Time Decay

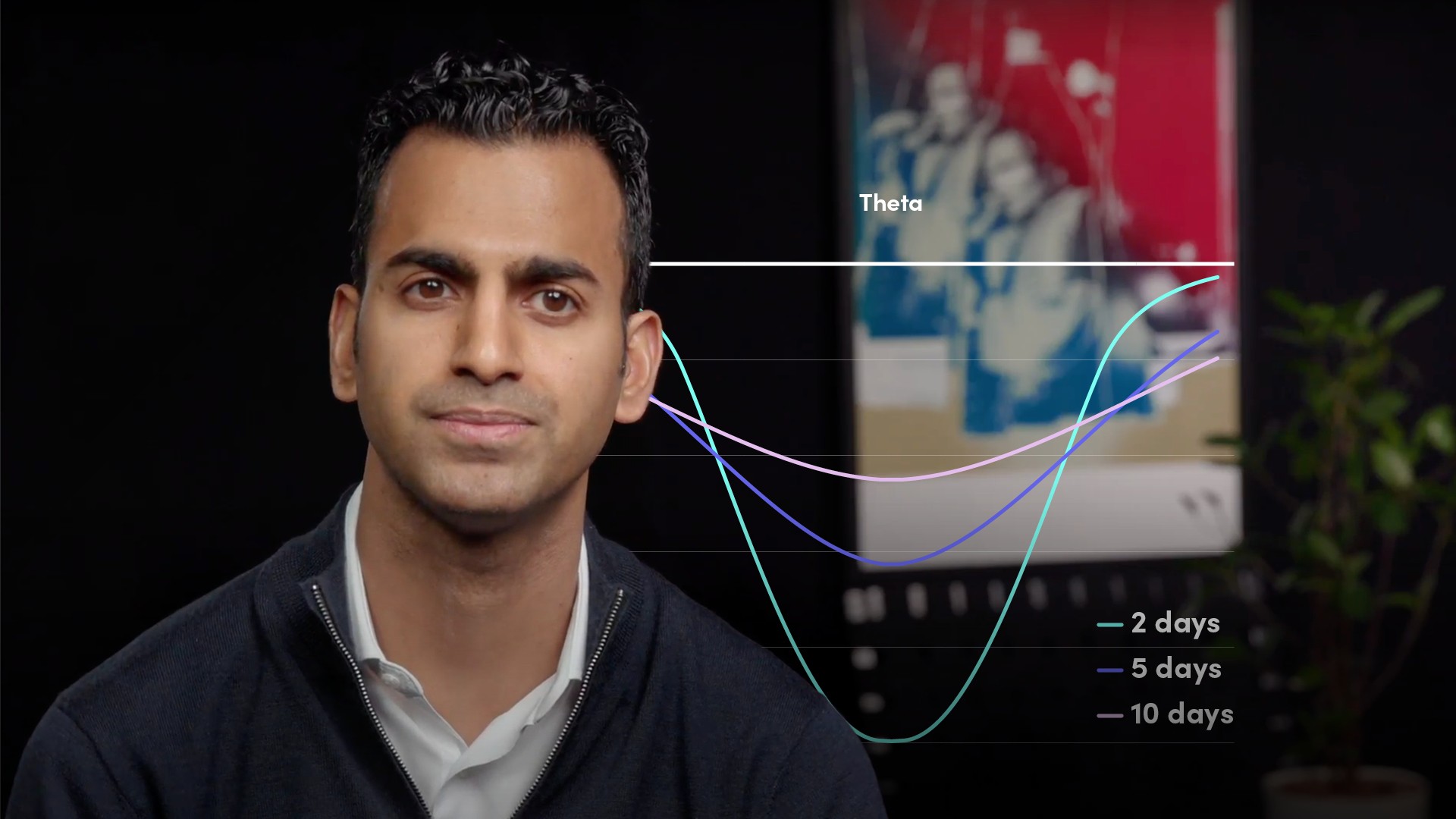

The decline in the value of an option as it moves to expiry is the effect of what is known as time decay. Options have intrinsic and extrinsic value. Even if an option’s intrinsic value at a given point time is zero (i.e. if the strike price is the same as the price of the underlying i.e. the option is at-the-money) the option would still have extrinsic value based on the profit potential to expiry. Time is perhaps an option’s key extrinsic factor. It follows that the longer an option has until expiry, the higher the time value, simply because the underlying has more time to move in the option holder’s favour. Time decay is reflected in the option premium paid to own the option, which cheapens as expiry approaches. Time decay is a constant but it doesn’t have a constant impact on options premiums. Again it is intuitive that time decay has a smaller impact on options with a longer time to expiry than it does on options close to expiry. The sensitivity of the price of an option to time decay is known as Theta (cf.).