What is Securities Lending?

Richard Comotto

30 years: Money markets

In this video, Richard explains securities lending and borrowing, and how they work. He also outlines the types of collateral used in the trades.

In this video, Richard explains securities lending and borrowing, and how they work. He also outlines the types of collateral used in the trades.

What is Securities Lending?

12 mins 38 secs

Key learning objectives:

Understand how securities lending and borrowing works

Outline the types of collateral used in the trades

Overview:

Securities lending is a financial activity in which a borrower obtains the temporary use of a security from a lender in exchange for a fee. In most cases, the loan is collateralised, meaning that the borrower provides other securities or cash as collateral to the lender. There are three main types of securities loans that are collateralised with cash: financing trades, cash pool trades, and reverse repurchase agreements.

What is securities lending and borrowing?

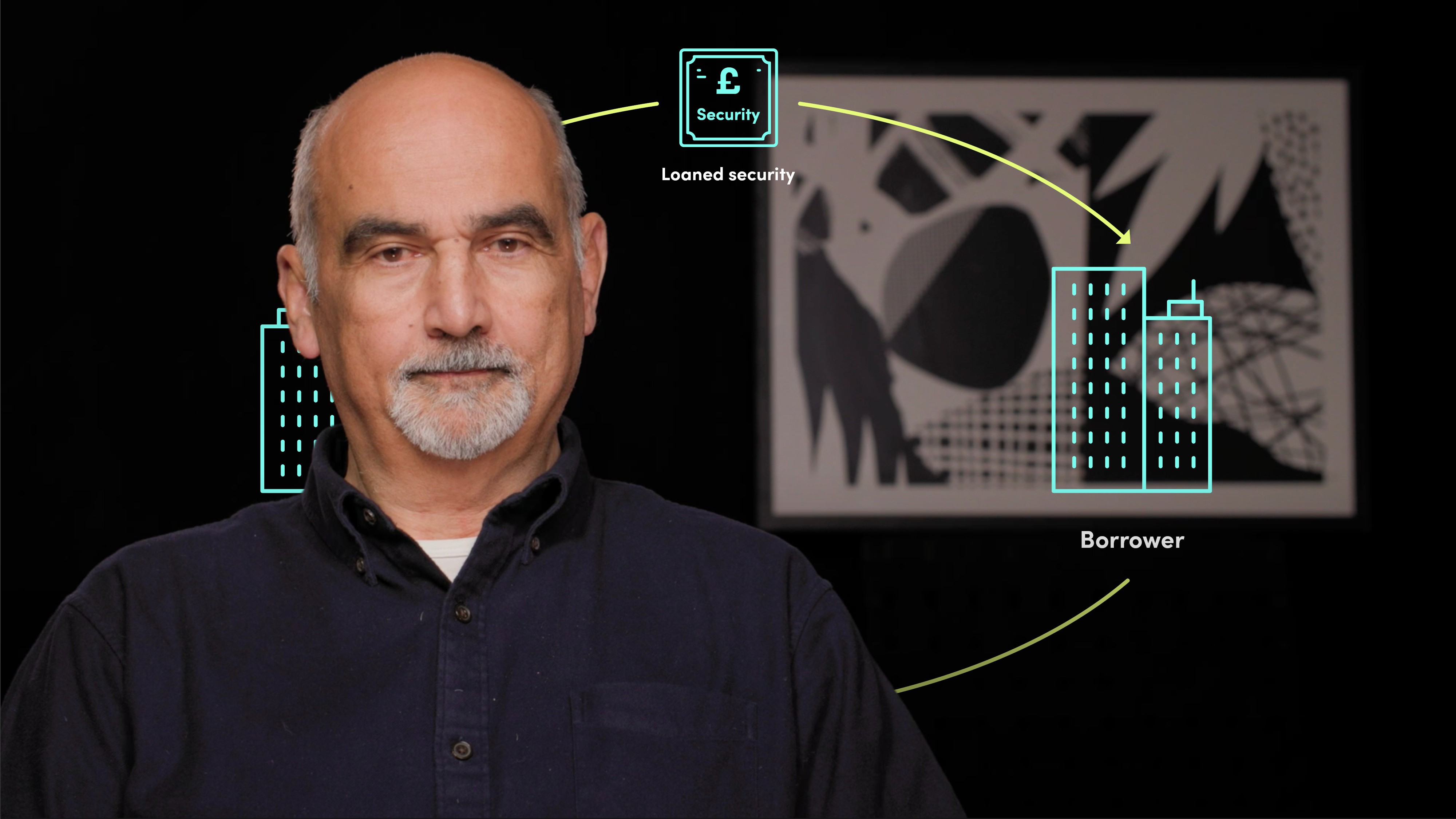

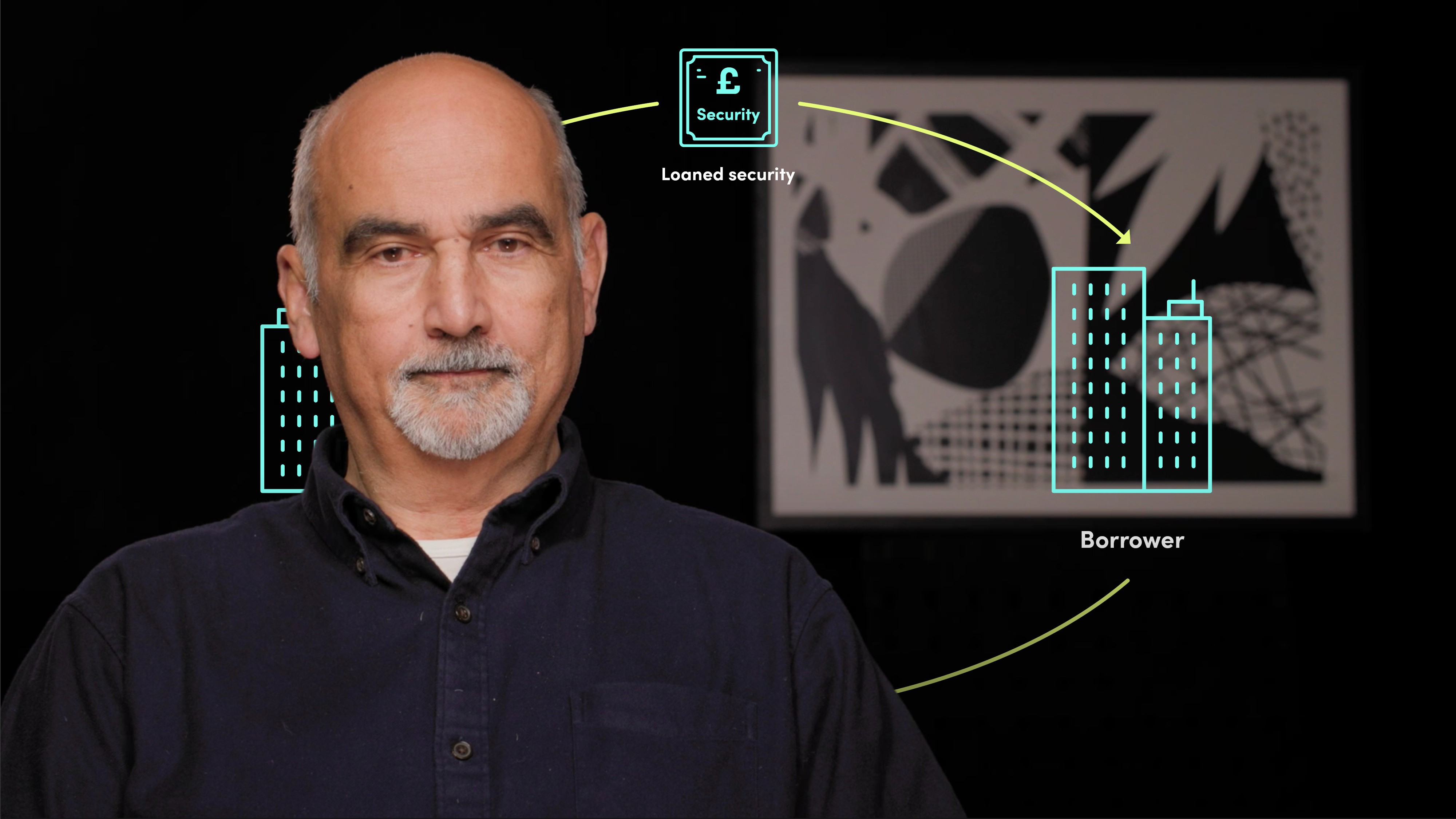

The “lender” gives the “borrower” a security for an agreed period or until one of them terminates the loan, after which, the borrower returns the loaned security to the lender. But this “loan” is unusual in that the borrower gets ownership of the loaned security during the loan period.

The loan can be uncollateralised, but more likely will contain some sort of collateral, whether cash or non-cash.

The lender will receive a fee from the borrower for providing the security.

What are the collateral requirements in a securities loan?

There could be no collateral required if the parties in a transaction deem it appropriate, however, most securities lending is collateral.

About ⅓ of the collateral used globally in securities lending is cash. In this case, it is assumed that the lender will reinvest the cash collateral in the money market, in which case they are expected to return some of the return to the borrower, known as rebate interest.

Cash-collateralised securities loans are divided into “financing trades” and “cash pool trades”. Cash pool trades are also known as “fee trades”. Financing trades can be further divided into “cash rebate trades” and “reverse securities loans” or “reverse stock loans”. Financing trades are so-called because their primary motivation is to borrow or lend cash, whereas the primary motivation of cash pool trades is to earn a fee on the loaned security.

Securities loans are more likely to be collateralised, in this case, the loan will be made in exchange for collateral securities plus a fee. The collateral will often have to be high quality and a nominal value higher than the loan is usually required.

Richard Comotto

There are no available Videos from "Richard Comotto"