Volatility and Option Pricing

Abdulla Javeri

30 years: Financial markets trader

In this final video of the series on volatility, Abdulla demonstrates the use of volatility in option pricing. No prior knowledge of options is required.

In this final video of the series on volatility, Abdulla demonstrates the use of volatility in option pricing. No prior knowledge of options is required.

Volatility and Option Pricing

3 mins 26 secs

Key learning objectives:

Understand volatility in the context of options pricing

Overview:

Volatility is most easily visible in the world of options. The example provided walks us through the price of an option and how volatility can be impactful.

What is an option?

An option is a type of derivative instrument that comes in the form of calls and puts which can be bought or sold. If you buy a call option, you’re buying a time-limited right to buy an underlying asset, for example a stock, at a fixed price, otherwise known as the strike price. Securing the option to buy the asset involves the buyer of the call paying a market determined non-refundable cash premium, to the seller.

How does volatility impact the price of an option in the example provided?

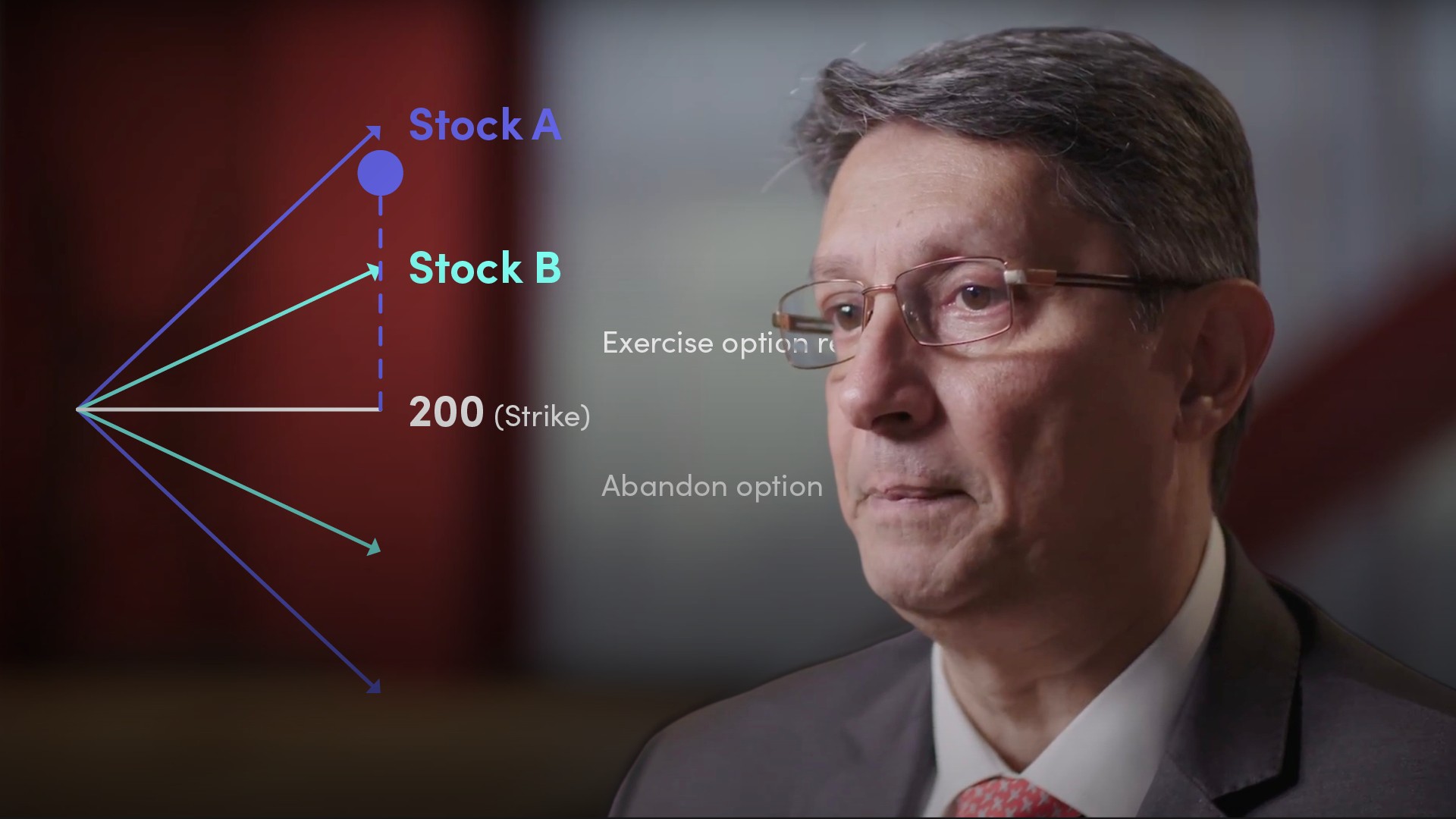

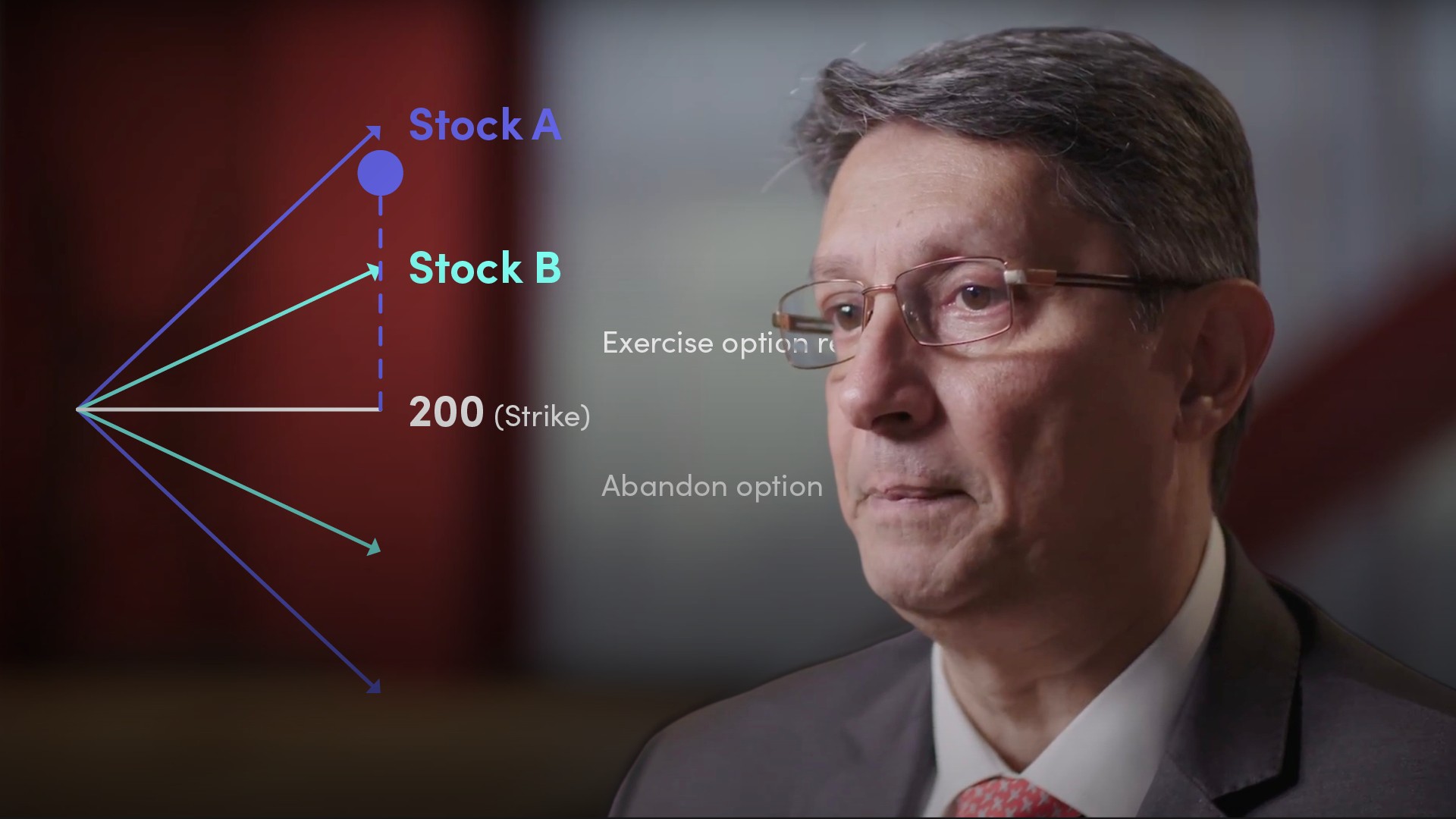

In this simple example, you have the choice to buy a call option conferring the right to buy, either stock A or stock B. Assume for simplicity, the current market price of each is 200 and neither pays a dividend. The option expires in one year and the option is only exercisable on its expiry day. A and B have different volatilities, 29% for Stock A and 12.50% for Stock B. You’ve chosen a strike price of 200. Assume the option premium is 10 for both stocks. Given the choice to buy one of them, which one would you prefer to buy?

For stock B, if the stock price is below 200, the option is worthless and will be abandoned. You wouldn’t choose to pay 200 if the stock price is below that price. If the stock price at expiry is above 200, say 220 you would choose to exercise your right to pay 200. The option would have a pay-off or value of 20 which is a positive difference between the two.

With stock A, because it has a higher volatility, the range for the price will be higher than stock B. As with stock B, if the price is below 200 the option is worthless, but if the price is above 200, the option pay-off will again be the positive difference between the stock price at expiry and the strike price of 200.

If you were able to buy the call on stock A for the same premium as the call on stock B, then clearly you'd be getting the potential for an additional pay off for free. In these circumstances, you would always choose to buy the call option on A. Alas, you won’t be able to because the option premium for stock A won’t be the same as for B at the time you enter the trade. The market will price the stock A option to reflect A’s higher volatility. The difference will incorporate the potential to get the additional pay off.

Volatility is a peculiar bit of financial market terminology, but there’s nothing particularly special about it. At the end of the day, it’s just standard deviation by another name. Its application in so many areas of the financial world is what makes it special.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"