Convertible Preferred Stock

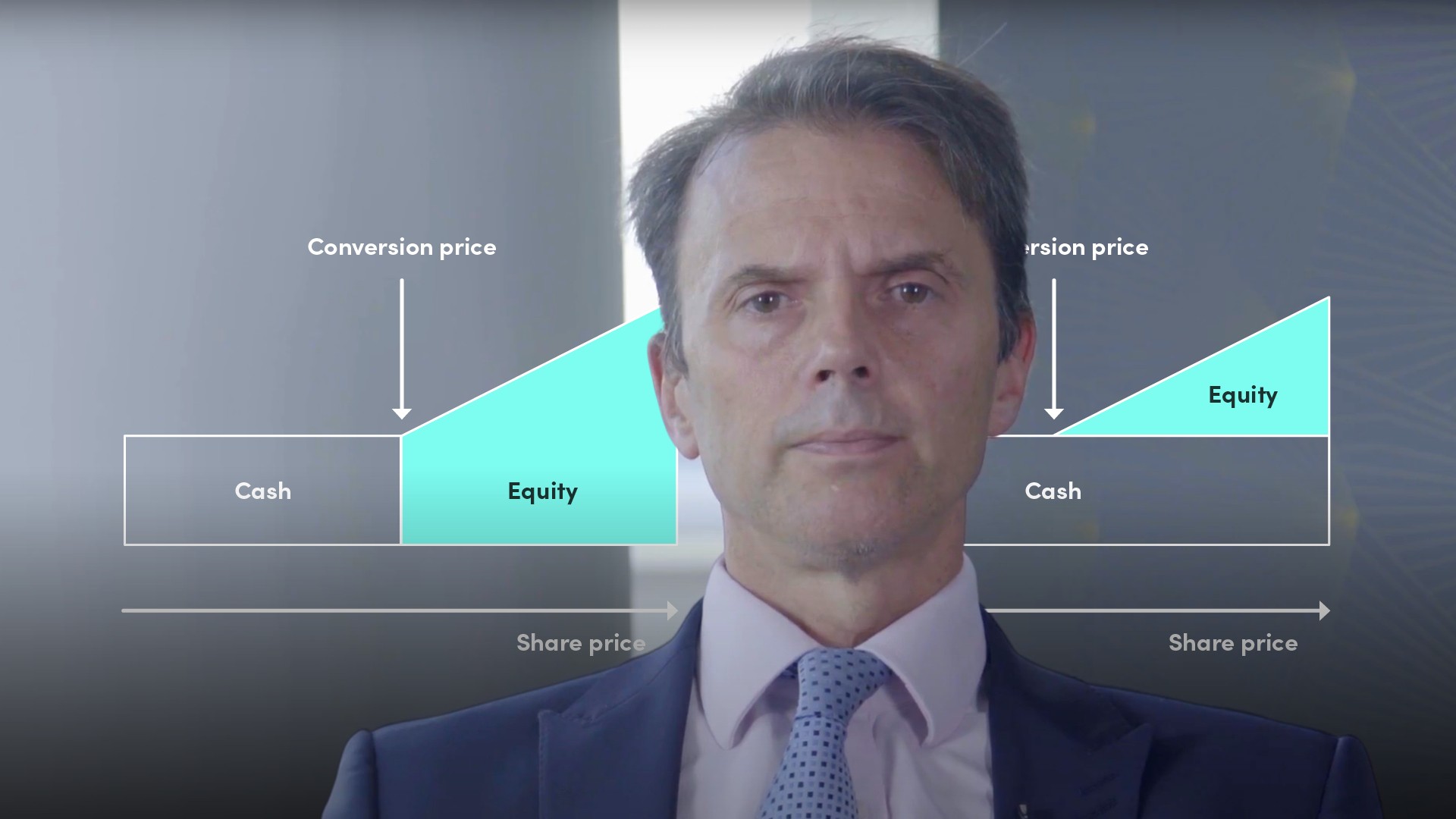

Convertible preferred stock gives holders the right to convert preferred stock into a set number of common shares, just as with convertible bonds. Preferred shares (or preferred stock) are a hybrid financial instrument sharing elements of debt and equity. They sit above common equity in liquidation but below senior debt. Preferreds pay fixed dividends (akin to bond coupons) but unlike senior bonds, dividends on preferreds can be non-cumulative i.e. if the company misses a dividend payment, investors lose the right to it. If preferred dividends are cancelled, the company is unable to pay shareholder dividends. Like common stock, prefs are perpetual but unlike common stock, they have embedded calls that give issuers the right, under certain circumstances, to redeem.