What is Mezzanine Debt?

Tim Skeet

35 years: Debt capital markets

There are forms of capital that combine elements of debt and equity. An example of this is mezzanine debt. In this video, Tim Skeet discusses the structure of mezzanine debt and why it attracts investors.

There are forms of capital that combine elements of debt and equity. An example of this is mezzanine debt. In this video, Tim Skeet discusses the structure of mezzanine debt and why it attracts investors.

What is Mezzanine Debt?

4 mins 4 secs

Key learning objectives:

Define mezzanine debt

Learn the usage of mezzanine debt in LBOs

Define equity kickers

Explain the PIK feature

Overview:

Mezzanine debt is a flexible form of deeply subordinated debt, often used in leveraged buyouts, that combines elements of debt and equity.

What is mezzanine debt?

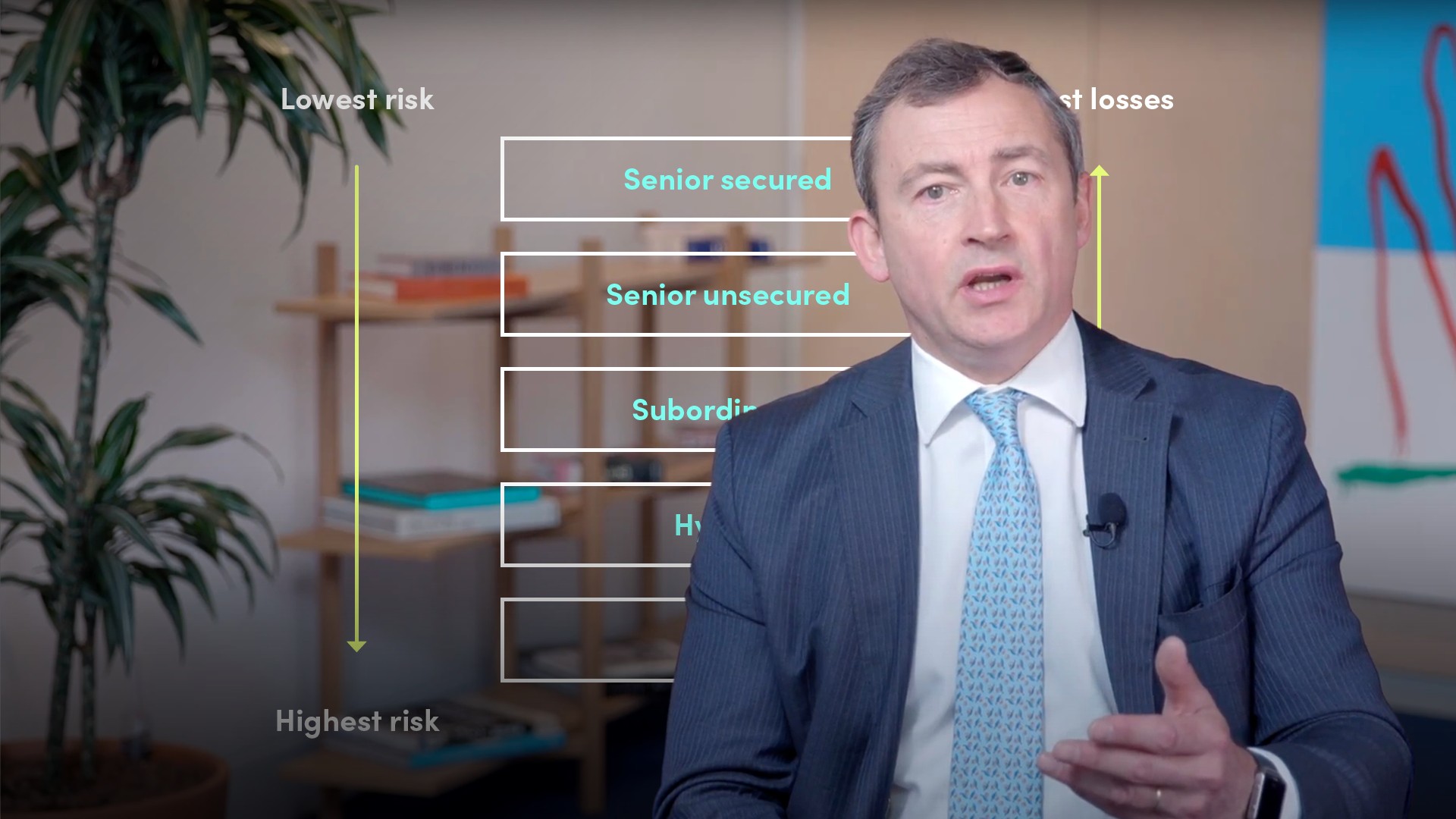

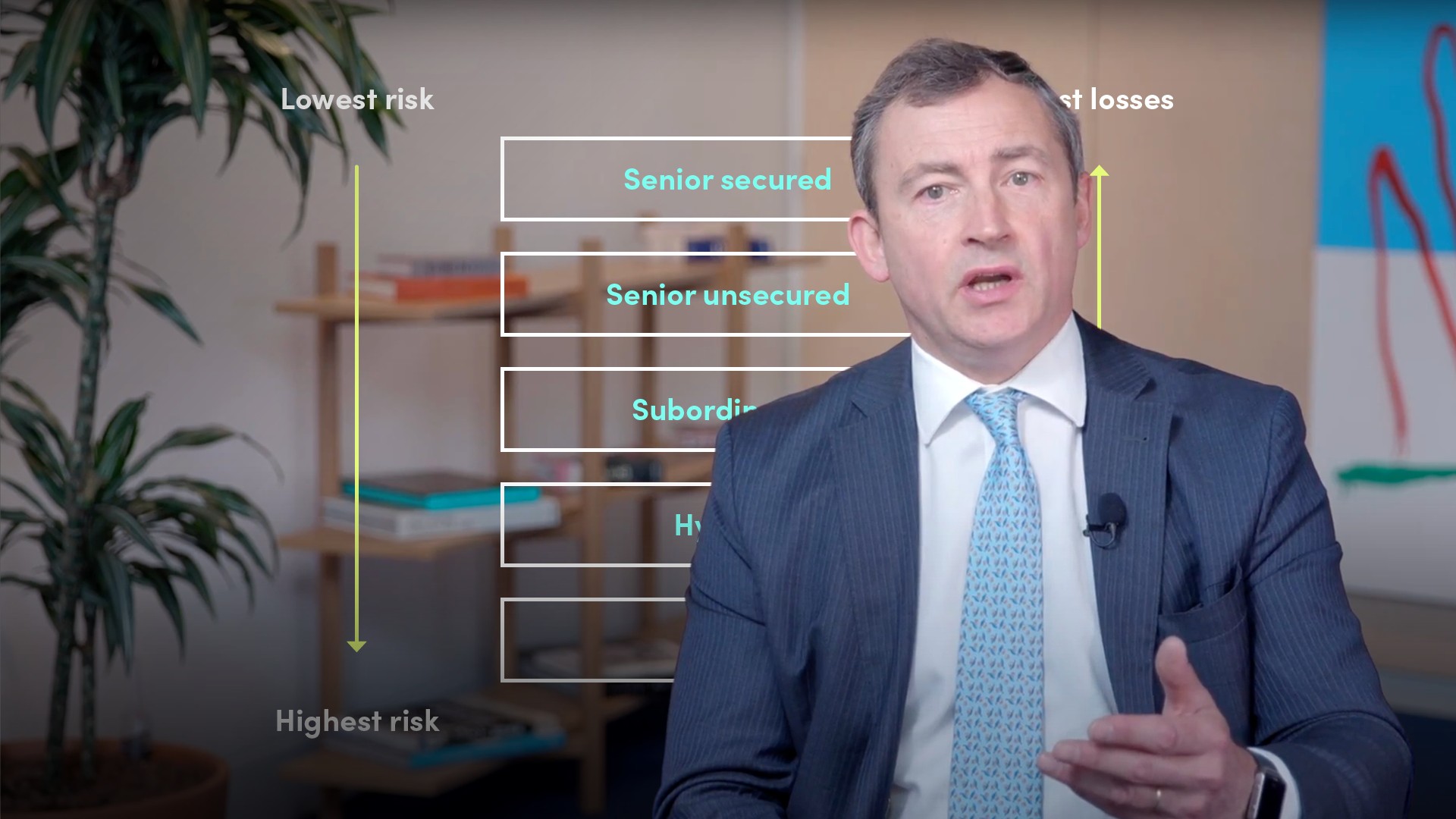

Mezzanine debt is a flexible form of deeply subordinated debt, often used in leveraged buyouts, that combines elements of debt and equity. It is sometimes referred to as quasi-equity or preferred equity and pays lenders high returns.

How is mezzanine debt used in LBOs?

In LBOs, mezzanine debt offers private equity buyers a layer of debt that sits above their own equity while protecting senior lenders. It can fill a funding gap between how much senior lenders are prepared to lend based on their risk and leverage models and how much equity i.e. how much of their own money, private equity buyers are prepared to put in. Mezzanine debt increases the leverage of an acquisition because it reduces the proportion of equity. But at the same time, it can increase the returns on an acquisition and can enable private equity buyers to meet their return floors.

What are equity kickers?

To incentivise mezzanine debt investors, mezzanine debt will generally have some form of equity conversion or acquisition feature which can confer significant equity ownership rights and offer valuable upside if conversion triggers are hit, such as profitability or other operating targets, or if the company is sold. Equity kickers can give mezzanine holders:

- Equity-purchase rights at specified future dates

- Equity-conversion rights that give debt holders rights to convert their debt into equity

- Equity co-investment rights with the private equity owner

What is a PIK feature?

Mezzanine can also come with so-called PIK features. PIK stands for Payment-in-Kind. If a company has a cash shortfall, the PIK feature allows them to pay debt holders in the form of additional debt. Interest payments, in other words, are capitalised. This adds to a company’s debt load but buys some breathing room that diverts companies from the road to technical default.

Tim Skeet

There are no available Videos from "Tim Skeet"