Glossary

BankingModified Duration

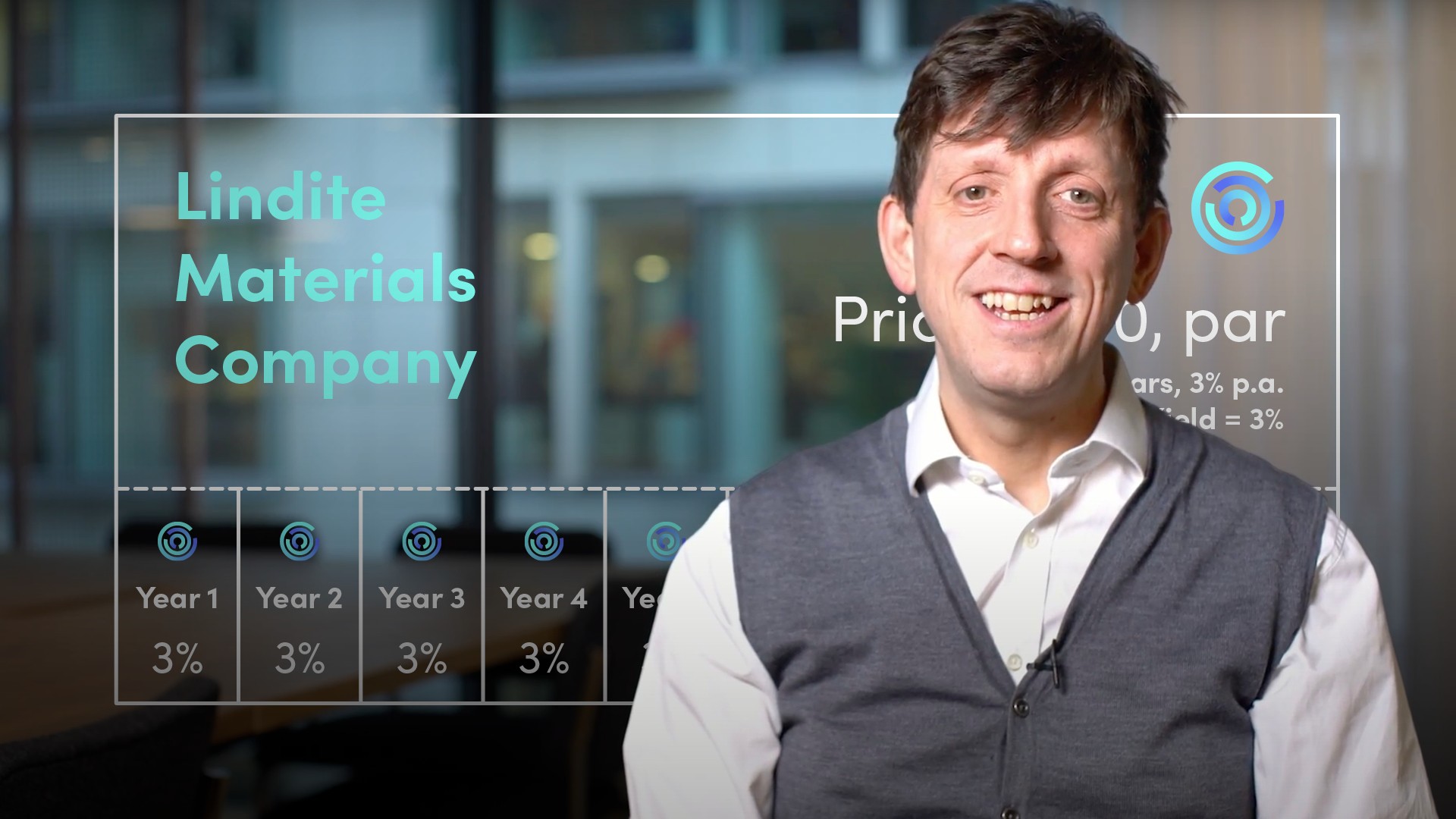

Macaulay duration is a helpful starting point for calculating modified duration. Modified duration is calculated by dividing the Macauley duration by: 1 + (yield to maturity ÷ number of coupon payments per year). This modification adjusts the duration to make it more useful when thinking about interest rate sensitivity. Modified duration measures, in percentage terms, how sensitive a bond is to changes in interest rates. The longer the modified duration, the more the value of a bond will rise or fall given changes in interest rates. The price of a bond will increase/decrease by 1% for every 1% decrease/increase in interest rates for each year of modified duration.