What is a Green Repo?

Richard Comotto

30 years: Money markets

Green principles have now hit the repo market - and so we now have green repos. But what is it? There’s no market consensus. In this video, Richard will guide us through green repos, what makes it green and what differentiates it from traditional green financing.

Green principles have now hit the repo market - and so we now have green repos. But what is it? There’s no market consensus. In this video, Richard will guide us through green repos, what makes it green and what differentiates it from traditional green financing.

What is a Green Repo?

12 mins 7 secs

Key learning objectives:

Learn what a green repo is

Understand why greenness or lack thereof in a collateral does not make a repo ‘green’ or ‘brown’

Identify key aspects of a repo that differentiate it from traditional green financing

Overview:

Although there is no consensus on what a green repo is, you still have repos that finance green objectives. The use of green, or brown, collateral does not make a difference to whether a repo is green or not. However, Richard outlines 5 basic principles to use in assessing green repos.

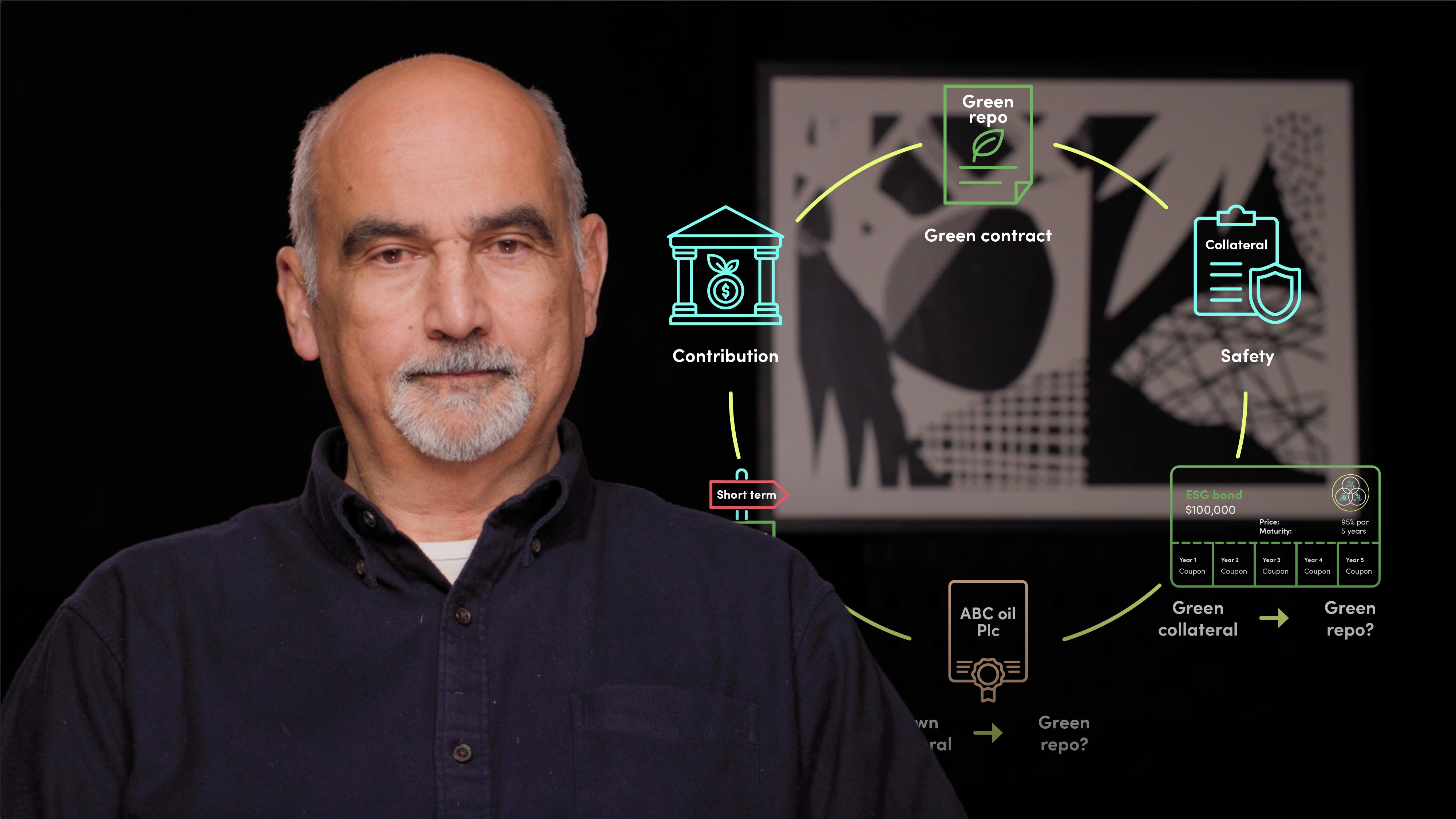

What is a green repo?

There is no such thing as a green repo - only repos that might be financing green objectives. The fact that the collateral in a particular repo might be green, or that the proceeds are being used to finance a green project or activity, or that the buyer has strong green credentials, does not change the fundamental nature of a repo. Repo has a legal structure that can be used to sell and repurchase a type of asset, raise funding for any purpose, or from any type of counterparty. The legal structure of a repo is agnostic to its use.

Does green collateral make a repo green?

No - If you lend money in a repo against green collateral (however you define green collateral) you have done nothing that entitles you to claim you are a green investor.

In a repo, the seller commits to repurchase collateral at the same price as it sold that collateral (plus some repo interest). Any change in the value of the collateral during the repo impacts the seller, not buyer. This is reflected in the international accounting treatment for repo, under which the collateral is not removed from the balance sheet of the seller and does not appear on the balance sheet of the buyer. If the seller retains the risk and return on the collateral, the buyer cannot also claim it. Therefore, a repo against green collateral does not entitle the buyer to claim they have made a green investment. That would be double-counting - just another type of greenwashing.

Does the use of brown collateral make a repo not green?

No - if the use of the proceeds of a repo is genuinely green, then that repo is green because it is providing green financing. That contribution is not vitiated by the use of non-green or brown collateral. Repos against brown collateral may be needed to help finance transitions to more sustainable business models by firms that do not hold sufficient green securities to use as collateral. In these cases, it is the use of proceeds or the environmental credentials of the seller that need to be assessed rather than the greenness of the collateral.

What are the basic principles of a green repo?

Principle 1: There is no such thing as a ‘green repo’

Principle 2: Remember that the primary role of collateral in repo is safety

Principle 3: Green collateral does not make a repo green

Principle 4: Brown collateral doesn’t mean a repo isn’t green

Principle 5: Repo is short-term and green financing is long-term

Principle 6: Does repo trading make any contribution to green financing?

Richard Comotto

There are no available Videos from "Richard Comotto"