Glossary

Investment ManagementInternal Rate of Return

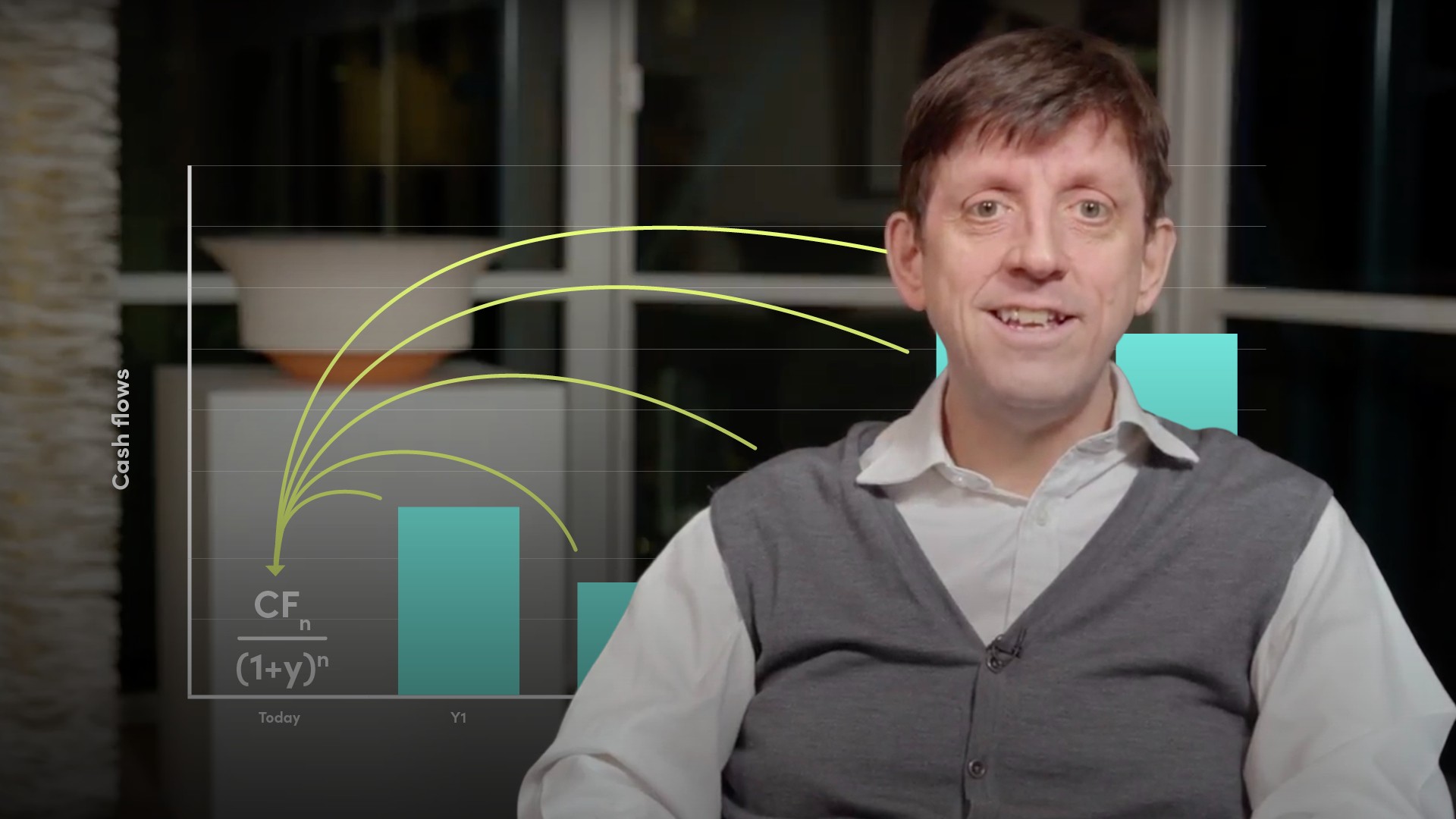

The internal rate of return (IRR) is widely-used in financial markets as a method of calculating the returns on a project and determining whether the projected returns meet management hurdle rates that justify capital expenditure. If the IRR is higher than management’s hurdle rate of return, they should fund the project. IRR is the discount rate applied to projected cash flows that yields a net present value of zero.