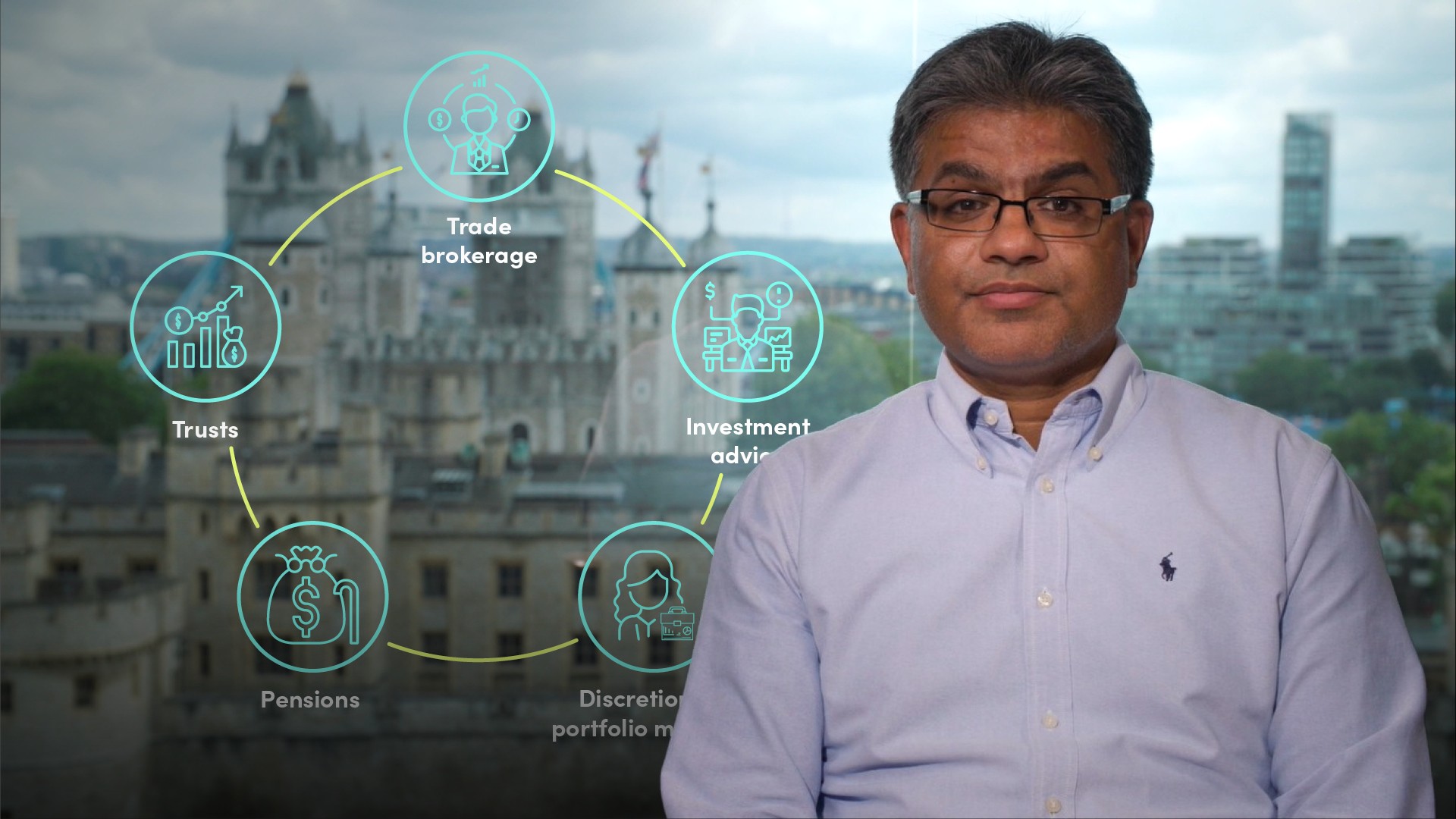

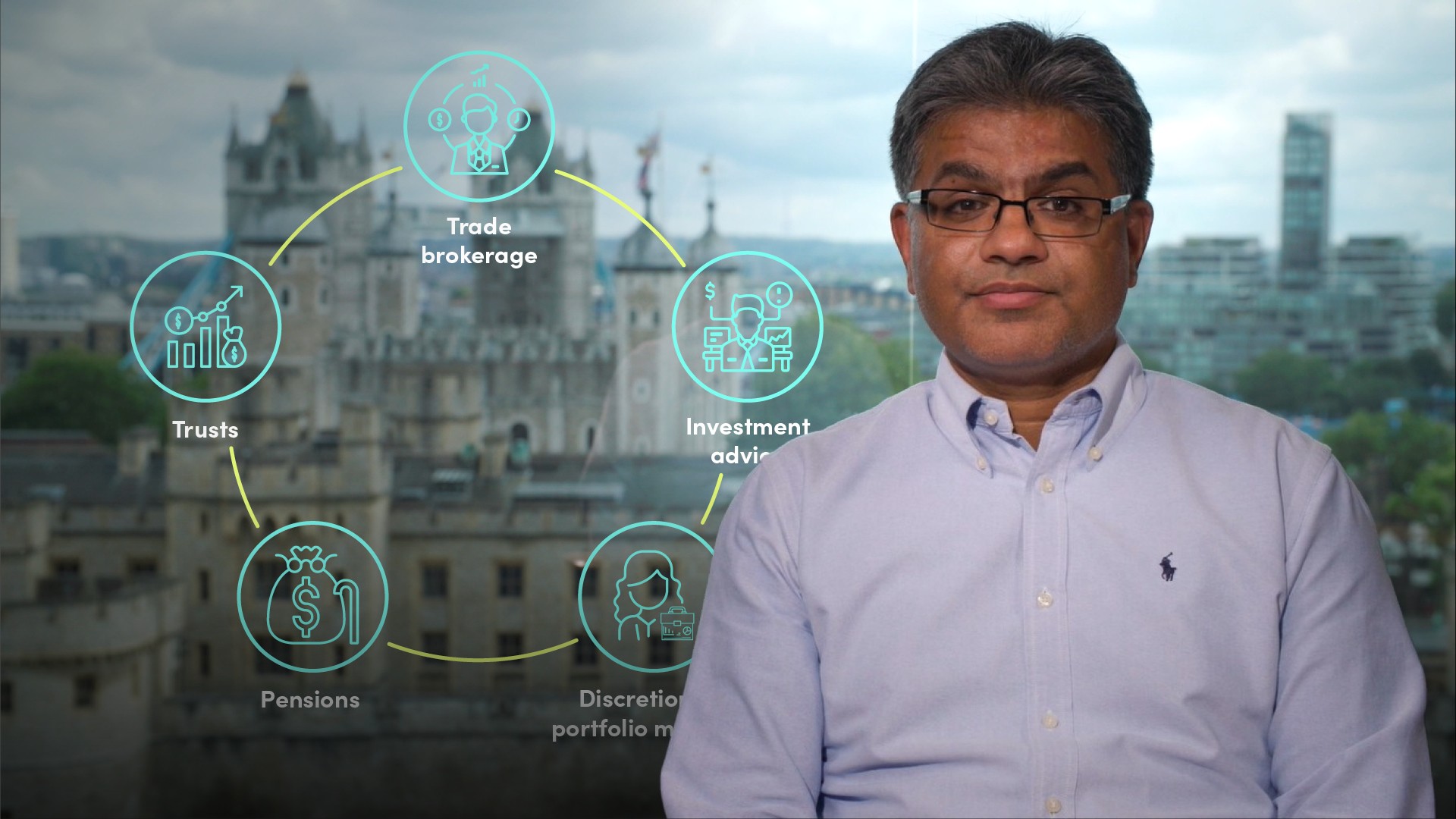

Wealth Management Service Offering

Faisal Sheikh

25 years: Wealth and risk management specialist

In this video, Faisal will talk about the services that wealth management professionals offer their clients, such as trade brokerage, investment advice, discretionary portfolio management, and the use of investment vehicles such as pensions and trusts. He will also explain the extremely demanding regulatory environment in which these services are provided that requires wealth managers to always ensure the services provided are suitable and appropriate for their clients.

In this video, Faisal will talk about the services that wealth management professionals offer their clients, such as trade brokerage, investment advice, discretionary portfolio management, and the use of investment vehicles such as pensions and trusts. He will also explain the extremely demanding regulatory environment in which these services are provided that requires wealth managers to always ensure the services provided are suitable and appropriate for their clients.

Wealth Management Service Offering

14 mins 9 secs

Key learning objectives:

What are the services that wealth management professionals offer their clients?

Understand the regulation of the wealth management industry

Overview:

The wealth management industry is a very extensive and wide-reaching area of the financial services sector. It caters to a range of different people, from those with many millions in assets to those with substantially less, but in all cases offering a great deal of different services to its clients.

FCA regulations on the wealth management industry

The regulations that are particularly relevant to the Wealth Management industry cover the areas such as Financial Crime prevention and include the Proceeds of Crime Act and Investment suitability requirements covered extensively in Markets in Financial Instruments Directive and finally Treating Customers Fairly guidelines issued by the Financial Conduct Authority that are aimed at the fair treatment and protection of clients that are individuals.

What do the FCA regulations help to ensure?

- Fair treatment is central to the corporate culture

- Products and services offered are designed to meet clients' needs

- Clients possess the required knowledge and experience to make investments

- Clients are provided with clear information and are informed of changes

- Clients receive investment advice that takes account of individual circumstances

- Clients do not face unreasonable post-sales barriers to stop switching providers or products

What services do wealth management professionals provide?

- Trade Execution (Brokerage) -Trade Execution is the most basic service provided by Wealth Managers. It consists of clients placing orders with their wealth manager for the completion of a buy or sell orders. The Wealth Manager gets the order executed at the best available price, usually through a member of the exchange.

- Investment Advice - Wealth Managers provide personalised recommendations regarding an investor's portfolio. The key requirement is that the advice is bespoke to the client and considers their unique financial situation. Advice is usually provided verbally in meetings or calls but needs to be documented in written form.

- Discretionary Investment Management - Discretionary investment management is a form of investment management in which buy and sell decisions are made by a portfolio manager for the client's account. The investment manager's strategy involves purchasing a variety of securities in the market that are in line with his or her client's risk profile and goals.

- Financial Planning - Financial Planning is a professional service for individuals and families who need help to organise their financial affairs. This includes first establishing goals over the short, medium and long term. The next stage is to work out the clients existing financial assets; stocks, shares and liabilities such as mortgage debt. An adviser's job is to work with the client to find the optimal level of investment risk required to achieve their financial goals. This could involve changing investment holdings from low risk such as cash into higher risk assets so as to achieve higher returns and requires the preparation of a detailed client risk profile.

- Retail Banking - Many Wealth Management clients will expect their wealth management firm to accommodate their basic retail banking needs. This includes the provision of services such as savings & current accounts, mortgages, personal loans and debit and credit cards. The service is particularly important for those who have their wealth managed by a large universal bank like Barclays.

- Trusts - Trusts are the means by which a person called a settlor can pass property or assets, including money. Common reasons for the use of Trusts include reducing future inheritance tax liabilities. Providing funds for future needs such as the maintenance of young children or supporting charities.

- Pensions - Wealth Management clients can have complex retirement planning needs. Pensions provide a highly tax efficient means of investing during the client's life. Tax relief is provided at the time of investment. In the UK these pension vehicles are often referred to as SIPPs.

- Other Investment Vehicles - Wealth Managers focus on the provision of a number of other investment vehicles. These include: Investment Savings Accounts, Venture Capital Trusts and Enterprise Investment Schemes. All these vehicles provide a highly tax efficient means of investing in government approved schemes. The level of investment made annually or over a lifetime can be capped.

Faisal Sheikh

There are no available Videos from "Faisal Sheikh"