Spillover Effects of the COVID-19 American Rescue Plan

Corrado Macchiarelli

15 years: Macroeconomist

In this video, Corrado discusses the impact the $1.9tn American Rescue plan is expected to have on inflation, as well as how the emerging market will be affected.

In this video, Corrado discusses the impact the $1.9tn American Rescue plan is expected to have on inflation, as well as how the emerging market will be affected.

Spillover Effects of the COVID-19 American Rescue Plan

11 mins 4 secs

Key learning objectives:

What will the effect of the American Rescue Plan have on inflation?

What are the financial spillovers to emerging markets?

What are the financial spillover impacts of the American Rescue Plan around the world?

Overview:

The stimulus could add around 3 percentage points to US GDP growth this year and 1 percentage point to global GDP growth, including spillovers from trade. However, results also support the idea that the size of the fiscal stimulus could lead to an increase in inflation and inflation expectations.

What will the effect of the American Rescue Plan have on inflation?

- Inflation is expected to rise by about 0.75–1.5 percentage points, relative to base during late 2021 and early 2022. If the share of low-income households is high, inflation is projected to raise as much as 2.5 percentage points relative to baseline

- If this were to push up longer-term inflation expectations substantially, it could trigger an earlier than projected interest rate rise by the Federal Reserve

- An active policy by the Federal Reserve is expected to somewhat mitigate the projected rise in inflation, as higher interest rates constrain investment and put upward pressure on the exchange rate

What has the impact been on Financial markets?

They have also swung: the yield on 10-year US Treasury bonds rose from 0.9 percent on 4th January 2021 to 1.7 percent on 18th March, and had retraced some ground by the 21st of June to trade below 1.45 percent.

What are the financial spillovers to emerging markets?

- The positive US trade spillovers of the American Rescue Plan to emerging markets

- An increase in global risk aversion, with emerging market financial conditions coming further under pressure; akin to the taper tantrum in 2013

Why will spillover effects differ in emerging economies?

- The degree of openness to trade

- The extent of trade with the US

- The evolution of the pandemic in each country

- Severity of the downturn in domestic economic activity

What do the spillover effects through the financial channel depend on?

- The size of external financing requirement

- The share of foreign currency denominated debt

- The level of international reserves as well as monetary policy space and exchange- rate regime in each country

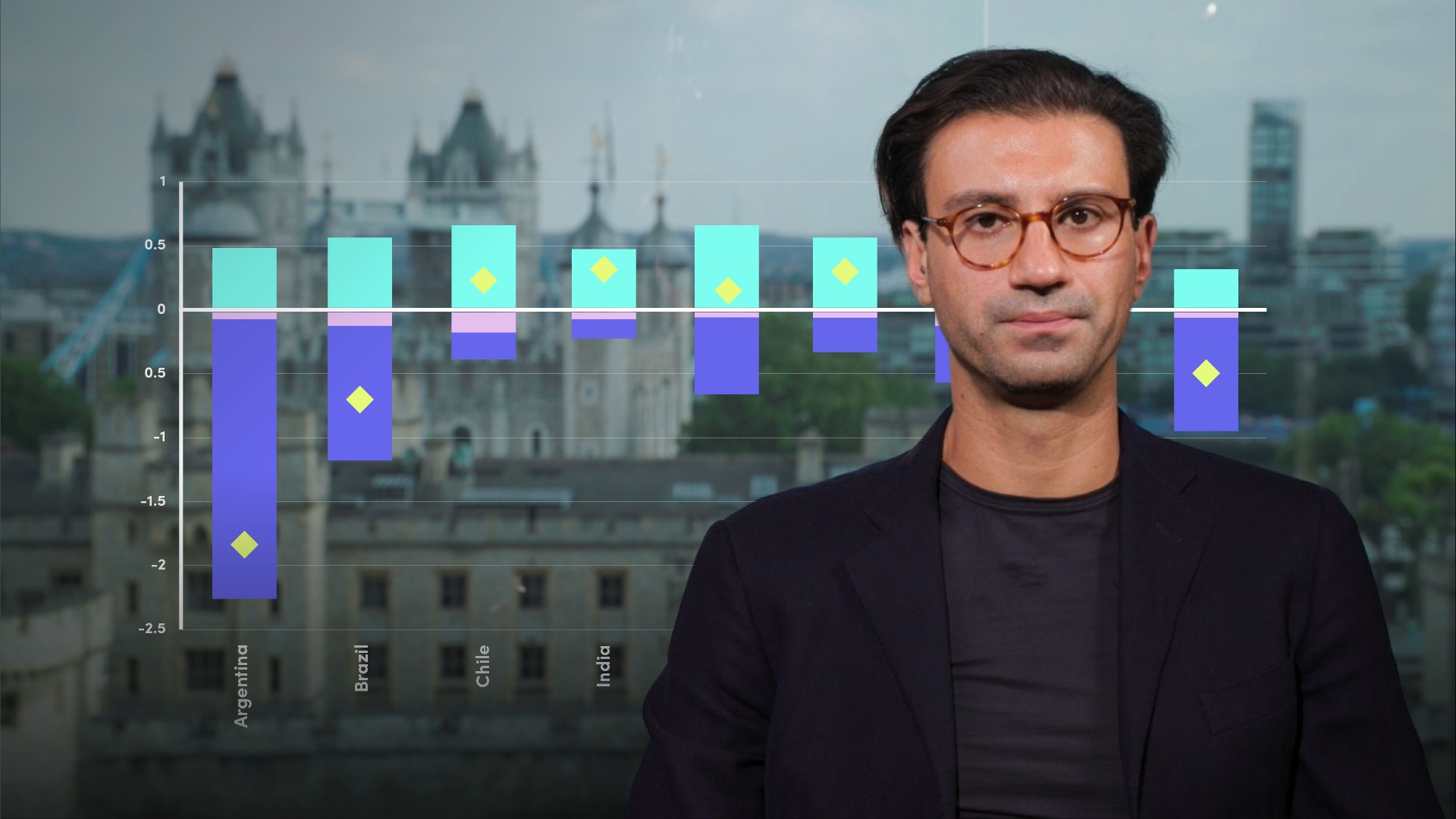

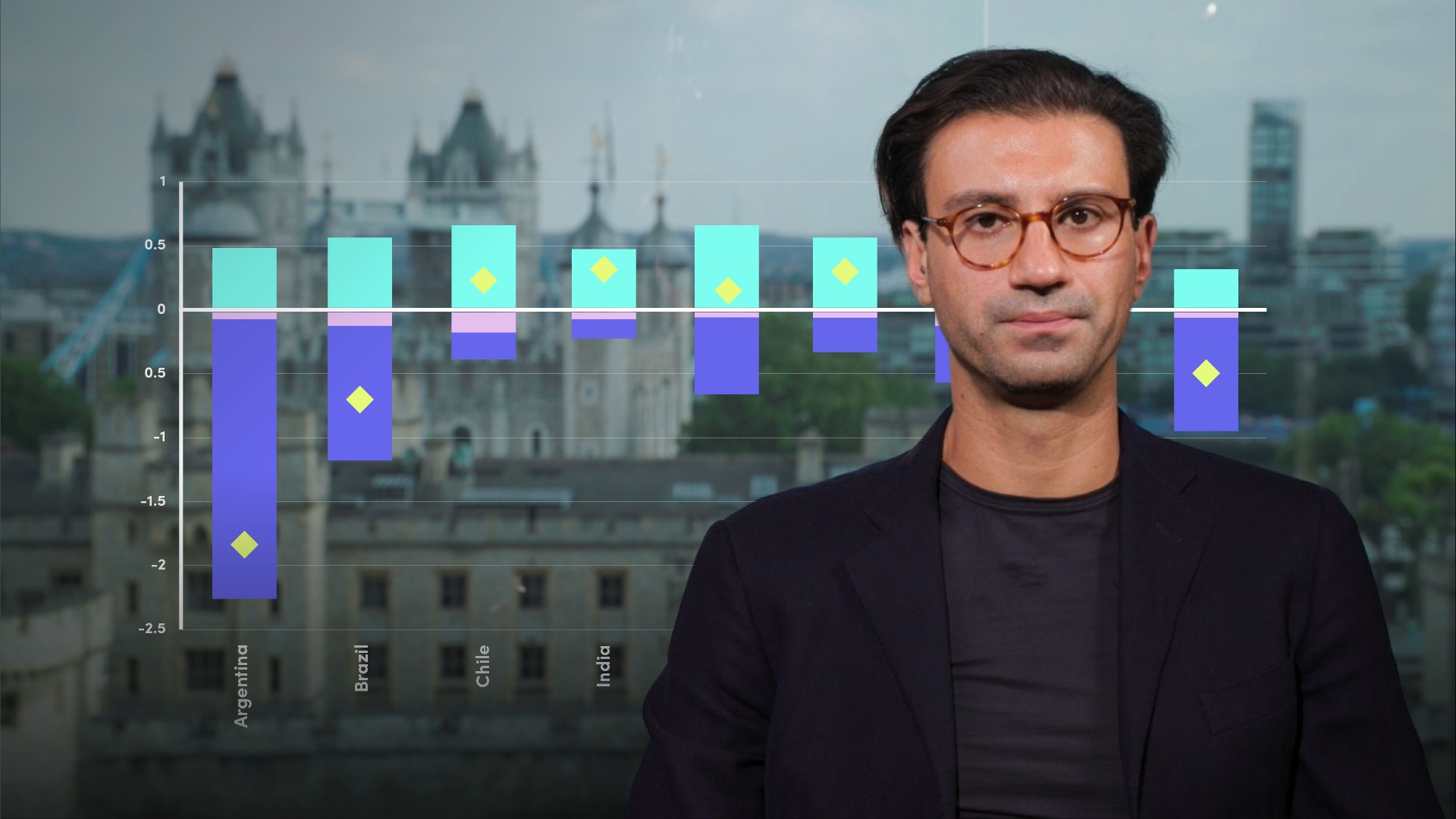

What are the financial spillover impacts of the American Rescue Plan around the world?

- Financial spillovers have the potential to offset fully the positive impacts of the American Rescue Plan in countries with higher risk premia such as Argentina, Brazil and Turkey, and may also constrain the positive spillovers in lower risk-rated countries such as Indonesia and Russia

- For countries such as Argentina, Brazil and Turkey, the net effect of US fiscal stimulus on GDP risks being negative, with output losses between 2% compared to the base in the case of Argentina, to about 0.5%, in the case of Turkey

- This suggests that there is significant divergence in the way emerging markets could react to a change in US fiscal policy

Corrado Macchiarelli

There are no available Videos from "Corrado Macchiarelli"