What is Banking Recovery?

Gilles Renaudiere

Corporate Advisor: BNP Paribas

In this video, Gilles introduces the concept of bank recovery and resolution. He has outlined what resolution is and what banks need to have in place.

In this video, Gilles introduces the concept of bank recovery and resolution. He has outlined what resolution is and what banks need to have in place.

What is Banking Recovery?

8 mins 36 secs

Key learning objectives:

Understand why Recovery and Resolution regulation is required

Outline the Recovery stage of Recovery and Resolution

Overview:

The financial crisis of 2008 showed that there were insufficient rules to deal with failing banks. Through changes in regulation Recovery and Resolution rules have been implemented around the world through various sets of regulation. The rules provide standardised tools and powers for national authorities to deal with failing banks, with the intention of minimising the negative impact of bank failures on taxpayers, without jeopardising the financial system as a whole. Recovery is the first stage. It is implemented whilst the bank is still a ‘going concern’. A bank must write a recovery plan showing how it intends to restore its viability in a timely manner should it find itself in a severe stress situation, and how it will continue to provide critical services to the economy.

What was the need for Recovery and Resolution regulations?

The 2008 financial crisis was a turning point for banks. With the failure and near failure of multiple ‘too big to fail’ financial institutions around the world, and significant bailouts at the expense of the taxpayer, the crisis highlighted the fragility of the financial system. It proved not only that there were not enough rules and regulations on keeping banks viable, but that there was also a lack of rules around what to do with failing banks.

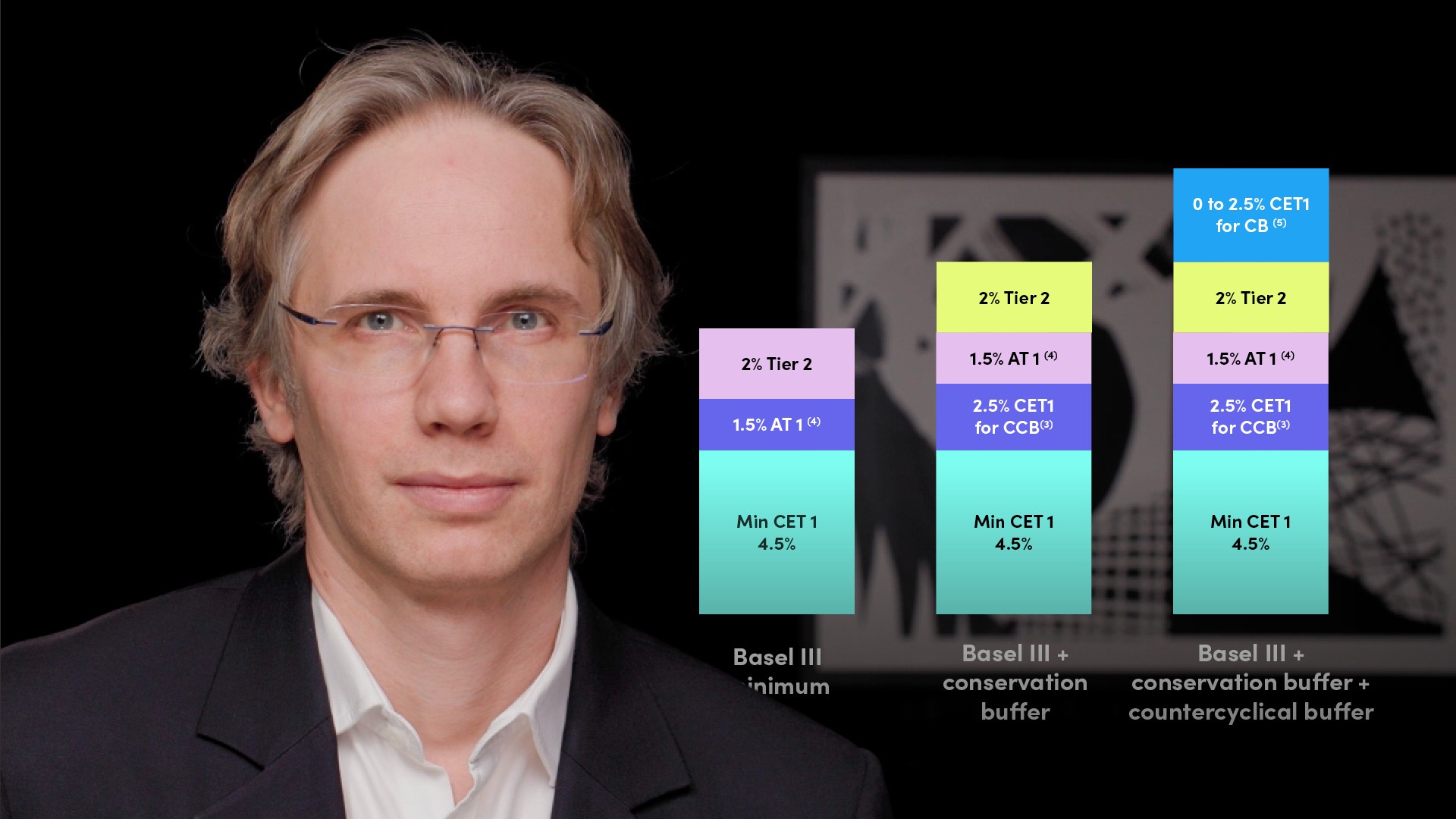

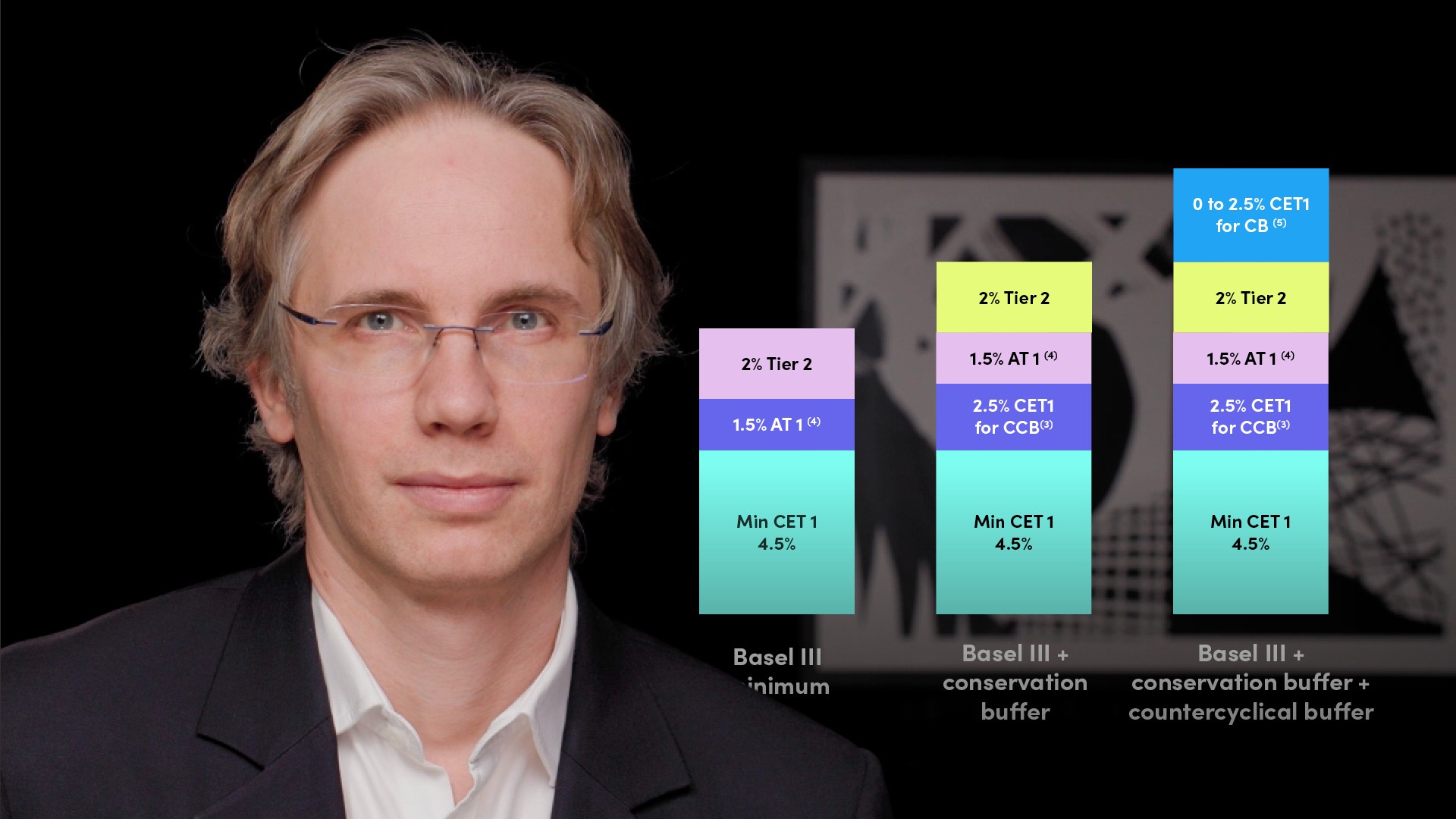

There is now a great deal of regulation in place with the intention of preventing banks from getting into trouble in the first place, through the likes of increased capital requirements, capital buffers, and lower leverage ratios. However, banks can still find themselves in difficulty, so Recovery and Resolution was implemented.

Regulators in the US and Europe established several laws implementing Recovery and Resolution rules, specifically through the UK Banking Act of 2009, the US Dodd-Frank Act in 2010 and the EU Bank Recovery and Resolution Directive of 2014. The rules provide standardised tools and powers for national authorities to deal with failing banks, with the intention of minimising the negative impact of banks failures on taxpayers and without jeopardising the financial system as a whole.

What is bank Recovery?

Recovery is about planning. Banks must prepare themselves to deal with situations that could lead to financial distress, either through liquidity or capital losses. To that end, a bank must write a recovery plan showing how it intends to restore its viability in a timely manner if it should find itself in a severe stress situation. It also needs to show how it will continue to provide critical services to the economy.

Recovery books are handbooks with options and actions the bank could take to get it back to health. They are triggered once the bank finds itself in financial distress, but while the bank is still expected to remain viable. Banks are required to submit their recovery plans to the relevant Competent Authority for review.

Recovery plans may be activated by the bank when certain qualitative or quantitative metrics indicate that certain actions may be necessary. These metrics are called Recovery Indicators and include the breach of certain capital or liquidity ratios, significant operating losses or asset quality deterioration, as well as market indicators such as share price drop, increase in the cost of debt or credit rating downgrade.

Actions that the bank could put in its recovery plan include capital raising (e.g. issuing new shares), disposals (e.g. selling a subsidiary), asset sales (e.g. selling of a securities portfolio) or access central bank liquidity facilities.

The actions outlined intent to bring a bank back from the brink and restore its financial position. If this fails, however, the authorities may deem the bank a ‘gone concern’ and implement the resolution plan.

Gilles Renaudiere

There are no available Videos from "Gilles Renaudiere"