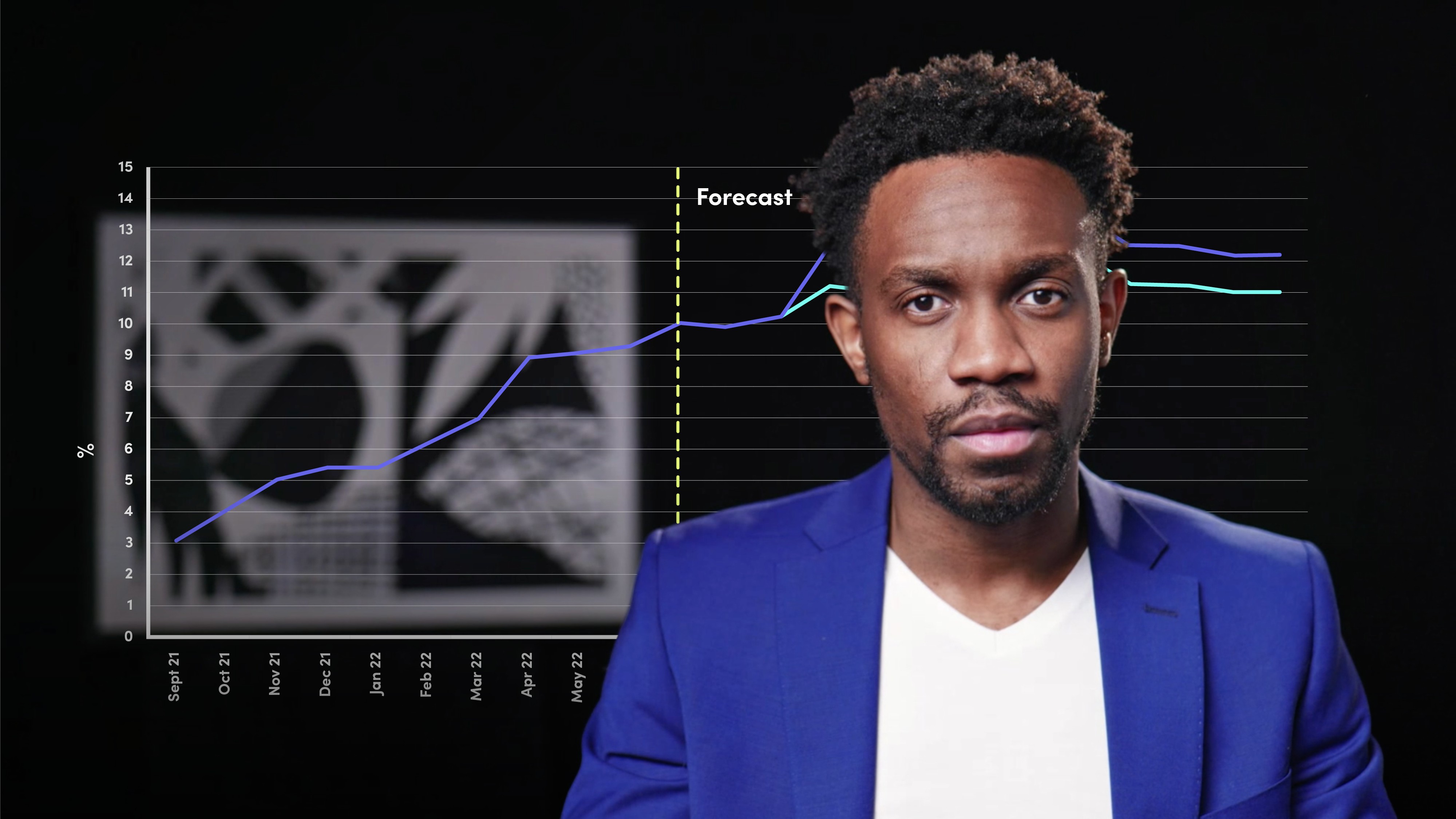

How is inflation trending?

Inflation is trending higher with a peak of 11.0% in January 2023. The Monetary Policy Committee of the Bank of England raised interest rates to reduce inflationary pressure and return inflation to the target of 2%, however, inflation is not expected to reach this target until the third quarter of 2025. The markets expect further rate hikes in the coming months, however, the MPC may raise rates by a smaller amount. The highly inflationary budget has raised market expectations for the peak in the Bank Rate, which is expected to be around 4.75% in the third quarter of 2023. The central case scenario assumes that the MPC sets a path for Bank Rate in line with market expectations, which delivers a fall in inflation back to target by mid 2025.

Kemar Whyte

There are no available Videos from "Kemar Whyte"