Underwriting Syndicate

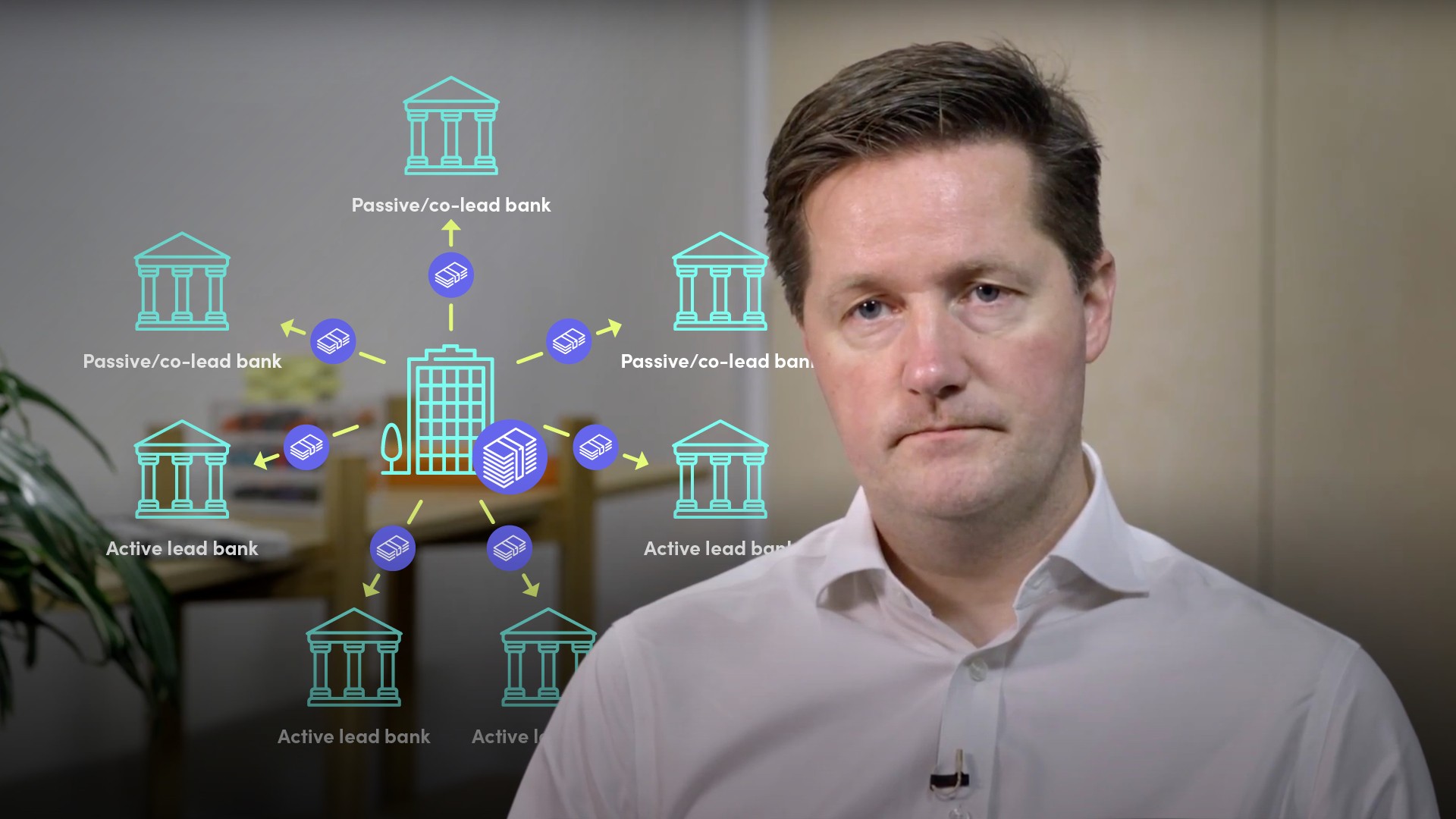

An underwriting syndicate is a group of banks and brokers that is convened for the purpose of selling securities in a new offering of equity or debt securities. The syndicate is headed by so-called lead managers that are responsible for the smooth execution of a transaction. The benefit of having a syndicate is to ensure wide marketing of the securities. Syndicate orders are shared, and lead managers are responsible for final allocation. In the Lloyd’s insurance market, insurance brokers intermediate between policyholders (those seeking to mitigate risk) and underwriting syndicates, which are groups formed by members (capital providers) that accept underwriting risk. Syndicates can write insurance across the spectrum of risks; others specialise on one or more types of risk. Most member capital is provided by corporations, although individuals can also form and participate in syndicates