Credit Ratings

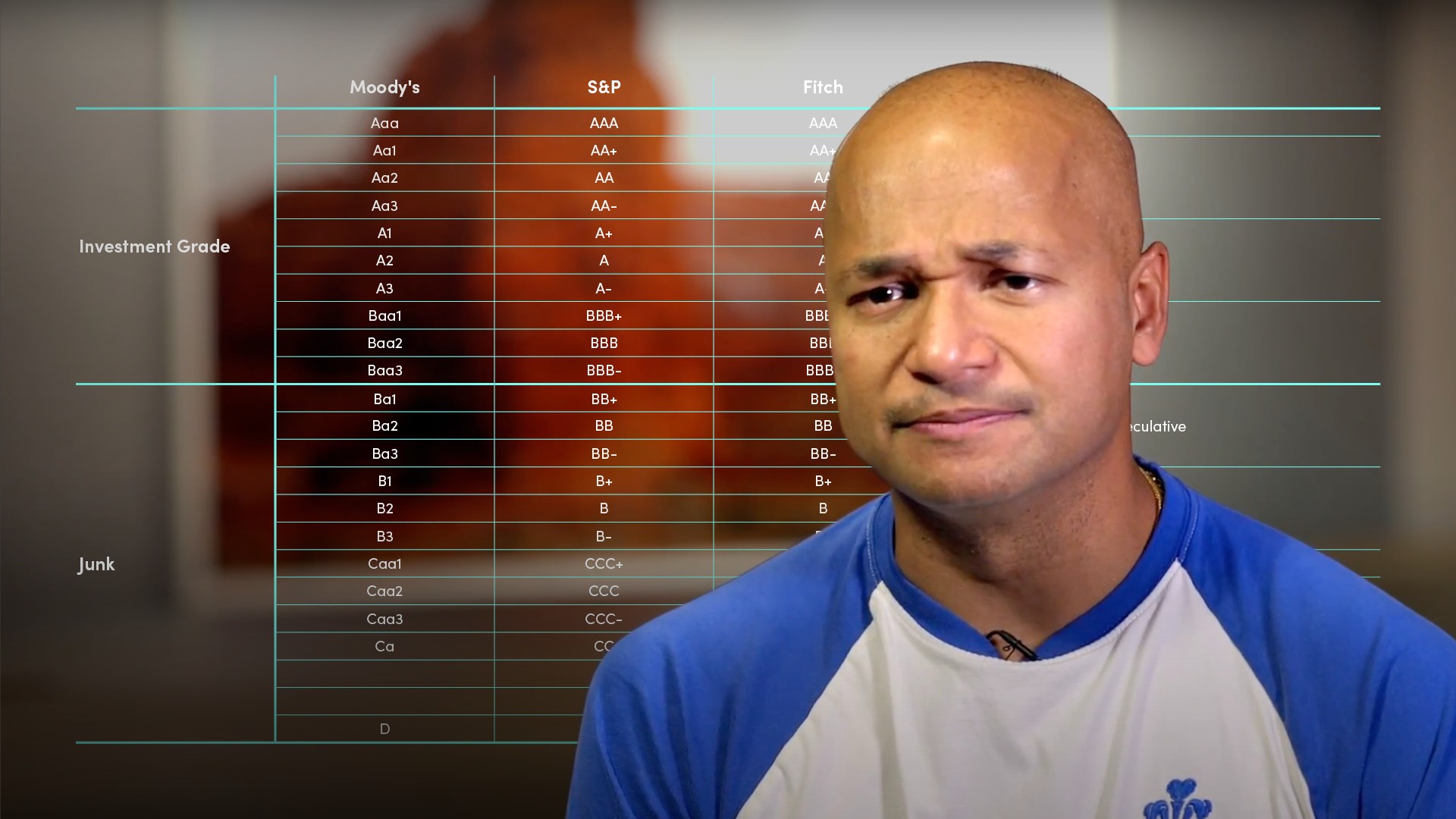

Credit Ratings are forward-looking opinions about about the relative capacity and willingness of an entity to meet its financial commitments as they come due. Credit ratings can be assigned to companies, governments, financial institutions such as banks, leasing companies and insurers, and regional governments. Issue ratings are based on the credit rating of the issuer and can be assigned to secured and unsecured debt securities, loans, preferred stock. Rating agencies use published criteria which set out in detail their methodology for assigning credit ratings. Credit ratings Credit ratings are not an absolute measure of risk but express relative credit worthiness in rank order. That is they are ordinal measures of credit risk and are not predictions of credit default. Rating agencies use rating scales to express their opinion of creditworthiness. For example Standard & Poor’s has a rating scale from AAA (the highest creditworthiness) to D. Credit ratings are used by many participants in the financial markets. For example some institutional investors will not buy unrated debt or below a certain rating.