Uses of ETFs in Portfolio Management

Lee Bartholomew

15 years: Fixed income markets

Exchange Traded Funds, or ETFs, are index funds that trade like shares on a regulated stock exchange. In this video, Lee explains what ETFs are and the different ways they can be used in a portfolio.

Exchange Traded Funds, or ETFs, are index funds that trade like shares on a regulated stock exchange. In this video, Lee explains what ETFs are and the different ways they can be used in a portfolio.

Uses of ETFs in Portfolio Management

12 mins 56 secs

Key learning objectives:

Understand the uses of ETFs and what they are responsible for

Learn how ETFs can help drive investment outcomes

Learn how ETF’s play a key role in portfolio management

Outline the various types of ETFs

Overview:

Exchange traded funds (ETFs) are, very simply, index funds that trade like shares on a regulated stock exchange. ETFs offer investors the best of both worlds; the diversification of an investment fund, with the easy tradability of a stock, offering investors potential benefits like intraday trading and daily transparency of holdings, and low fees.

When do investors use ETFs, and what are they responsible for?

ETF issuers are responsible for creating and redeeming ETF shares, and the authorised market participants. Market makers along with banks and brokers provide liquidity in the market. ETFs now track most major indices for stocks, bonds, commodities and many other asset types, opening the door to markets that may have been difficult for investors to access in the past.

What role do ETFs play in portfolios?

Exchange traded products (ETPs) are increasingly being used for the ‘satellite’ or tactical parts of investment portfolios. Here are key ways that ETFs can be used in portfolios.

- Invest in a single ETF as a core exposure for the heart of your portfolio

- Fine tune your preferred exposure in a particular region, commodity or asset class

- Build an entire investment portfolio at a lower cost using ETFs

- Reduce portfolio costs to allow for more active investing

With over 200 ETPs available on the ASX, and with the range of exposures expanding, both passive and active ETPs are increasingly being used as a “satellite” tool.

How do ETFs drive investment outcomes?

ETFs can be used in a number of ways. In the past 10 years, listed ETF options volume has grown from 22% to nearly 40% of overall U.S. listed equity options volume. Here are some of the many ways that ETFs drive investment outcomes:

- Reduce fees and build a stronger core: ETFs are diversified, low-cost funds designed to help you build a strong foundation for your portfolio

- Seek income: ETFs can help generate income through bonds, dividend-paying stocks, and preferred stocks

- Prepare for market turbulence: Minimum volatility ETFs are designed to help reduce risk and keep you invested

- Seek to outperform: Multi-factor ETFs offer exposure to companies that have the potential to deliver above-market returns over the long term with similar risk to the broad market

- Invest internationally: ETFs can help you expand your global reach, offering access to a variety of different markets, from broad exposures to single countries

- Build a model portfolio: Model Portfolios can be a simple and cost effective way to help you achieve your investment goals

What are the types of ETFs?

There are two main types of ETFs; Credit and Bond ETFs.

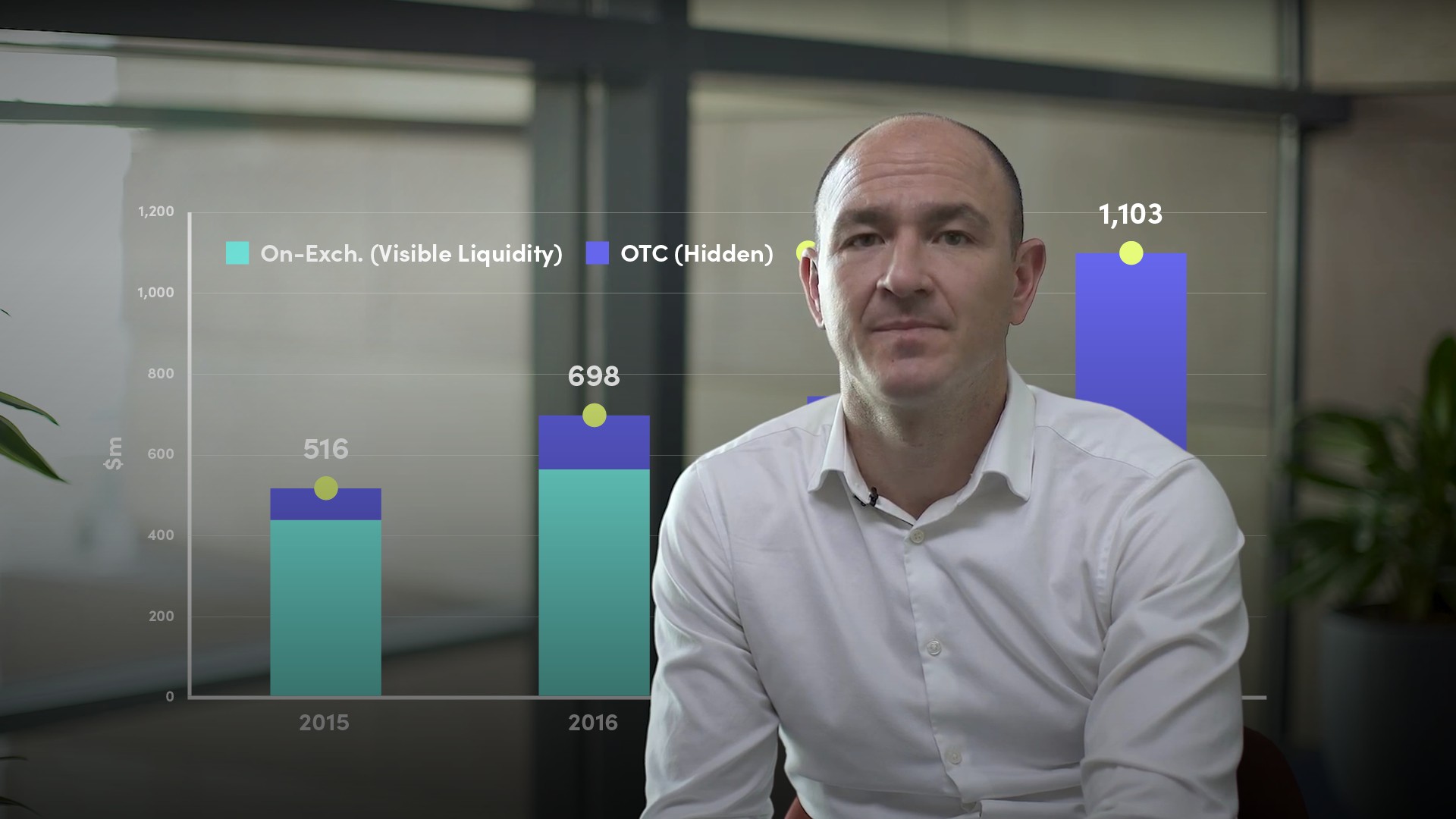

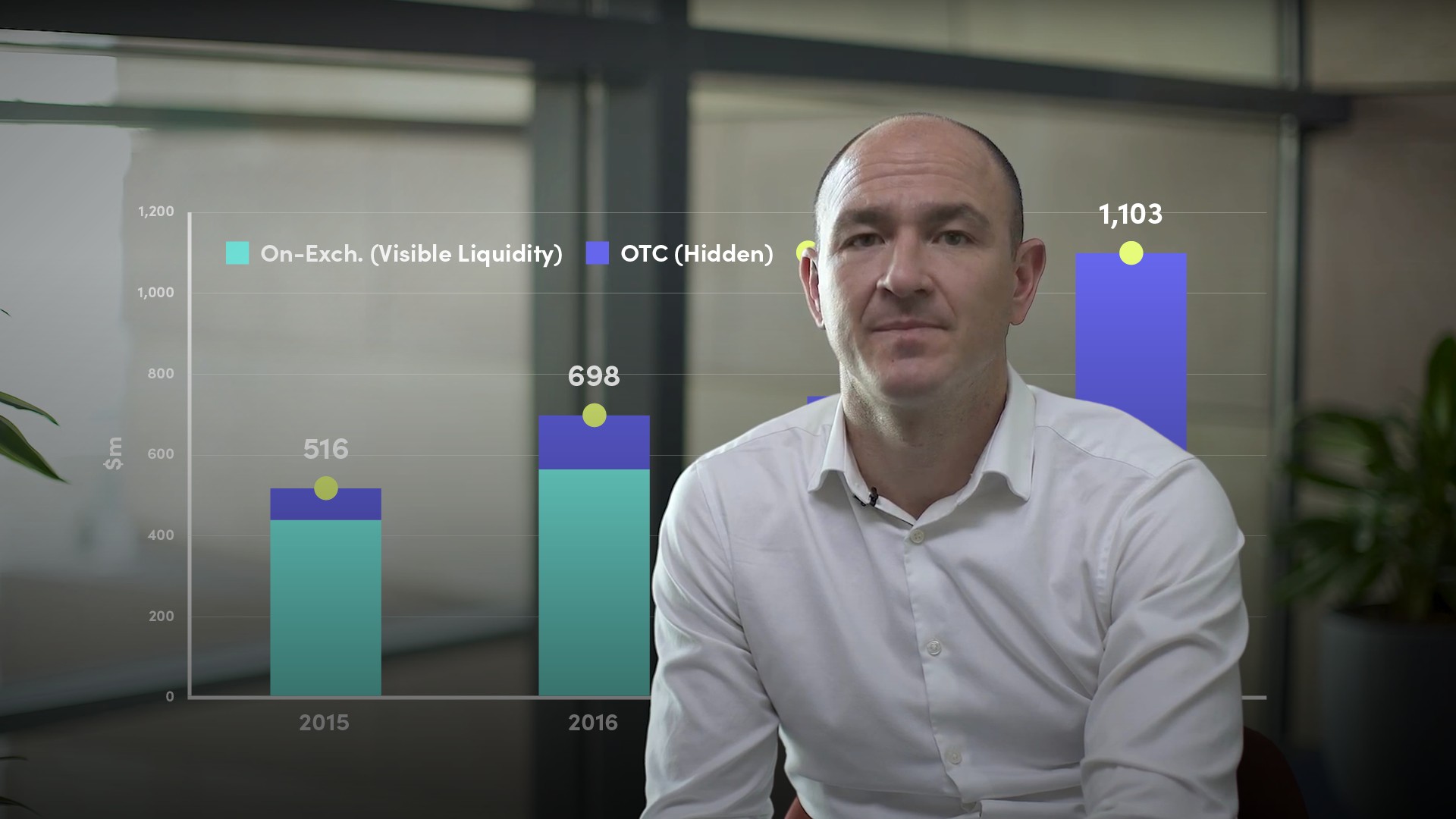

The changing regulatory landscape has drastically impacted the liquidity profile of cash bonds, driving investors to rethink how they manage fixed income risk and liquidity. Investors have adapted and responded by increasingly utilising liquid, basket exposures to access bond markets.

What are the benefits of Index-based products?

Index-based products offer efficient access to specific segments of fixed income markets, helping investors quickly put cash to work and gain market exposure, hedge portfolios, or generate alpha through tactical asset allocation or relative value trading. In addition to credit default swap indexes (CDX) and index total return swaps (TRS), liquid bond ETFs provide a tool for investors to manage their credit portfolio and can be used in similar applications to other beta vehicles.

An investor’s preference for one approach over another is a function of the following considerations:

- Cash versus synthetic exposure

- Interest rate versus credit spread composition

- Leverage and liquidity requirements

- Direction of exposure

- Holding period

- Operational, accounting and regulatory attributes

- Relative cost

Lee Bartholomew

There are no available Videos from "Lee Bartholomew"