Glossary

BankingConvertible Loan Notes (CLNs)

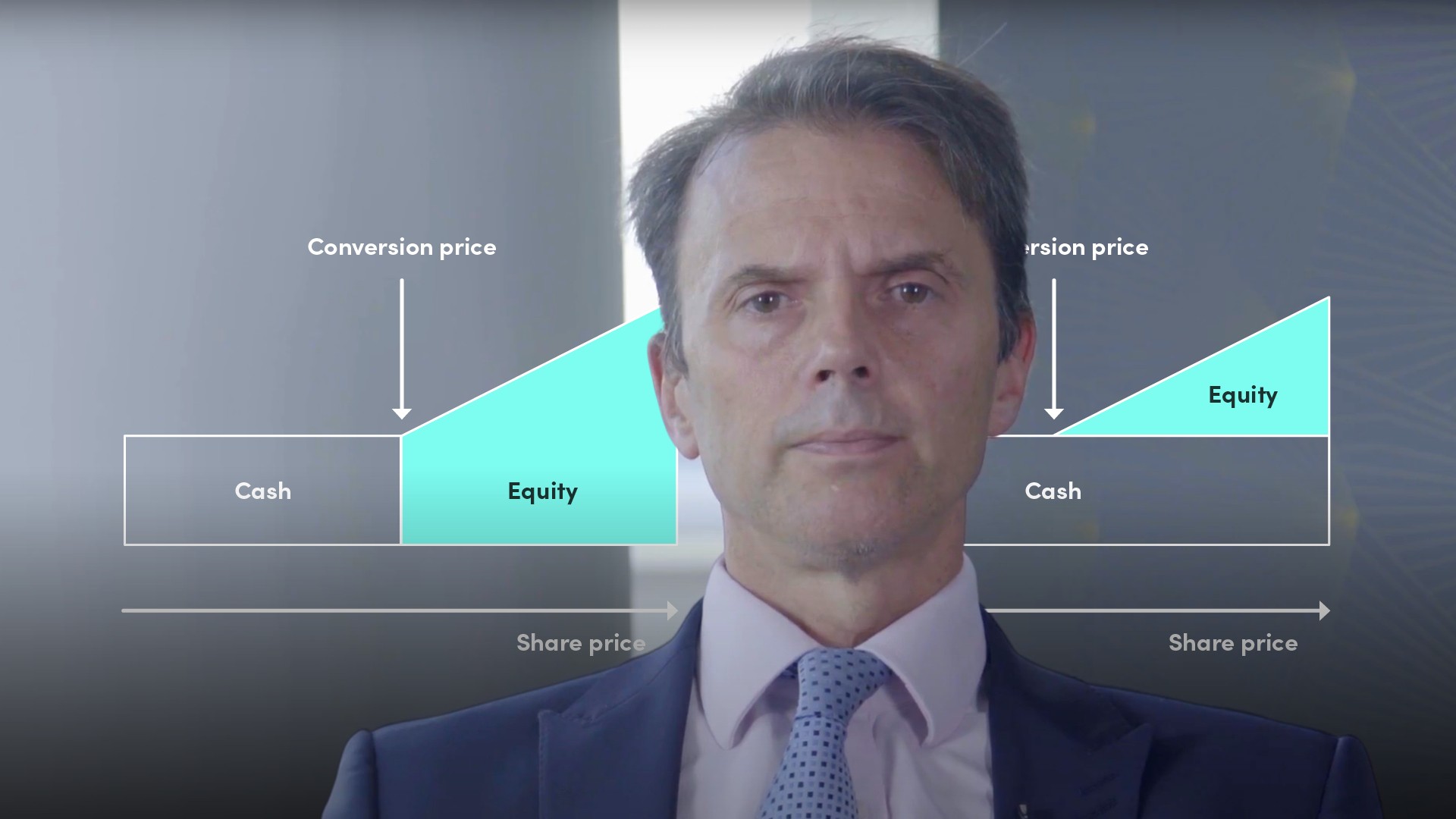

Convertible loan notes (CLN) are interest-bearing debt instruments with covenants that allow investors to convert principal and accrued interest into equity. In the case of growth companies or start-ups, conversion can be scheduled to occur at the time of a next qualifying funding round – and at a discount to the price of the qualifying funding round. In some cases, if a funding round does not take place prior to the maturity date of the CLN, conversion automatically takes place at a pre-set conversion price.